Income Generation Options Trade

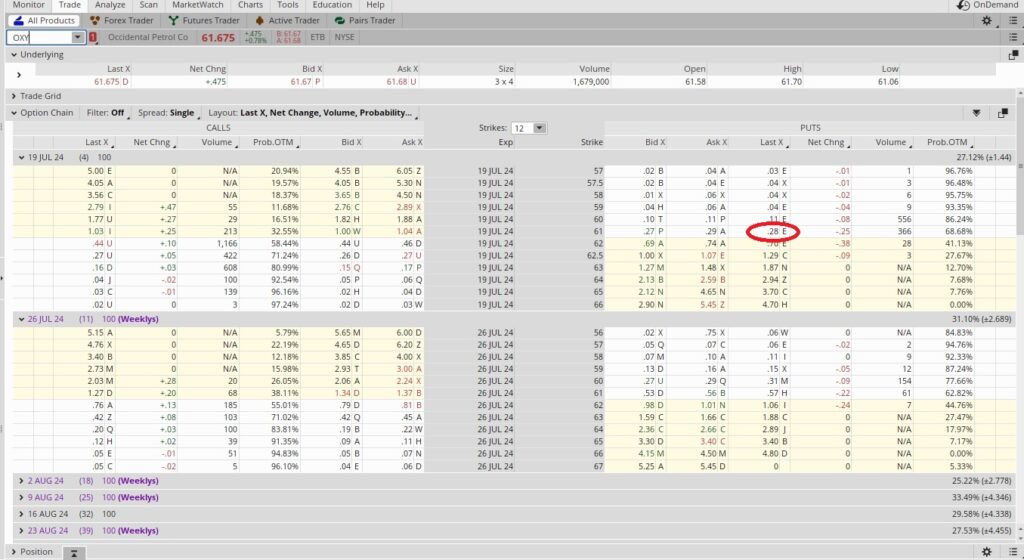

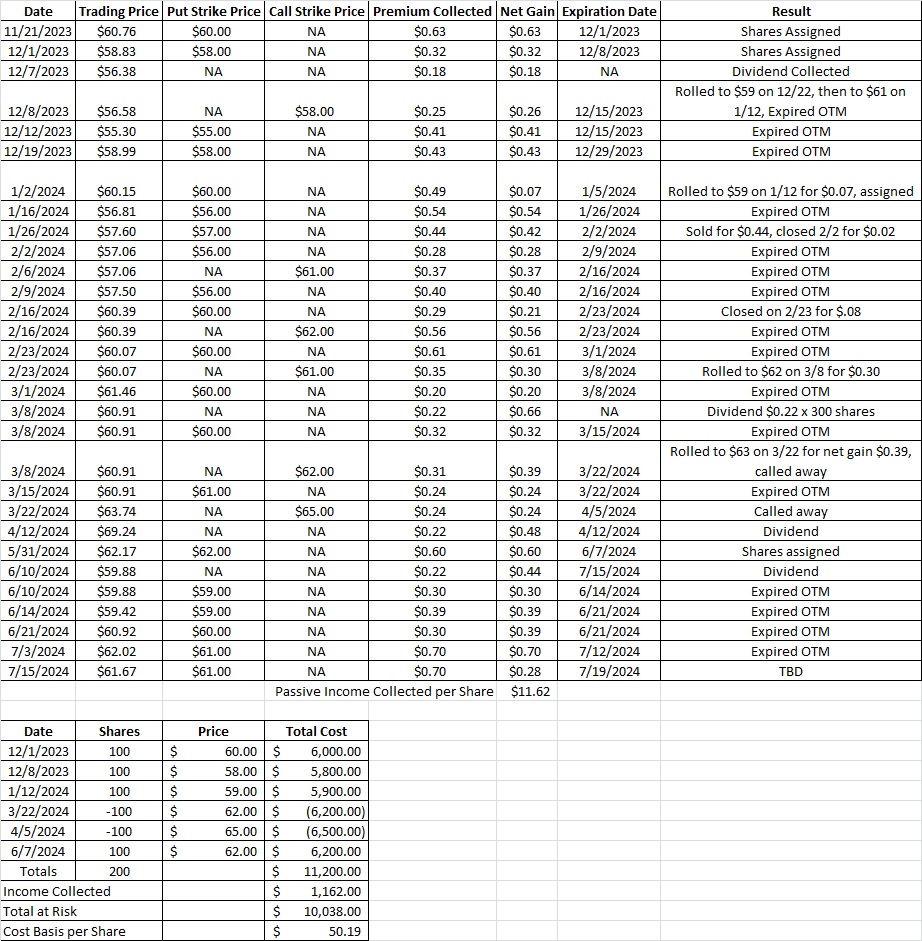

Our income generation options trade lately has been a wheel trade on OXY. We currently have 200 shares of OXY in this portfolio. We sold a cash secured put at the $61 strike price that expired out of the money on Friday, 7/12. Now we have access to that capital again so we’re going to sell another put. It’s the start of the third quarter right now.

Before we sell to open another put option contract we should check to see when OXY’s earnings announcement is. That’s scheduled for after market close on 8/7. We can sell a put with an expiration date prior to that without needing to worry much about what might happen with their earnings announcement.

Weekly Options Trade

Right now OXY is trading at $61.67. The $61 strike for the put option with the July 19 expiration date is trading at $0.28. Today is 7/15, so this trade will expire in four days. We divide the total number of days in a year (365) by the length of the trade (4), and that gives us 91. So in theory we could do this trade 91 times over the course of a year.

Then we take the premium we get for selling this cash secured put option contract ($0.28) and divide that into the capital we’re going to risk on this routine options trade. That amount is our strike price, which in this case is $61. That $0.28 in premium dividend into the $61 strike price is 0.0046. Then we multiply that by our time multiplier, which is 91. So 91 times 0.0046 is 0.418. That’s 41.8%. This income generation options trade will give us an annualized return of 41.8%. Here’s a tool that helps with the math. We’re happy with that return.

Since one contract is for 100 shares, we need to have 100 times the $61 strike price, or $6,100. If we sell two cash secured puts, we’ll need $12,200 available in our brokerage account.

Cost Basis per Share

Since we sold the $61 put we’ll need to keep an eye on OXY this week. If OXY continues to trade above $61 per share from now through the expiration date on Friday, 7/19 our put will expire out of the money. If OXY is below $61 at expiration, we’ll be assigned the shares at the $61 strike. We could also buy to close the position and roll it to another strike price. After selling to open this income generation options trade our cost basis is down to $50.19 per share.

Trade Recap

We currently have 200 shares of OXY in this portfolio. We sold the $61 put expiring this Friday, 7/19 for $0.28. If we get assigned we’ll have 300 shares with an overall cost basis of $53.79 per share. Then we can sell a call on those shares at the $61 strike to further reduce our cost basis. If the put expires worthless out of the money we’ll still have 200 shares, and our cost basis per share will be $50.19.