Why I Sold Put Option Contracts on BAC as a Passive Income Strategy for Accredited Investors

This is a walk through of a passive income strategy for an accredited investor. I just did this trade in my fund and I’ll explain why and how I did it. This is not financial advice or a recommendation to buy or sell anything. I picked Bank of America (ticker BAC) as the underlying company for the option contract for a number of reasons. Here are a few:

Warren Buffett likes them. In fact he owns 13% of the outstanding shares of BAC, and BAC represents over 8% of his total portfolio. And he has a BIG portfolio!

The experts (big hedge fund managers) have been buying shares of BAC this year. This chart shows the trading price trend and the volume of shares bought and sold by the expert fund managers. The chart shows the experts were selling BAC when it was trading in the low $40’s. They started buying BAC when it began trading under $30 in the first quarter this year. In1Q23 the experts bought 38.4 million shares of BAC and sold 10.6 million shares. In the second quarter, the experts bought 24.8 million shares and sold just 5.5million. That’s a net purchase of 47.1 million shares. Here’s a link to an article that shows why I like my passive income strategy as an accredited investor to mirror what the experts are doing.

There’s a price channel from about $23 to $26.50 from June of 2020 through October of 2020. Each of those support and resistance lines were hit multiple times during that period. BAC has not traded in this price range since then.

BAC has their quarterly earnings call on 10/17. If this put gets assigned, my passive income strategy as an accredited investor would sell a call on the shares. I should be able to get some solid premium if I sell the call through earnings.

If I get assigned and I keep the shares BAC will likely pay another dividend around 12/1.

BAC typically trades around 140% of tangible book value, and it is currently trading at about 110% of tangible book value. Here is the tool I am using to find that.

I believe the price of BAC has been dropping this year due to the increases in interest rates and also the increase in credit card delinquencies. As a bank, things are likely to be tougher for BAC over the next twelve months than they were in the last twelve months. Be sure you understand BAC, the banking industry, and the overall economic outlook before selling put option contracts on BAC as a passive income strategy for an accredited investor.

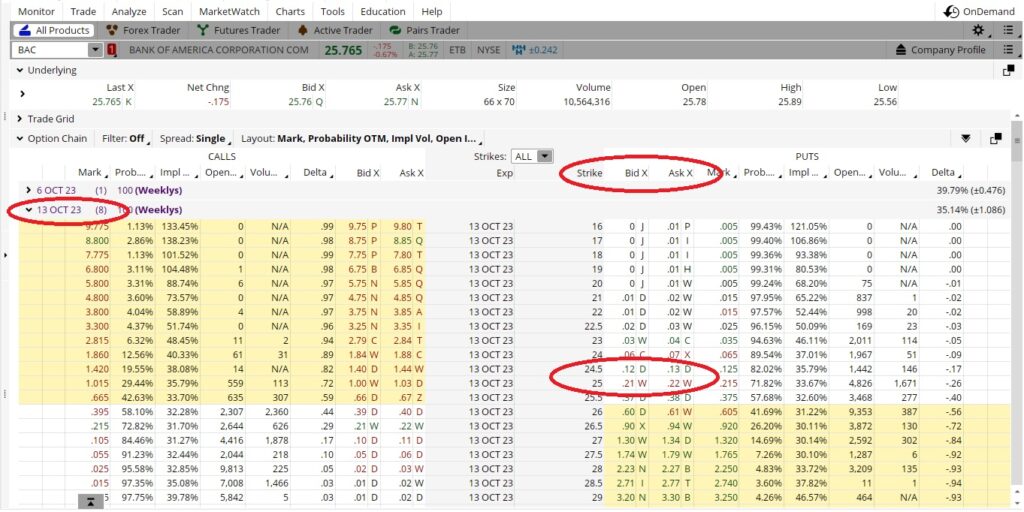

I like to sell short dated options because the time value of the contract expires more quickly than it does on contracts over a longer period. In this case, I’m picking the contract that expires next Friday, 10/13. That’s eight days away. The picture below shows the Expiration Date and the number of days until the expiration date (DTE) on the top left. The red circle on the top right is for the Strike, which is the contract strike price, and the Bid and the Ask. For an explanation of those terms, read this post. The red circle on the bottom right shows the $25 strike with a Bid of $0.21 and an Ask of $0.22. As a seller of the option contract I can hit the Bid at $0.21 and my passive income strategy as an accredited investor gets $21 for the contract (minus your broker’s contract fee).

Since this trade is an 8 day trade, I take 365 days in a year and divide that by 8. That gives me 45. That means there are 45 periods of 8 days in a year. So in theory I could do this 8 day trade 45 times over the course of the year.

The $0.21 premium divided into the $25 strike is 0.0084. That’s the return I will get on the premium for this trade. I take that 0.0084 and multiply it by 45, and that gives me a theoretical return of over 37%.

If I do this passive income strategy as an accredited investor I need to have enough money in my brokerage account to cover this contract in case of assignment. The strike is $25, and one contract is for 100 shares, so I need to have $2500 in my brokerage account for each contract if I’m going to cover this trade with cash. That $2500 covers the trade until it expires on 10/13. At that point either the contract will expire worthless or I will be assigned the shares at $25 each.