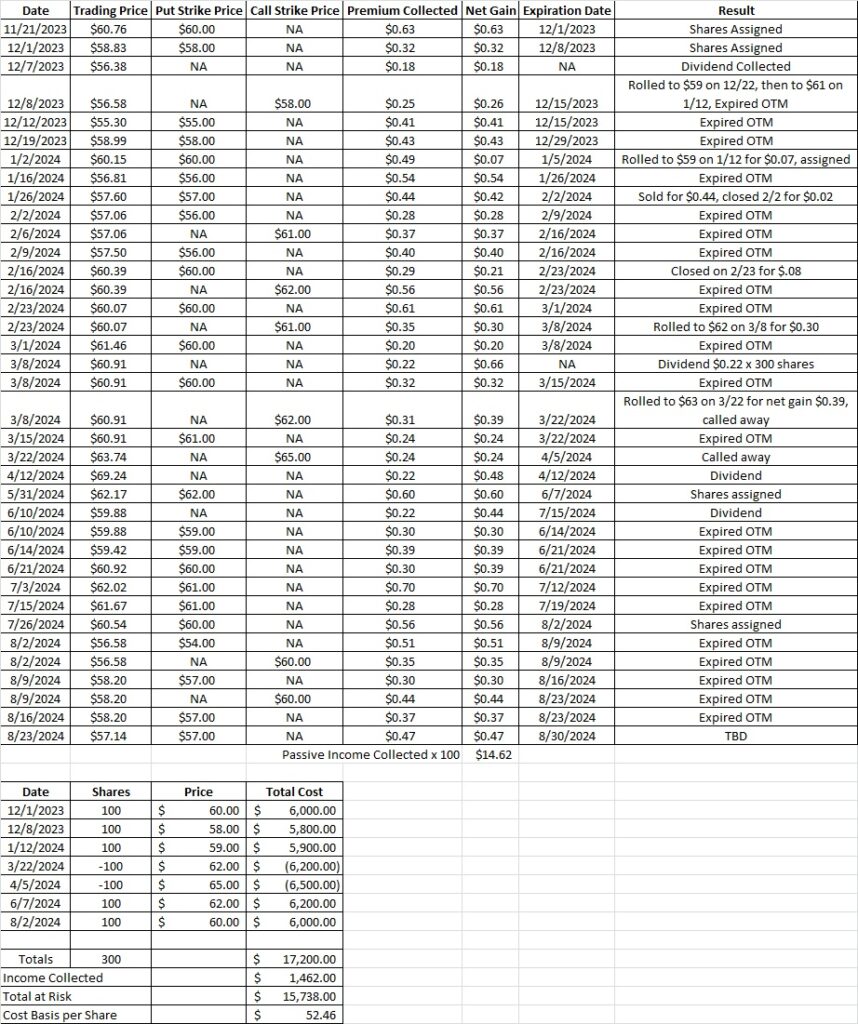

Options Trade for Cash Flow

Our options trade for cash flow today is a strangle on OXY. Last week we took advantage of the upcoming dividend to sell a put very close to the money on OXY. We also have a call option contract on OXY that will expire out of the money today, 8/23. OXY is just above our put option strike, so we’re going to look at rolling that contract vs getting assigned.

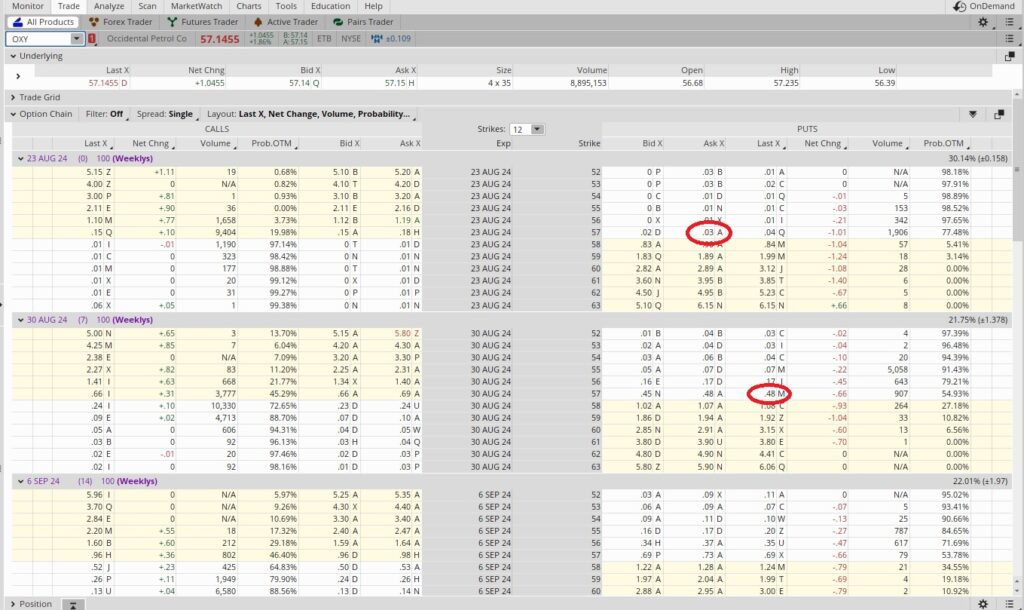

We currently have 300 shares of OXY in our portfolio. We also have a put at the $57 strike and a call at the $60 strike. Both options contracts expire today and OXY is trading at $57.14. Our call will expire worthless at market close, so we’ll keep that premium and our shares. Our put is borderline. We’ll keep the premium we collected when we sold to open that trade, and we might also buy those shares. We have some choices on how to handle this options trade for cash flow.

One choice is to let the day run its course and see where OXY lands at market close. We’re happy to buy shares at $57 and that’s what will happen if OXY closes below $57 today. Since we received $0.37 in premium when we sold to open that put option contract, our effective cost basis per share would be $57 – $0.37 = $56.33 if we are assigned the shares. Our overall cost basis on OXY will be lower than that because our current cost basis per share is $52.62.

We could also buy to close our put option contract. Since we received $0.37 in premium when we sold to open the contract, as long as we can close it for less than $0.37 we’ll have made money on the trade. Right now we can buy it back for $0.03, which means we we’ll lock in a profit of $0.34 by exiting the trade.

We could also roll the contract. That means we could buy to close the put option, then sell to open another put option that is further out in time. Doing that would generate more premium. We could also move the strike price from $57 down to $56, or we could use the same $57 strike.

Since we’re doing this options trade for cash flow we want to safely generate as much cash flow as we can. So we’re going to roll the trade to generate more options premium. We’re able to buy to close the put option contract for $0.03. That locks a profit of $0.34 on the expiring put. Then we sold to open the $57 put that expires next Friday, 8/30. That put gave us $0.48 in premium.

To figure our annualized return on that trade we take the $0.48 in premium we received for selling to open the contract and divide that into the $57 put strike. That gives us 0.008. This is a one week long trade, so in theory we could do a trade similar to this on OXY or a different company each week over the course of a year. That would be 52 trades, so we multiply the 0.008 by 52 and we get 0.438, or an annualized return of 43.8%. That works for us. This tool helps with that annualized return calculation.

With OXY’s dividend coming up we’re not going to sell a call right now because we want to be sure we collect the dividend.

Trade Recap

This week our put at $57 and call at $60 on OXY will both expire worthless out of the money. Our options trade for cash flow was to sell the $57 put for the 8/30 expiration date for $0.48. That reduces our cost basis down to $52.46 per share. We currently hold 300 shares of OXY in this portfolio. We will begin to sell calls on the shares after we collect the upcoming dividend.