Option Trade for Cash Flow

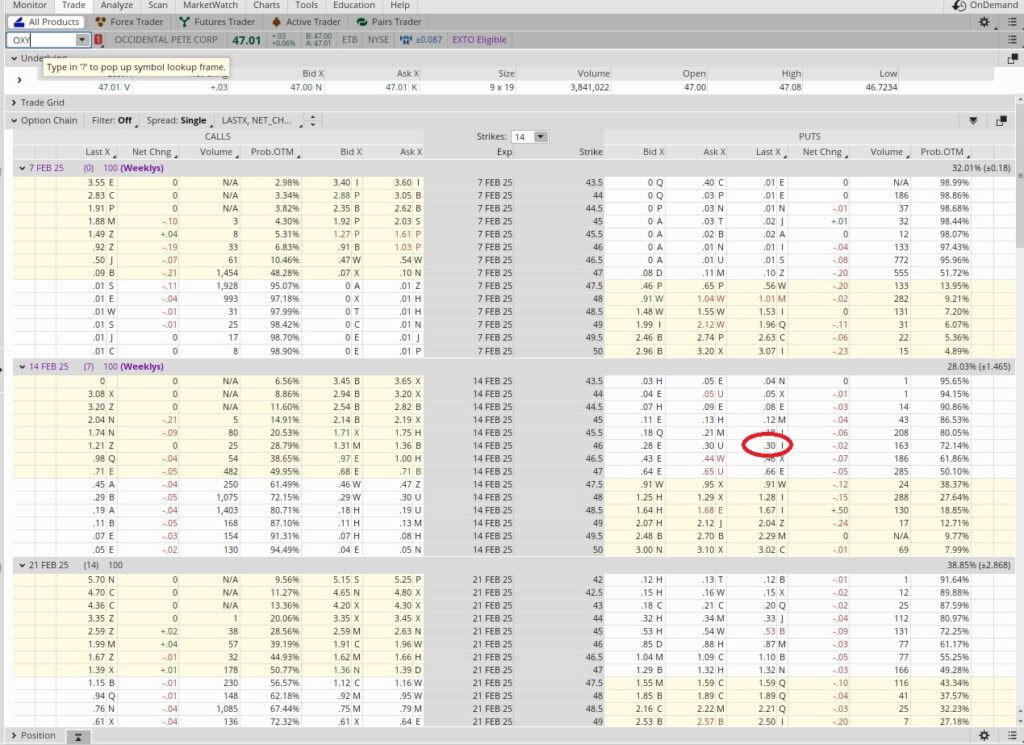

Our option trade for cash flow this week is to sell a put on OXY. We have a cash secured put on OXY at the $46.50 strike that will expire out of the money today, 2/7. So we’re going to re-deploy that capital.

When we sell to open a cash secured put we need to have enough capital available in our brokerage account to take the shares if the contract goes in the money. Since each option contract represents 100 shares, we need to have 100 times the strike price available.

We’re selling to open the $46 put for the 2/14 expiration date. So we’ll need to have $4,600 available in our brokerage account for each contract we sell to open.

This trade lasts one week, and there are 52 weeks in a year. So 52 is our time multiplier for this trade. When we sell an option trade for cash flow we want to be sure we’re factoring in the annualized return. OXY has earnings coming up on 2/18 so we want to be aware of that when selecting our expiration date. Here is where we find that information.

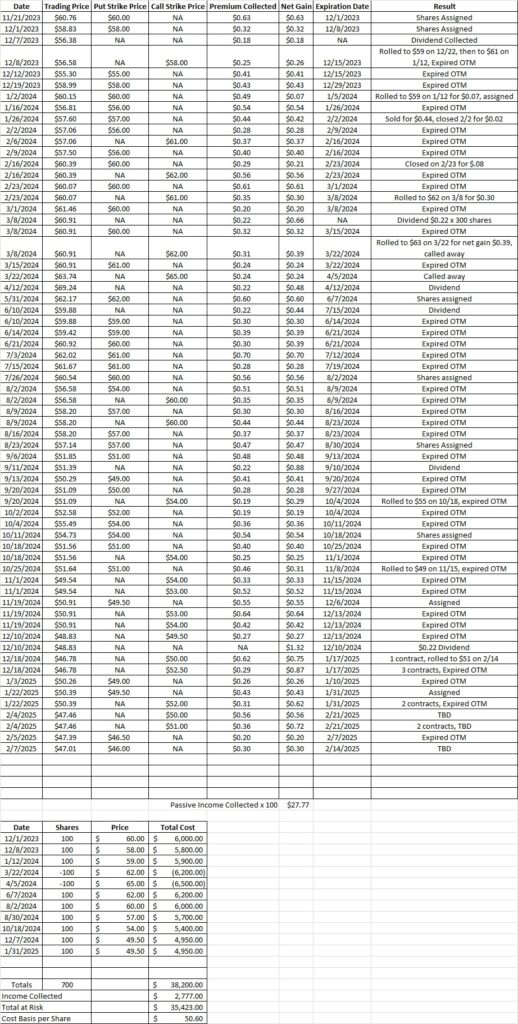

Then we look at the premium. We received $0.30 in premium when we sold to open this put option. SO we take $0.30 and we divide it into the strike price of $46. That gives us 0.0065. Then we multiply that by our time multiplier of 52 and we get 0.339. That’s an annualized return of 33.9% on our capital. Remember that we’re only selling this option trade for cash flow because we’re happy taking more shares of OXY in this price range. Here’s a link that walks through one of our recent trades on OXY.

This easy option trade brings our basis on OXY down to $50.60 per share.