How to Roll a Call Option

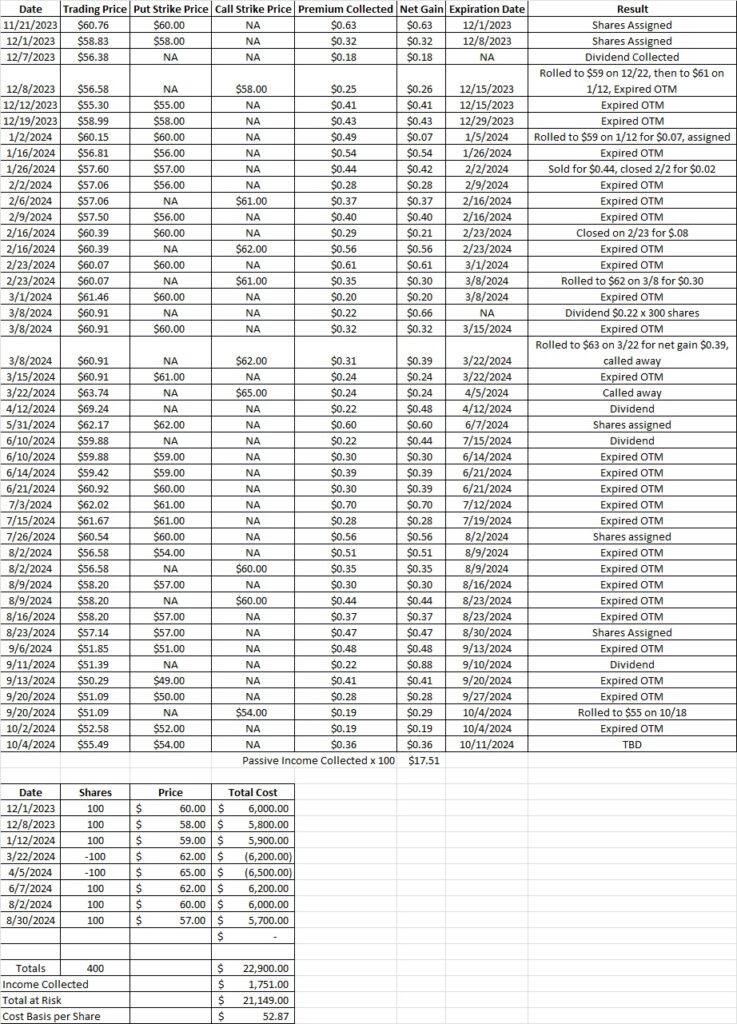

Today we’re talking through how to roll a call option contract. We currently have 400 shares of OXY in this portfolio with a cost basis of $52.99 per share. We have a put at the $52 strike and a covered call at the $54 strike, both with the 10/4 expiration date. Here’s the post where we walk through selling to open the put option. The post where we walk through selling to open the covered call option is here.

