Learn to Trade Options

When we wanted to learn to trade options we started with simple cash secured put options. We found a company we wanted to own that was trading near a price we wanted to buy shares. Then we started selling cash secured put options just below the trading price. We collected the option premium several times and were eventually assigned shares. We then started selling covered calls on a portion of those shares, using the passive income from the option contracts to build equity in the shares we owned. As the trading price of the company we owned rose, we had some shares called away. That reduced our basis on the shares we held. Then the trading price pulled back, and as that happened we began selling more put options. The premium from those put options gave us cash flow from options trading.

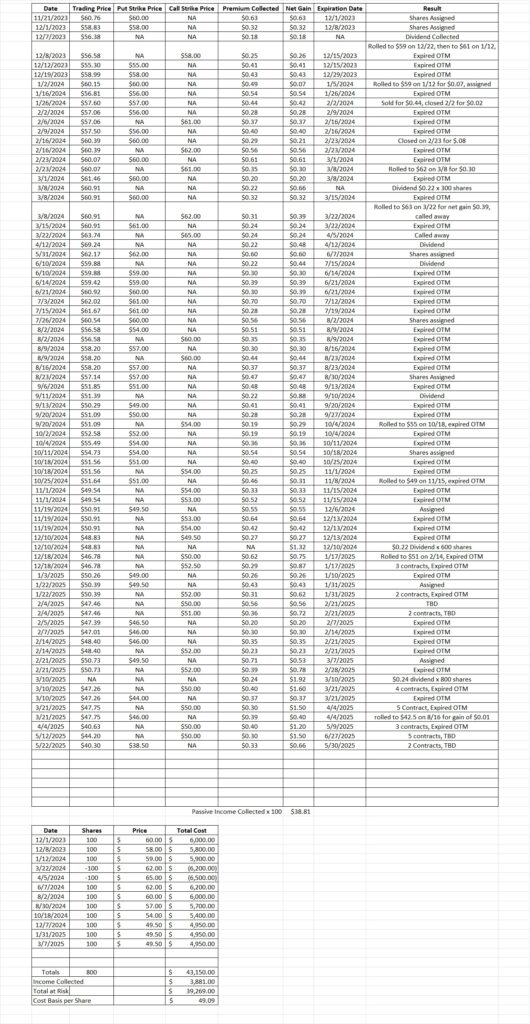

Fast forward to today. In this portfolio we currently own 800 shares of OXY with a basis of $49.17 per share. We have five covered calls at the $50 strike for the 6/27 expiration date. We also have one contract of the $42.50 put for the 8/16 expiration date. Then we have the $0.24 dividend coming up. OXY goes ex-dividend on 6/9, so we can be more aggressive with our covered calls after that date. Here is our most recent post on OXY. So we have a few trades on OXY right now, and we’re using the options premium to reduce our basis per share. When we learn to trade options we want to use simple, high-probability trades like these to boost our return.

Today OXY is trading at $40.30. After pulling back yesterday and this morning we’re going to sell to open another cash secured put option position. Our lowest purchase price for OXY so far in this portfolio is $49.50, so getting a tranche here has the possibility to move our basis down quite a bit. It was also give us more shares to collect the upcoming dividend.

When we sell to open a put option contract we need to have enough money in our brokerage account to cover 100 shares of the company we choose for the put. So when we sell a put we need 100 times the strike price available in our brokerage account. We want to generate the highest return we can, but we also want to be safe with our put option.

Since we already have shares of OXY we don’t want to sell a put right at the money because it’s more likely we’ll be assigned shares. We also don’t want to sell a put option that is super far below the trading price because we won’t collect enough premium to make it worth doing the trade. So we target the sweet spot between a good return on the premium but far enough away that we’re unlikely to be assigned the shares. That usually means an annualized return of 20%+ on the capital we’re risking. The risk is that we end up buying the shares of the company. So we only want to do these trades if we’re comfortable buying the company at the strike price we choose.

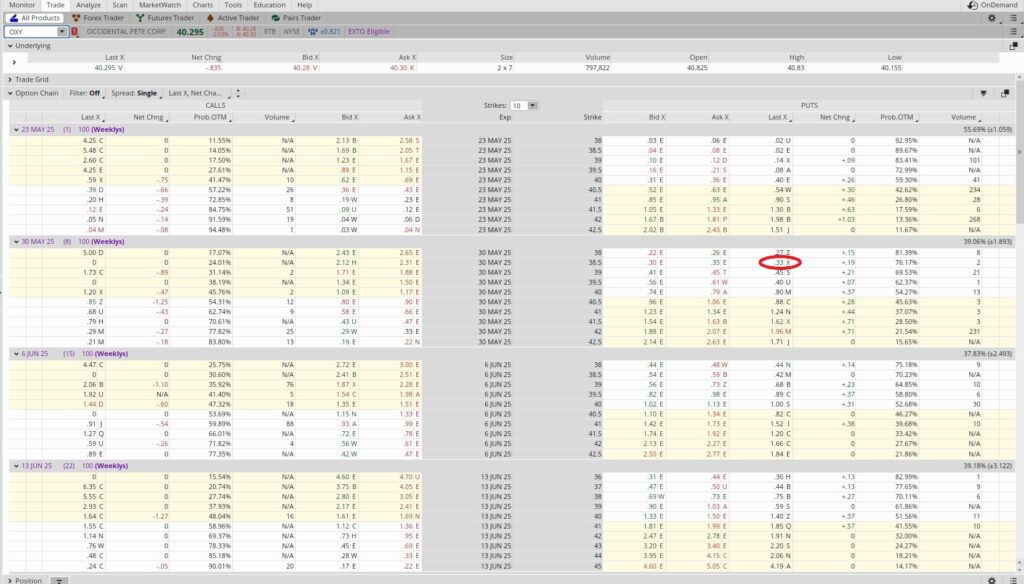

The $38.50 strike for the 5/30 expiration date looks good. We sold to open the $38.50 put option for $0.33. We need to have 100 times $38.50 in our account for each contract we sell, or $3,850. When we learn to trade options we want a framework for choosing our put option strikes. So let’s discuss how we evaluate the possible strike prices.

One variable is the time period of the trade. Is the expiration date is out one week from now or one month from now? In this case the contract expires next Friday, 5/30. That’s eight days from now. So we take the 365 days that are in a year and we divide that by the time period for the trade. So that’s 365 divided by 8, which gives us 45. That 45 number becomes our time multiplier.

Then we look at the premium for the contract and divide that into the strike price. In this case we got $0.33 for the contract, and we divide that into the $38.50 strike price. That gives us 0.0086. Then we multiply that by our time multiplier of 45. That gives us 0.386. That’s an annualized return of 38.6% on the capital we’re risking on the put option. That’s a strong return, and the risk is that we buy more shares of OXY. If that happens we’ll own more shares of a company we want to own, it will reduce our basis, and we’ll be eligible for the dividend. When we learn to trade options we want to be sure we consider each of those factors. They are each positive, so we went ahead with the trade.

Weekly Trade Recap

We sold to open two contracts of the $38.50 put option on OXY for the 5/30 expiration date. We currently have 800 shares of OXY in this portfolio, and this trade brings our basis down to $38.81 per share. We’ll be eligible for the upcoming $0.24 dividend on 6/9 with the shares we own right now. We’ll also get the dividend on these new shares if we are assigned.