Options Trading Basics

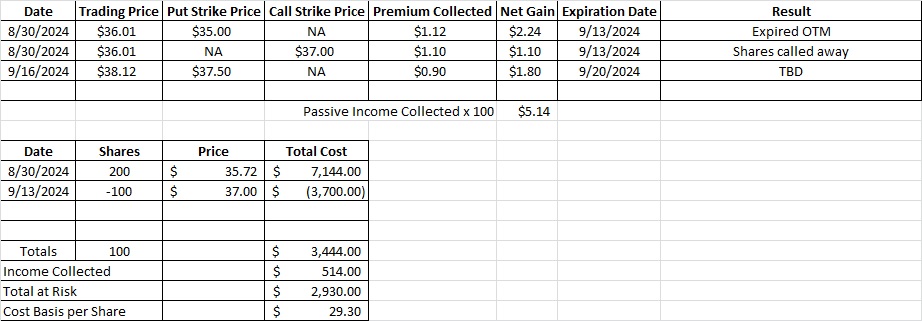

When we’re talking about options trading basics we include things like the strike price, the expiration date, and the overall strategy for the trade. Our last trade on CPRI was an option strangle strategy. We bought 200 shares of CPRI. Then we sold to open two put option contracts at the $35 strike price. We also sold to open one call option contract at the $37 strike price. CPRI closed last Friday, 9/13 at $38.22 per share. Our cash secured put option contracts expired out of the money so we keep that premium without buying the shares. Our covered call option contract at the $37 strike price was in the money, so we sold those shares at $37. After collecting the premium and selling 100 shares at $37 our cost basis stands at $31.10 on our remaining 100 shares.

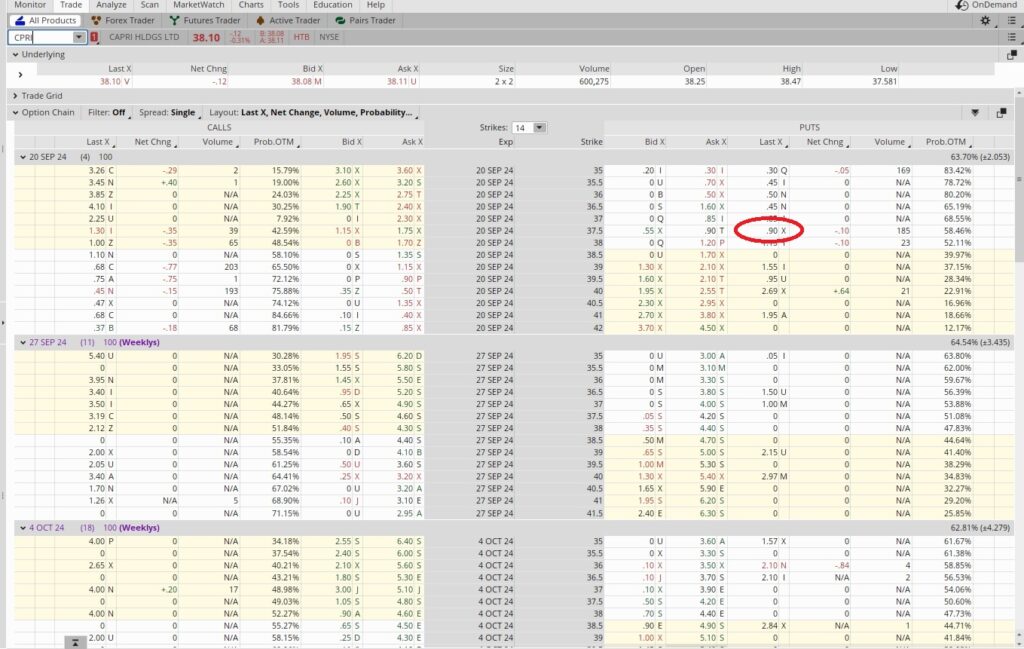

When we’re thinking about options trading basics we want to be sure we’re making effective use of our capital. Since our puts at the $35 strike price expired out of the money last Friday, we now have access to that capital again. So we’re going to sell another put option on CPRI. Today CPRI is trading at $38.10 per share. When we sell a cash secured put option contract we need to have 100 times the strike price available in our brokerage account in case we need to buy the shares. If we sell the $37.50 put option we are making a promise to buy 100 shares of CPRI at $37.50 per share on (or before) the 9/20 expiration date. So we need to have $3,750 available for each contract we sell to open. We’re doing two contracts.

Weekly Option Trade

Today we sold the $37.50 put option contract with the 9/20 expiration date for $0.90 in premium per share. This trade expires this Friday, 9/20, and today is Monday, 9/16. This trade is active for five days, so we’re risking our $37.50 per share for that long. There are 365 days in a year, so we could say that we could do this trade 73 times over the course of a year. We could also say that this trade is effectively one week long, as CPRI has weekly options contracts, not daily options. That would mean our time multiplier would be 52, because there are 52 weeks in a year.

Then we take a look at the premium versus the strike price. In this case we’re earning $0.90 in premium, which means we’re risking $37.50 per share to earn $0.90 in premium. So we take the $0.90 in premium and divide that into the $37.50 strike price, and that gives us 0.024. Then we multiply that by our time multiplier. Since this trade lasts one week, we’ll use 52. So 52 times 0.024 is 1.248. That’s an annualized return of 124.8%. This annualized return calculation is a key component of options trading basics. Here’s a tool that helps with determining the annualized return.

When we get an annualized return this high we should think about why the premium is so high. In this case it’s because the FTC is bringing suit to block the Tapestry acquisition of CPRI. We’re happy to own shares of CPRI over the long term if the merger does not go through, and we’re also happy to own shares if the merger does go through because we’ll get $57 per share at completion of the transaction.

Selling the premium on the $37.50 put option contract with the 9/20 expiration date on two contracts reduces our cost basis down to $29.30 per share.