Profitable Options Trade

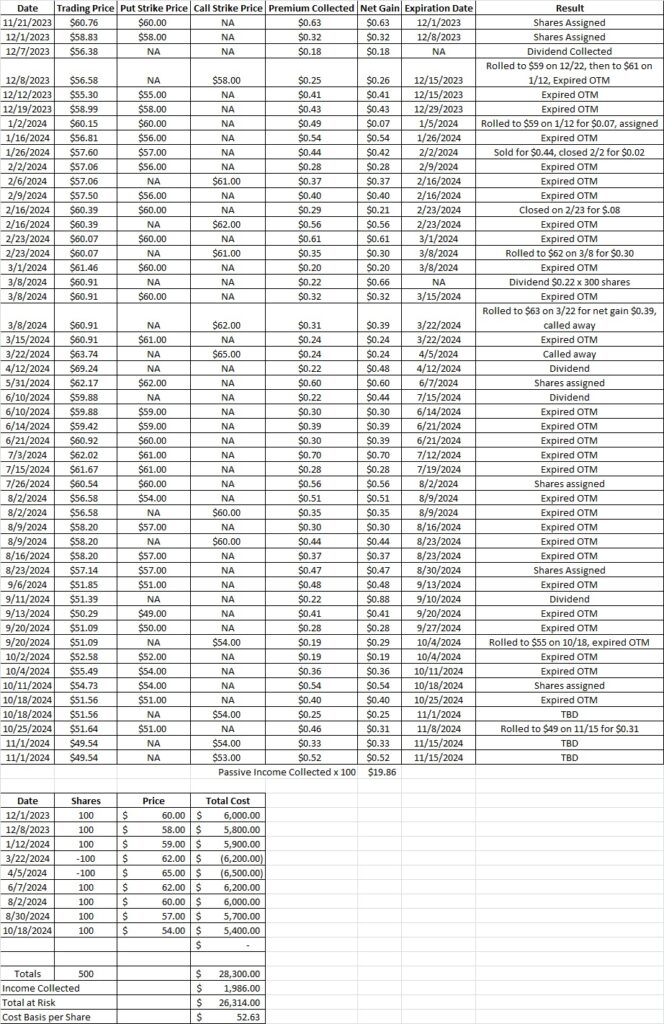

This week we’re showing how to do a profitable options trade on OXY. We currently have 500 shares of OXY with a cost basis of $52.77 per share in this portfolio. We have the $51 put that is in the money with OXY trading at $49.54 per share. That put option contract expires today, 11/1. We also have the $54 covered call, and that option contract will expire out of the money today. So we’ll just keep the premium from that trade and sell to open another one. Here’s a link to the post that walks through how we sold to open these trades.

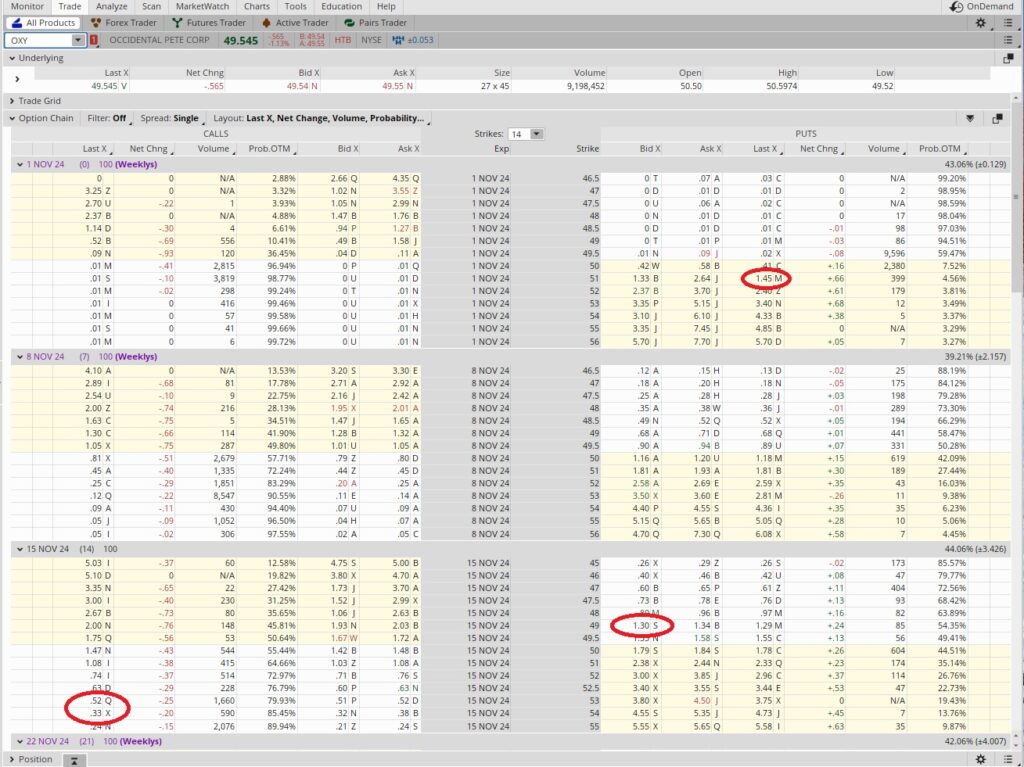

Since we already have 500 shares of OXY we’re ok with rolling our cash secured put option contract down to a lower strike price that is further out in time. We brought in $0.46 in passive income when we sold to open this contract. We’ll factor that in when we evaluate which strike and expiration date to ensure we have a profitable options trade. It cost us $1.45 to buy to close that cash secured put option contract. Since we brought in $0.46 when we opened the contract, we have a temporary loss of $0.99 on that trade. So when we look for the new strike price we want to be sure we’ll get at least $0.99 in premium.

We can see the $49 strike for the put option contract on the November 15 expiration date is giving premium of $1.30. If we sell to open that contract we’ll net a gain of $0.31. That will make this a profitable options trade. It also puts us in a position to add another tranche of shares of OXY to our portfolio, and we’re happy to do that at that price.

We can also sell to open another covered call option contract. The $54 strike is $0.33, and that will reduce our basis for the shares we currently own. We also sold to open the $53 call for the November 15 expiration date for $0.52 in premium. Since our cost basis is $52.77 per share, we’ll still be making money if OXY goes up and these shares get called away. We could roll up this trade if OXY gets close to it.

Weekly Trade Recap

Our profitable options trade this week was to roll our put option down. We chose the $49 strike on the November 15 expiration date for $1.30 in premium. We also sold to open the $54 call option contract for the November 15 expiration date for $0.33 in premium and the $53 call for $0.52. These trades combined to help us reduce our basis on OXY down to $52.73 per share.