Options Trading Strategy

Today we’re going to walk through how we used our options trading strategy to create cash flow without selling shares. We’ve been trading MBUU to generate passive income selling stock options. Here’s our most recent post on MBUU.

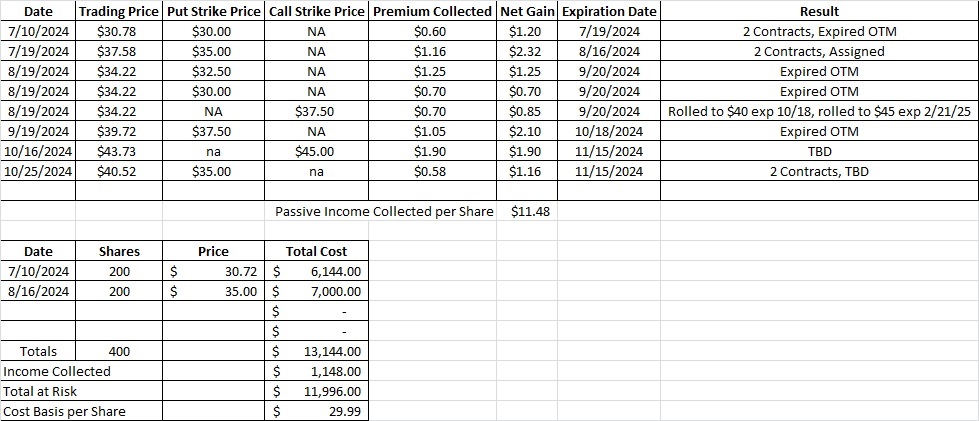

We currently have 400 shares of MBUU. As of our last post we had a cost basis of $30.89 per share. Their earnings call is next week on 10/31 before market open. We usually want to be careful selling puts through earnings releases. In this case our cost basis per share is low enough and or put strikes are low enough that’s we’ll still be buying shares at our on-sale price for MBUU if we get assigned.

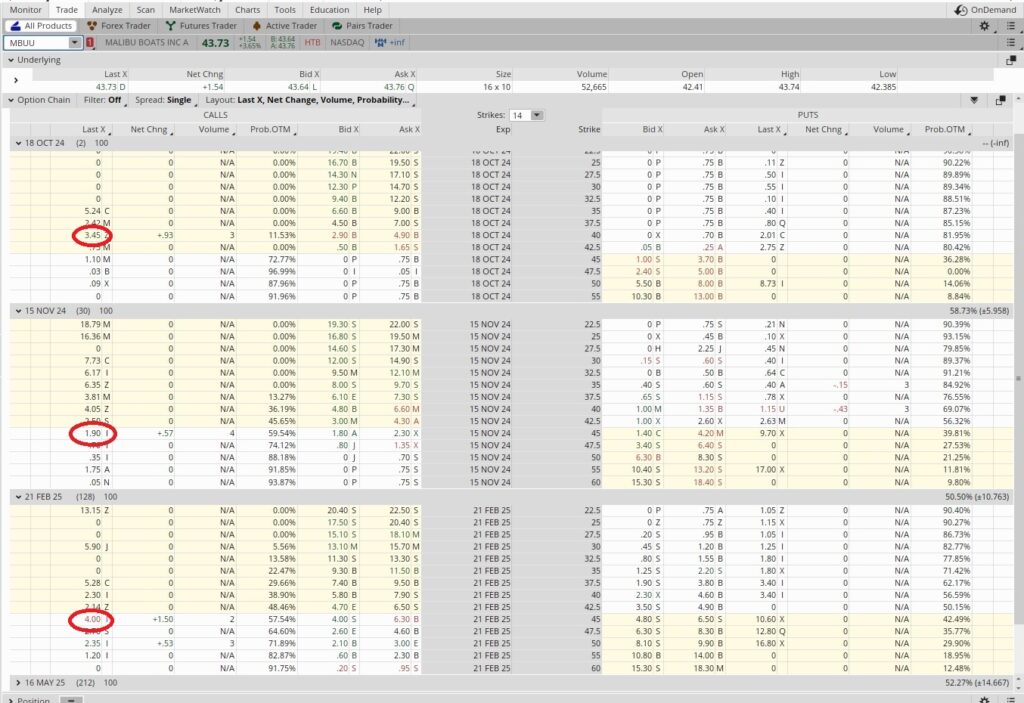

We had the $40 call for the 10/18 expiration date and we rolled that out to the February expiration date. We brought in $0.30 when we rolled from the $37.50 strike on 9/20 to the $40 strike on 10/18. Then we bought to close that covered call option contract for $3.45, which gives us a temporary loss of $3.15. Then we sold to open the $45 call option contract for the Feb 21 expiration date. That gave us $4, we add that to the loss of $3.15, and we’re at a net positive $0.85 for the trade. That’s not much considering we opened the original trade back on 8/19 and the trade is now active through February, so six months in total. But consider the potential sale price.

