Pick a Company for Passive Income: What does the company mean to you?

You are ready to pick a company for passive income… where do you begin? The most important part of selling options to generate passive income is picking a good company that you want to own over the long term. There are a number of things to consider when looking for a strong company to build passive income with stock options.

Warren Buffet’s four M’s are good place to start when you pick a company for passive income generation. The four M’s stand for Meaning, Moat, Management and Margin of Safety. Here is a short clip of an interview with Warren Buffet’s business partner Charlie Munger, during which Charlie discusses the four M’s at the 6:00 minute mark.

The four M’s are sequential, and the first is Meaning. If I don’t have meaning with a company, I keep looking for another company until I have it. I don’t want to move on to evaluating the company’s Moat if the company does not have meaning for me. The company needs to mean something to me for me to pay attention to the company.

A company that has meaning for me means that I like what the company produces, and also how they produce it or where they produce it. I might own the product the company sells. I might like how they treat their employees or how they donate to a certain non-profit entity that matches my values. I might like how they have a production facility in my town that employs people I know. If I use this company to generate passive income selling stock options, I could end up owning the company for a long time, and I want to make sure I’m interested enough in what the company does that I won’t mind reading about it every day for several months or even years. If I’m not interested enough in the company to read about them, then I move on and look for another company.

Does the company’s product match my values? Values are specific to each person, and that’s part of what makes investing this way so interesting. When I pick a company for passive income I invest in companies that interest me and to which I feel a connection. I drive a car, so it fits with my values to own a company that produces something that my car uses, such as tires, auto parts, or even oil. I eat food, so I might be interested in owning a company that produces some of the foods that I like to eat or a grocery store chain where I can buy those foods. I like to own companies that produce things I use, so when I buy those things I feel that in a small way I am paying myself. When I buy gas, I buy it from the gas station that is run by the oil company that I own shares in, I eat at a restaurant chain I own, and I buy food at a grocery store I own. Same for the socks and shirts I wear. I like the outdoors, so owning a company that makes boats, camping or fishing equipment may fit my values. A company that makes shoes or socks might also fit my values. A person who is a smoker may be interested in a company that produces cigarettes, while a person who does not smoke may see a company that produces smoking related products as not fitting into their values.

I also think about the company’s action and how those fit my values. Have I seen the company in the news recently for something that I agree or disagree with? If I live in a smaller town and a large retail chain store recently opened in my area that drove several of the smaller, family owned stores out of business, does it fit my values to own shares of that large retail chain?

I need to understand what the company does and why the product it produces is better than what the competitors are selling. That means when I pick a company to generate passive income selling stock options I need to know my circle of competence. To define my circle of competence, I think about the jobs I’ve had and how I spend my time. If I like to fish, I probably know more about fishing than a person who does not like to fish. That means I’m probably more familiar with fishing-related products than a person who is not interested in fishing, which gives me an advantage when looking at companies in the fishing industry. The same could be said for just about any industry. If you are interested in an industry and use products from certain companies, there was a reason you bought what you bought, and now that you have it you know about how the product actually works, which gives you an advantage over a person who does not own that product.

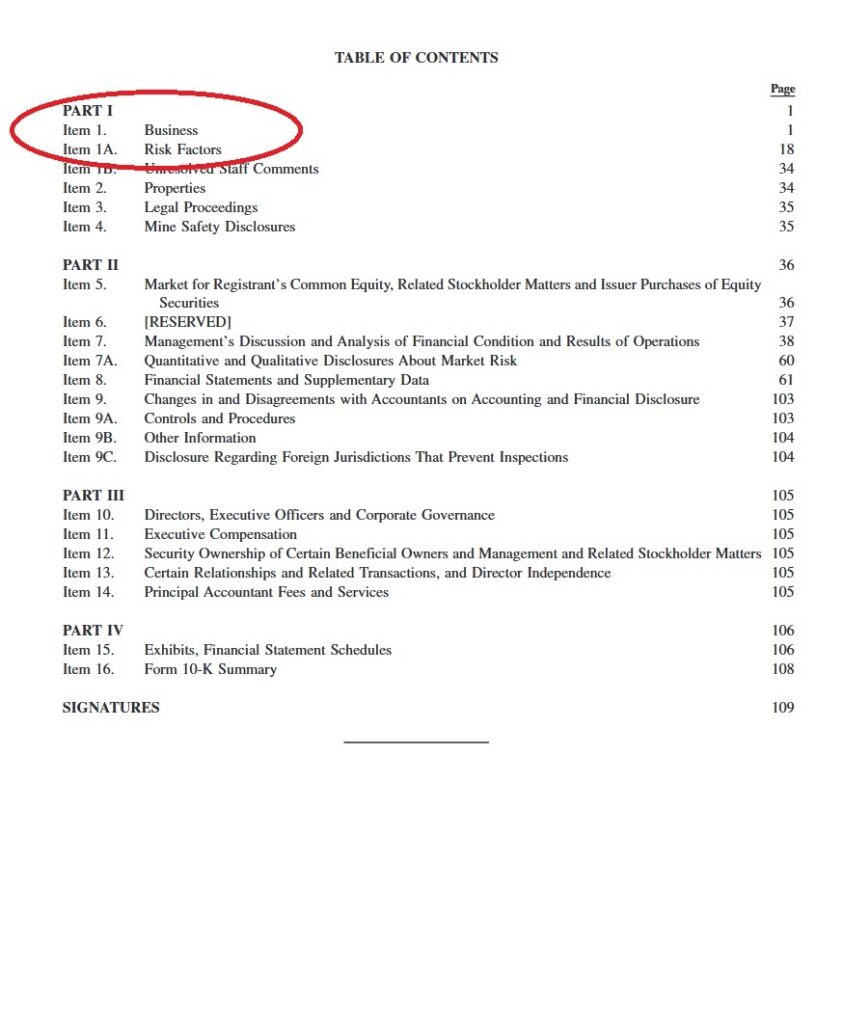

Once I feel like I’m interested enough in a company to learn more about it, I can go to the company’s website and look for ‘Investor Relations’. From there I want to find the most recent 10K, which is the annual report for the company. In the annual report go to Part 1, Item 1, which is ‘Business’. Read this section of the annual report (not the entire annual report, just the ‘Business’ section. Here is an example for Malibu, the company that makes Malibu, Axis, Cobalt, Pursuit, and other boats.

Reading the ‘Business’ and ‘Risk Factors’ sections of the company’s most recent annual report will help you understand what the business does, how it operates, and some of its plans for the future. After reading the ‘Business’ and ‘Risk Factors’ sections, you’ll either feel like you have a better understanding of what the company does the company is too difficult to understand. If it’s too difficult, that’s ok, just move on to the next company. If you feel like the annual report is not as clear as it could be, that’s a sign that the communication style of the company may not fit well with your communication style, or that management is not clarifying things well enough. You need to be able to understand what management says about the company, so if what they are saying isn’t clear, look for another company.

If you feel the company has meaning for you after reading thinking about what the company does, how they do it, and reading the ‘Business’ section of the company’s annual report, then congratulations, you are ready to move on to the next step, which is Moat. When you pick a company for passive income make sure you go through the steps of finding a fantastic company before selling stock options.