How we Used an Option Strangle to Open a Position

Today we used an option strangle to open a position in a company we want to own. The company is CPRI. We like them because Seth Klarman of Baupost Group and Jeremy Grantham both recently opened a position in the company. Prem Watsa also owns shares of the company and recently added to his position. We learned of these transactions by going through the form 13F for each of those funds. Here’s where we do that research.

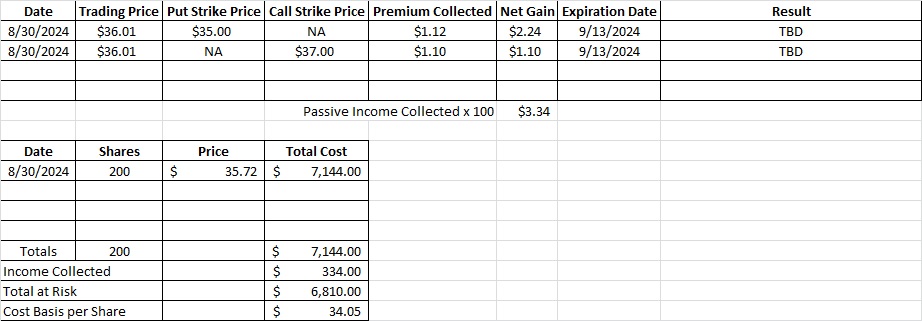

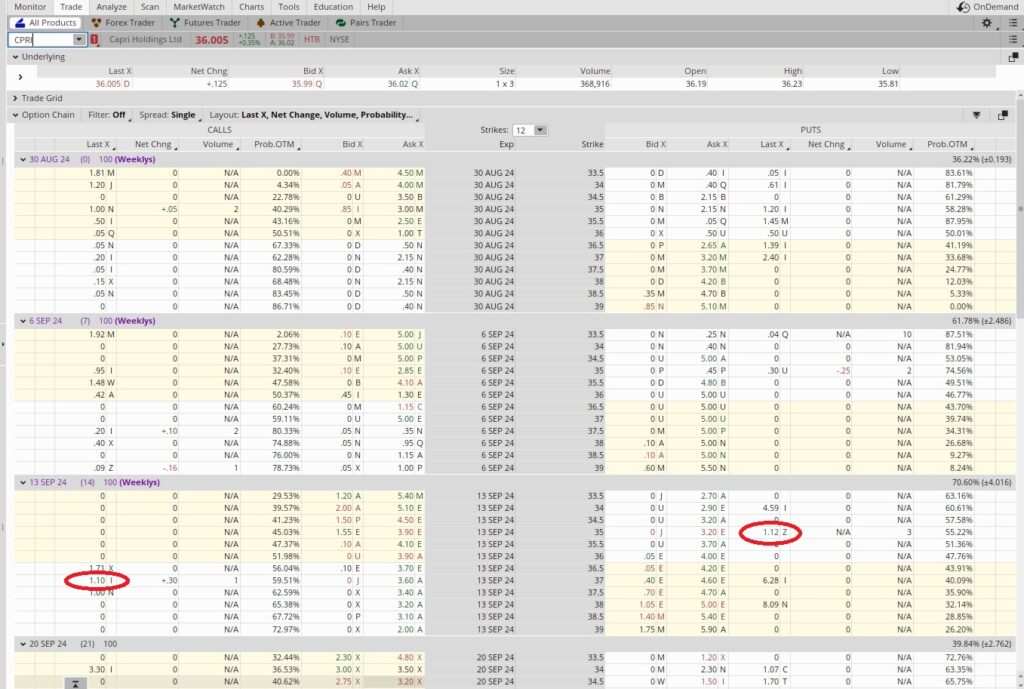

In this portfolio one tranche is about $6000. We bought 200 shares of CPRI outright at $35.72 today, 8/30. Then we sold two puts at the $35 strike with the 9/13 expiration date. The option chain below shows we received $1.12 in premium for each put. That premium is super high so let’s walk through the math. We did a two week trade, so we could theoretically do this trade 26 times over the course of a year. So our time multiplier is 26.

Then we look at the amount of capital we’re risking on this trade and compare that to the premium we get for selling the put option contract. In this case we received $1.12 to risk $35. So we divide the $1.12 into the $35 and we get 0.032. Since we could do this trade, or a similar trade on a different company, 26 times over the course of a year, we multiply that 0.032 by 26. That gives us 0.832. That’s an annualized return of 83.2%. That’s solid and we’ll take it. We use this tool that helps do that math. If we get assigned these shares our cost basis per share on this tranche will be the $35 strike price minus the $1.12 in premium, or $33.88 per share.

We also sold a call on CPRI at the $37 strike. We only sold one call because there’s a chance CPRI runs up through our call strike. If that happens we want to be sure that we’ll have some shares to ride CPRI up further. By using an option strangle to reduce our cost basis per share our entry is much more attractive.

Trade Recap

We bought 200 shares of CPRI at $35.72 per share. Then we sold two put option contracts at the $35 strike with the 9/13 expiration date for $1.12 in premium on each one. We also sold to open the $37 call, also with the 9/13 expiration date, for $1.10 in premium. That brings our cost basis down to $34.05 per share. Here’s how it looks after we used an option strangle to open a position: