Work from Anywhere Passive Income Trade

Lately my work from anywhere passive income weekly options trade has been to sell puts on BAC. Here’s a link to the most recent of those trades, which right now looks like it will expire this Friday out of the money.

Since BAC has run up from the $25 to $27 range up to $29+ I’m going to wait for a pullback on BAC before selling more puts on it. That brings me to another company I’m using for a work from anywhere passive income trade right now. 13Fs for the third quarter are now available. One company that one of my favorite experts likes is Occidental Petrol Company (OXY). Here’s a link to a post that walks through the what and how of 13Fs.

Why I Like OXY for a Weekly Trade

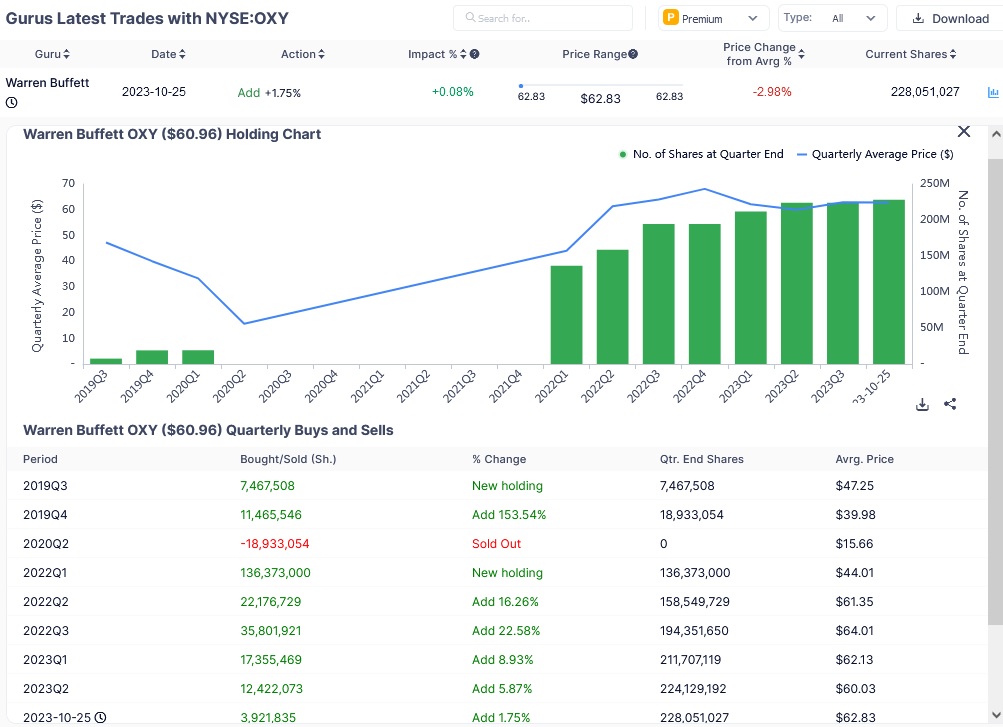

In a nutshell, I like OXY as a company in part because Warren Buffett likes them. In fact, right now he has over 228 million shares of it. Here is a history of Warren Buffett’s trades on OXY, and here is where I found that information.

We can see how Warren Buffett bought over 12,400,000 shares of OXY in the second quarter of this year for an average price of $60.03. We can also see how Warren bought another 3,900,000 shares of OXY on 10/25 at an average price of $62.83. Warren Buffett also has over $157 Billion in cash on hand right now. So if the trade price for OXY were to drop much, it’s likely that that Warren would buy more shares. And he has enough of a cash pile that his buying could put a floor in the trade price.

OXY has a dividend of $0.18 per share for owners of record as of 12/8. That means I need to own the shares by 12/7 to get paid the dividend, which will happen on 1/16/24. The dividend is a little bonus in case this work from anywhere passive income trade gets shares assigned to me.

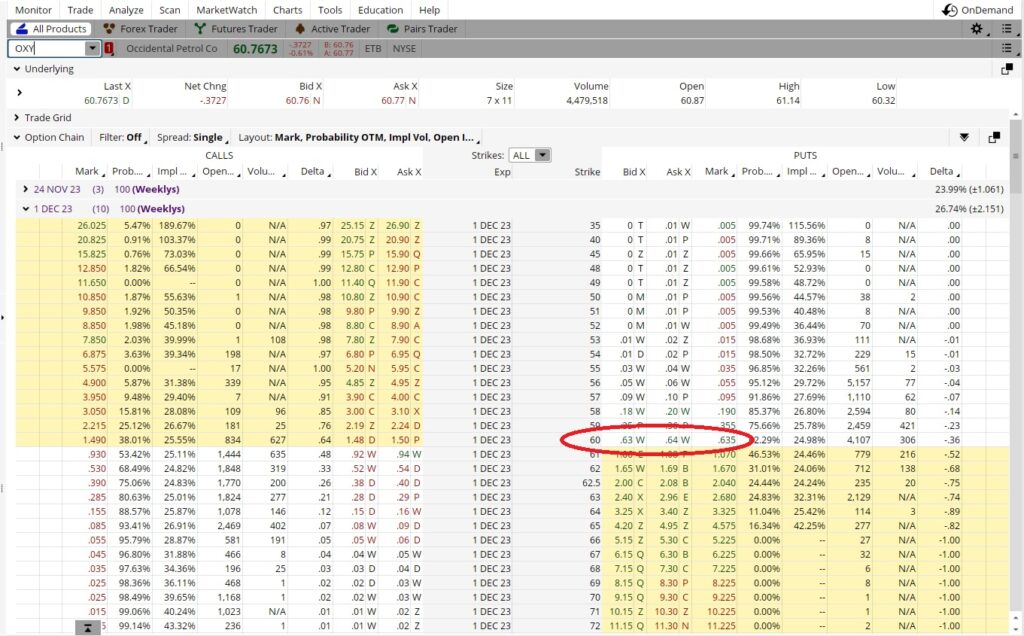

I also like OXY for a work from anywhere passive income trade right now because the chart below shows a resistance line just above $60. That means I can sell the $60 put with a decent chance that the trade price will hesitate before crossing down through that support line. That hesitation could be the difference for my weekly option contact to expire out of the money. OXY could also bounce off that support line back up above it. It’s also possible that OXY blows down right through the support line, but if that were to happen I’d get the dividend bonus. I’d also be likely to have Warren on my side, buying more shares to prop the price up.

The Weekly Trade

Right now OXY is trading at $60.76. The $60 put expiring 12/1 is trading for $0.63. It’s a 10 day trade, and 10 goes into 365 days 36 times. $0.63 divided into $60 is 0.0105, times 36 is 37.8. That equates to a 37.8% annualized return on the put. If I get assigned I will also get the $0.18 dividend. That dividend boosts the return on my work from anywhere passive income trade.