Using Options Premium for Cash Flow

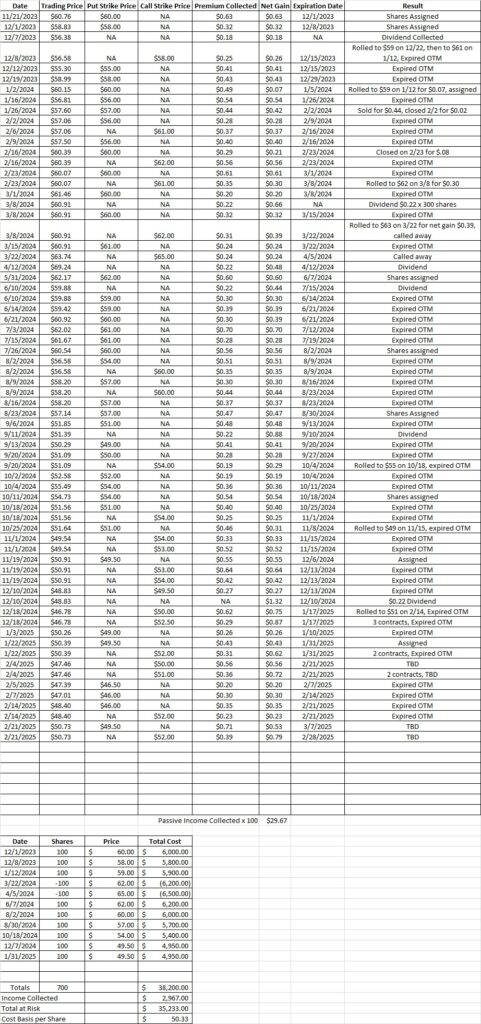

We’re using options premium for cash flow and we have two positions expiring today. We currently own 700 shares of OXY in this portfolio with a basis of $50.52 per share. Right now OXY is trading at $50.73 per share. We’re going to sell a put below the money to generate passive income with options premium. We’re also going to sell a covered call above the money.

With OXY trading at $50.73 per share we can sell the covered call just above the current trading price. If OXY runs up through the strike and some of our shares are called away we’ll make money selling those shares. If OXY stays where it is or drops, we’ll still make money because we’re using option premium for cash flow. We sold to open two contracts of the $52 covered call for the 3/7 expiration date. We brought in $0.39 per share in passive income on this trade for a total of $78.

We’re also going to sell to open a cash secured put option just below the money. The options premium from this trade will give us cash flow and will also reduce our basis. We’re selling the put at the $49.5 strike because we’re happy to buy more shares of OXY at that price. We brought in $0.53 per share on that contract by using options premium for cash flow.

One put option contract is for 100 shares. Selling the $49.50 strike we’ll need to have at least $4,950 in our brokerage account to make this trade. We’ll bring in $53 in passive income when we sell to open this contract. To figure our return, we first look at the duration of the trade. This trade is for two weeks. Two weeks goes into one year 26 times, so 26 is our time multiplier. Then we take the premium of $0.53 and divide that into the $49.50 strike. That gives us 0.0107. We multiply that by our time multiplier and we get 0.278. This gives us an annualized return of 27.8% for the period we’re risking our capital. Here’s the tool we use to do that math.

Using options premium for cash flow has helped us bring our basis on OXY down to $50.33 per share.