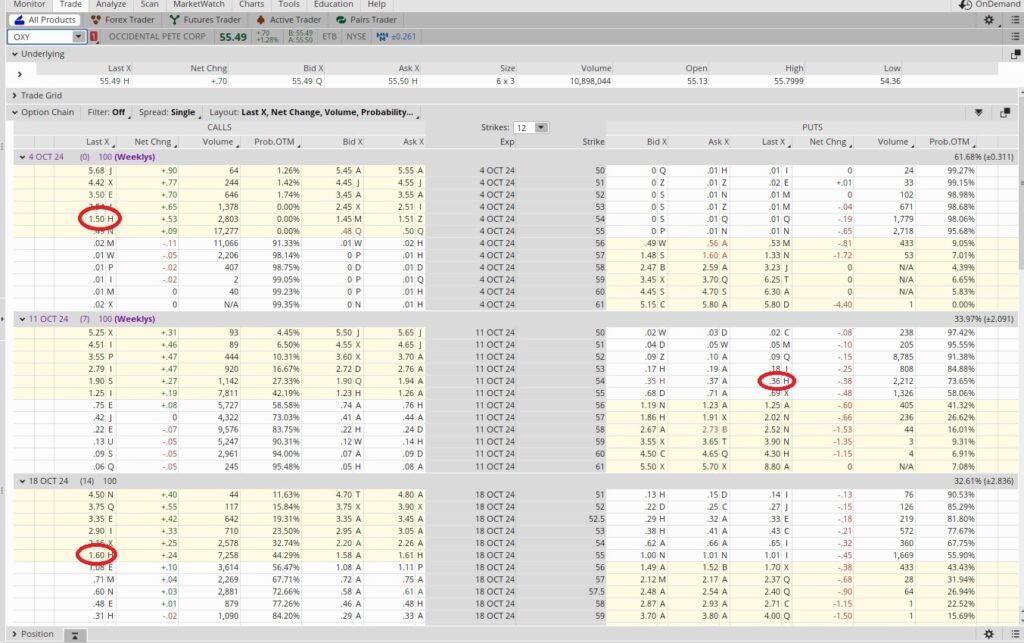

OXY has run up this week and is currently trading at $55.49. We can see the $54 call is in the money. So our shares for that contract will be called away at market close unless we take action. We sold to open the call for $0.19 back on 9/20. Right now it would cost us about $1.50 to close the contract. Since we took in $0.19 when we sold to open the contract, we’ll be down a net $1.31 if we buy to close the call ($1.50 to close it minus the $0.19 we received when we opened it). So we’ll look for a trade that gives us at least $1.31 before we close our covered call.

Since our cost basis is currently $52.99 per share we’ll make money if we let our shares go at $54. We’ll make money on the sale and also reduce our cost basis on our remaining 300 shares to $52.65. It’s nice to reduce our cost basis, but would we rather have 400 shares at $52.99 or 300 at $52.65? There’s not a huge difference, and we’re comfortable owning OXY in the current price range. So we could let the shares go and make money. Or we could explore some choices and possibly make more money.

We can see the $55 call for the 10/18 expiration date is going for $1.60. When we look at how to roll a call option we need to review the math to be sure we’re happy with the new trade. We could close our current contract for a loss of $1.31. When we roll it to $55 we could net a gain of $0.29 (the $1.60 in premium for the 10/18 call at $55 minus the $1.31 from closing our $54 call option). So we’ll make some money on the options premium. We could also make another $1 per share when we sell the shares if the call goes in the money. Since OXY is trading at $55.49 right now it’s already in the money, so unless OXY drops we’ll sell these shares at $55.

This trade is two weeks long, which means we could do this trade 26 times over the course of a year. We’ll make an extra $1 by selling our shares at $55 vs the current $54. And we’ll make another $0.10 on the trade. We’d be making $0.19 in premium if we let the shares go right now. Rolling to 10/18 would net us a total of $0.29 in premium, which is only $0.10 more than our current trade.

So if our shares do not get called away we’d net $0.10 on our capital over two weeks. That’s not great. But if our shares get called away we’ll net $1.10 per share. We divide that $1.10 into the $54 we would get right now and we get 0.204. Then we multiply that by our time multiplier (26), and we get 0.529. That’s an annualized return of 53% by rolling the trade from the $54 strike to the $55 strike. That’s worth it to us.

Now that we’ve walked through how to roll a call option let’s also look at the premium for a put. We can see the $54 strike for the 10/11 expiration date is giving $0.36 in premium. Let’s run through the math on that. It’s a one week long trade, so we could do this trade (or a similar trade on a different company) 52 times over the course of a year. That makes our time multiplier 52. We’re risking $54 per share to make that $0.36 in premium. So we divide $0.36 into the $54 strike price and we get 0.0067. Then we multiply that by our time multiplier of 52. That gives us 0.347. That’s an annualized return of 34.7% on our capital for this cash secured put option. We’ll take it.

Weekly Trade Recap

We looked at how to roll a call option, and we rolled our $54 covered call that expires today to the $55 strike expiring 10/18. We also sold to open the $54 put for the 10/11 expiration date for $0.36 in premium. Those trades together bring our cost basis down to $52.87 per share.