How I Follow the Expert Fund Managers

A great passive income strategy for accredited investors begins with following the expert fund managers. For those of us who want to retire early we need to be sure we’re investing in solid companies. And who better to follow than the expert fund managers who manage billions of dollars? Every quarter fund managers with at least $100 million of assets under management file a Form 13F. The 13F shows the companies each fund bought and sold over the course of the most recent quarter. For detailed explanation of the 13F process read this.

When the 13Fs come out each quarter I review the companies bought and sold by my favorite expert fund managers. I look for several things when I do this.

Buys and Sells

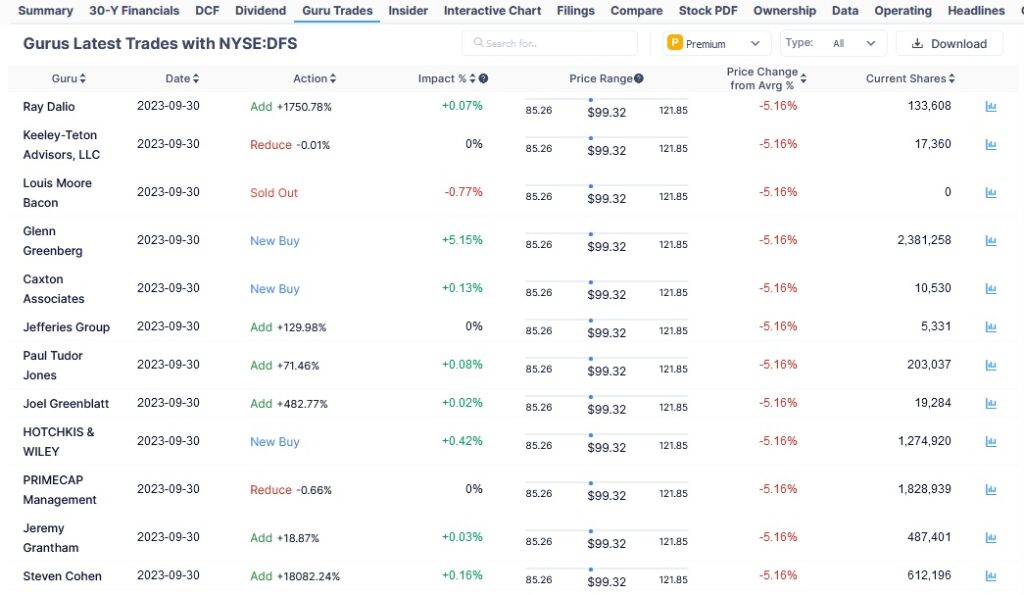

The first is if the company was bought or sold. On the ‘Buy’ side I look to see if it’s a new buy or an addition to an existing holding for that expert fund manager. On the ‘Sell’ side I look to see if the sale was to reduce the size of the position a little or to sell out of the position completely. Here is where I find this information.

I also look at the magnitude of each transaction. For many ‘add’ buys and ‘reduce’ sells, it can be more of a rebalancing of the portfolio than an actual addition to or subtraction from the portfolio. It’s common for an expert fund manager to adjust positions up or down by less than 1% each quarter. Just because the fund manager adds some shares to a position, it doesn’t actually mean the fund manager has a higher or lower conviction about that particular company at that point. That’s why it’s really important to look at the dollar value of the transaction in relation to the fund’s overall value.

A good example is DFS below. We can see how Keeley-Teton reduced their position by 0.01%, which had a very small impact on their overall portfolio. That’s technically a sale of DFS. Then we have Glenn Greenberg, who bought over 2.3 million shares with an impact of over 5% to his overall portfolio. It appears Glenn Greenberg feels pretty strongly about DFS, while Keeley-Teton may not have much of a change in opinion on DFS, even though they sold some shares.

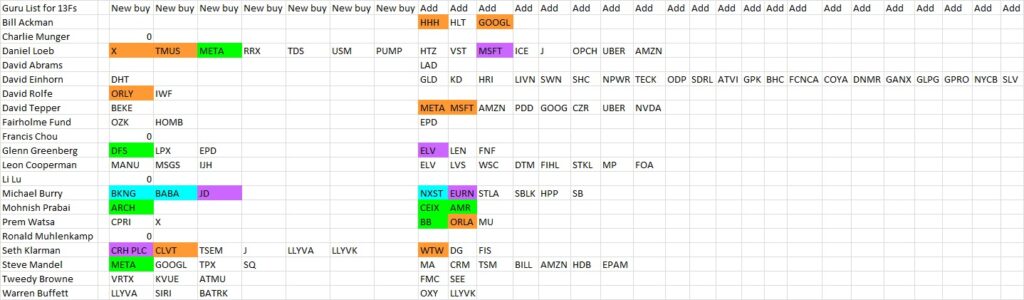

I like to list out all of the new buys, adds, reduces, and sold outs for each expert fund manager on my favorite guru list. Then I color code each buy or new buy by the percentage impact to the guru’s portfolio. I use orange if it’s a buy of 2%+, purple for 3%+, blue for 4%+ and green for 5%+. The visual that this gives me of who is buying what, and how much, in relation to their overall portfolio helps me see similarities between the bigger transactions. Here’s the sheet I just put together for the 13Fs from November. Those 13Fs report what the expert fund managers did in 3Q23.

Large Buys Can Mean a Good Company

For the portfolios of the gurus I follow META was a 5%+ buy in two different portfolios. DFS and ARCH were new buys for 5%+ in different portfolios. CEIX, AMR and BB were 5%+ additional buys in different portfolios. That gives me a starting point on some companies for a closer look.

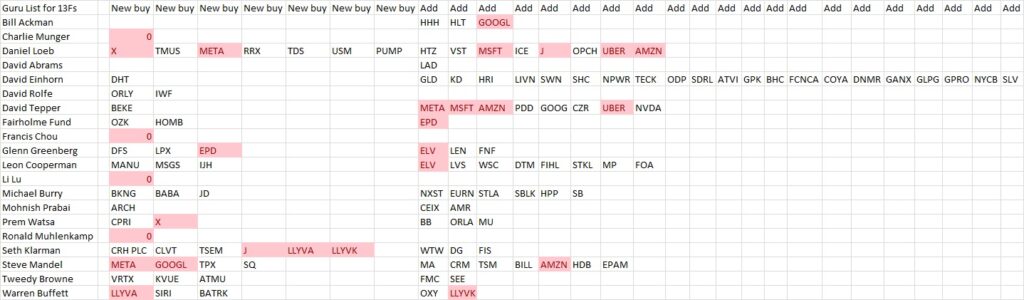

Duplicate Buys Can Mean a Good Company

I also like to do conditional formatting on the buys and sells to look for duplicates. The more duplicate buys, the better. This time around the expert fund managers I follow had more than one hedge fund buy each of the following companies: GOOGL, X, META, MSFT, J, UBER, AMZN, EPD, ELV, LLYVA and LLYVK. Even though these are duplicate buys, it’s possible that some funds are buying a company with small rebalancing transactions. So I want to look at the size of the transactions in relation to their overall portfolio.

Just because the expert fund managers who run large hedge funds are buying a certain company, or one large hedge fund is buying a lot of one company, does not mean that I should buy it. This just points me in a direction. Once I have a company on my radar, then I need to do more research on that company. Here is more information on how to do that.