Keep the Premium for Monthly Cash Flow

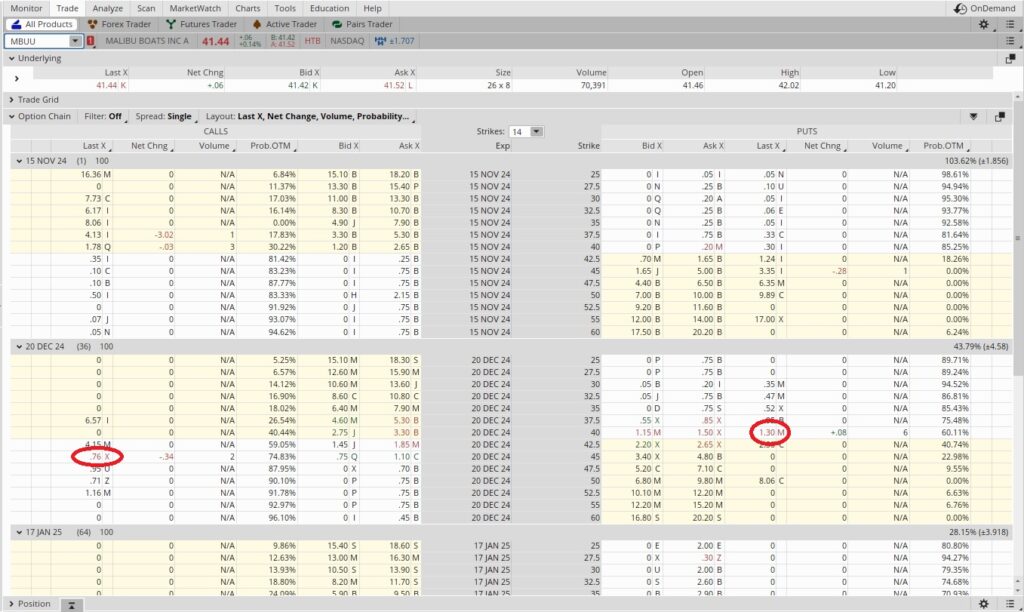

This month we have two sets of contracts on MBUU that will both expire out of the money tomorrow, 11/15. We have one contract of the covered call at the $45 strike price. We also have two contracts of the cash secured put option at the $35 strike. Both positions will expire out of the money tomorrow, and we’ll keep the premium for monthly cash flow. Now we’re going to sell to open more option contracts to create some additional passive income.

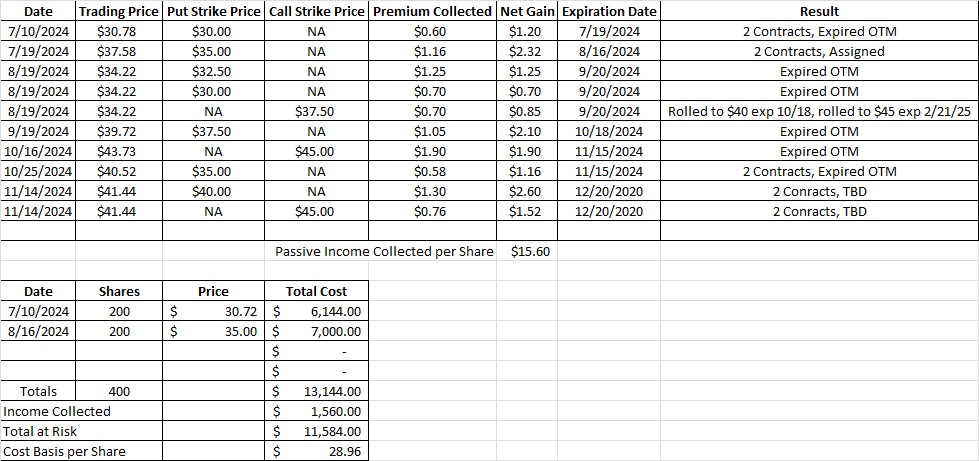

We currently have 400 shares of MBUU in this portfolio with a cost basis of $29.99 per share. Our lowest purchase price was $30.72 per share, and we have been able to reduce our cost basis selling options. With MBUU trading at $41.44 we’re going to sell another cash secured put below the current trading price. We’re also going to sell a covered call at a strike that is above the current trading price.

We like the $40 strike price for the cash secured put option contract. We sold to open the $40 put option with the 12/20 expiration date for $1.30. This trade was two contracts, so we took in $260 in passive income on this trade. If MBUU stays above $40 through expiration these puts will expire out of the money and we will not be assigned shares. If MBUU drops and is trading below $40 per share at expiration then we’ll be assigned shares at the $40 strike price. Either way, we’ll keep the premium for monthly cash flow. Remember that each put option contract obligates us to buy 100 shares of MBUU at the strike price. That means we need to have $4,000 in our brokerage account for each put option contract we sell to open.

When we sell cash secured puts we want to be sure we’re getting enough premium to make it an acceptable return on our investment. In this cash it’s a one month long trade, and there are twelve months in a year. That makes our time multiplier 12. Then we divide the premium by the strike price. So we take $1.30 and divide that into $40, and that gives us 0.0325. Then we multiply that by our time multiplier (12) and we get 0.39. That’s an annualized return of 39% on the capital we’re risking by entering into the contract. That’s above our 20% target, and we’re happy to own shares of MBUU at $40, so we’re going to go ahead with this trade. Here’s the tool we use to help do that calculation.

We’re also going to sell the covered call at the $45 strike price for the 12/20 expiration date. We sold to open that contract for $0.76, and we did two contracts. So we brought in $152 on both of those combined. If MBUU is trading above $45 at expiration we’ll be obligated to sell the shares at $45. We could also close the position and open a new one that is further out in time if we prefer to keep the shares. If MBUU is trading below $45 from now through expiration the covered call option will expire worthless. Regardless of where MBUU is trading we’ll keep the premium for monthly cash flow.

Weekly Trade Recap

We currently have 400 shares of MBUU in this portfolio with a cost basis of $29.99 per share. We sold to open two cash secured put option contracts at the $40 strike for $1.30 each. Then we sold to open two covered call option contracts at the $45 strike for $0.76 each. In total we brought in $260 on the puts and $152 on the calls, for a total of $412 in passive income. We’ll keep the premium for monthly cash flow regardless of whether or not these contract expire out of the money. These trades bring out current cost basis per share down to $28.96.