We had agreed to sell 100 shares at $37.50. Now as part of our options trading strategy we’re agreeing to sell shares at $45. So if we’re called away we getting an extra $7.50 per share. When we divide $7.50 into $37.50 we get 0.2. This is a six month trade, so we could do it twice over the course of a year. That gives us 0.4, or a 40% annualized rate of return, if we are called away. If we’re not called away we just keep the $0.85 in option premium as passive income and our shares. We’re happy keeping these shares because we feel MBUU will be trading much higher by the end of ’25.

Screenshot 10-16 $45 call

We also sold to open the $45 call for the 11/15 expiration date for $1.90 in premium. Since our cost basis was $30.89 per share, we use that number as our risked capital. So we divide the $1.90 in premium into the $30.89 and we get 0.061. This is a one month trade, so we could theoretically do this trade (or a similar trade on a different company) twelve times over the course of one year. So we multiply the 0.061 by our time multiplier of 12 and we get 0.738. That’s an annualized return of 73.8% to reduce our cost basis. We’ll take it. Here’s the tool we use for that math.

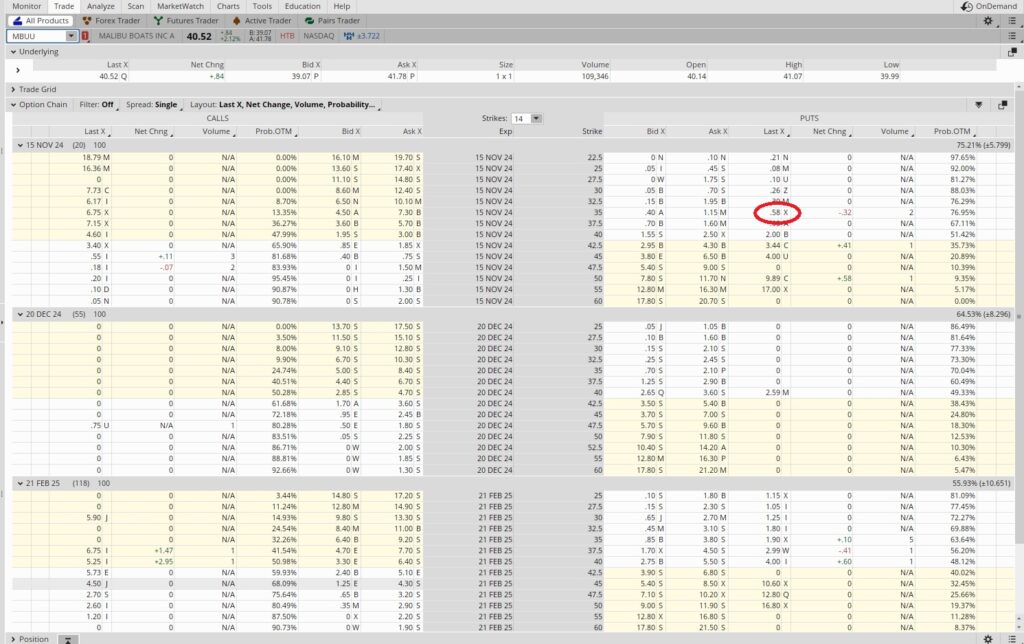

We also sold two more puts at the $35 strike for the 11/15 expiration date. For each contract we’re obligating ourselves to purchase 100 shares of MBUU at $35 per share. We think that’s a steal, and since someone offered to pay us to make that promise, we signed up!

We got $0.58 per share on the $35 put on 10/25. The expiration date is 11/15, so the duration of this trade is 3 weeks. When we divide 52 weeks in a year by 3 we get 17.3, which means we could do this trade 17.3 times in a year. We also divide the $0.58 in premium by the $35 strike price and we get 0.166. Then we multiply that by our 17.3 time multiplier and we get 0.287. That gives us an annualized return of 28.7%. So our options trading strategy pays us 28.7% annualized return to promise to buy a company we want to buy at a price we want to buy it at. Sounds good to us!

Weekly Trade Recap

We rolled our $40 call to the $45 strike with the February expiration date for a net gain of $0.85. We also sold the $45 call for the 11/15 expiration date for $1.90. Then we sold two contracts of the $35 put expiring 11/15 for $0.58 each. Our options trading strategy for passive income has helped us reduce our basis down to $29.99 per share. With MBUU trading over $40 right now, we’re happy with that.