Put Expired Worthless

On 6/21 our routine options trade was to sell a cash secured put, and that put expired worthless on 6/28. Now we have access to that capital again, so we’re going to sell another cash secured put option this week. Here’s a link to the post that walks through the trade we did to generate passive income selling stock options.

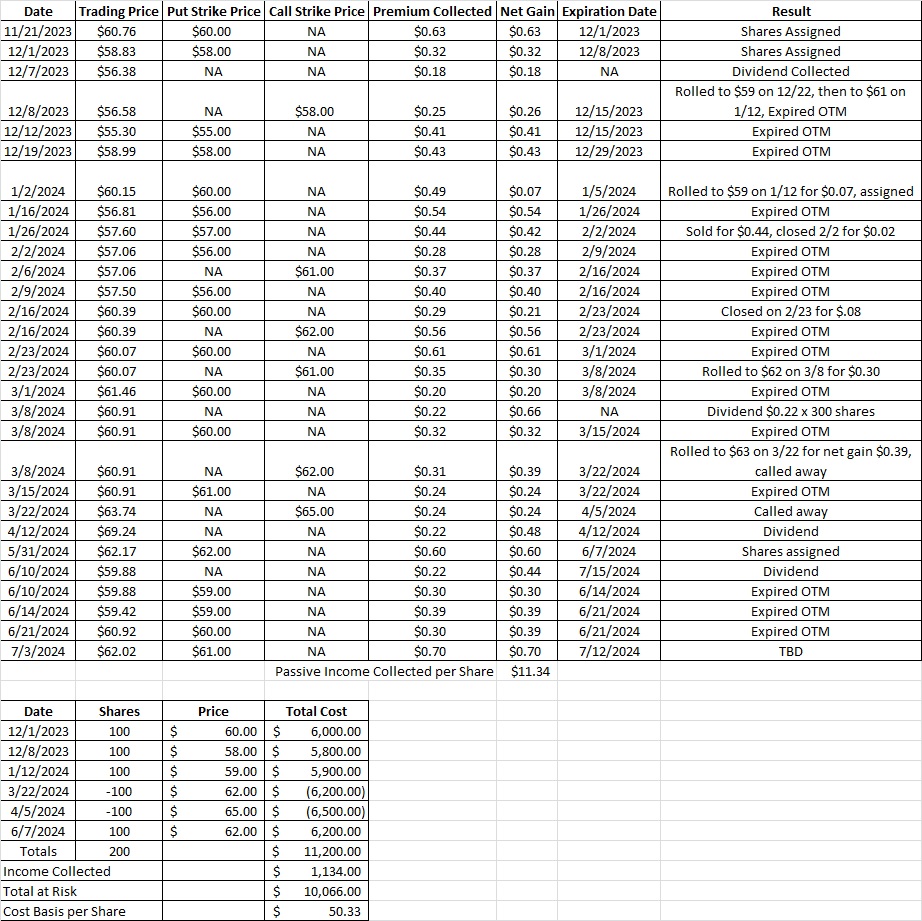

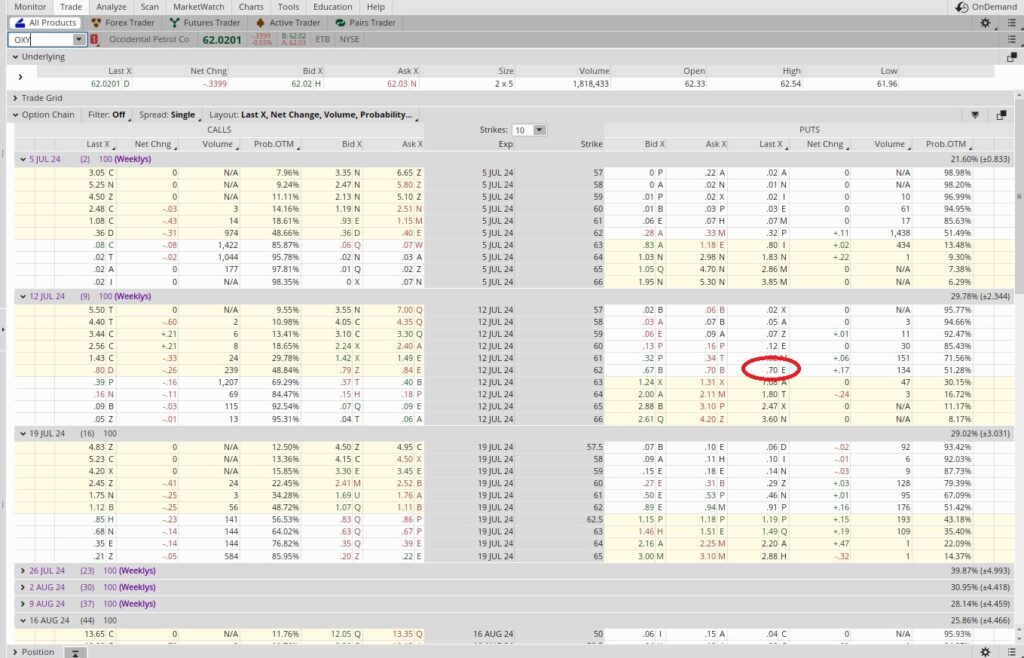

Today OXY is trading at $62.02 per share, which is above our current cost basis on OXY of $50.68 per share. We currently own 200 shares of OXY in this portfolio, and we’re happy to buy more in this price range. Since we’re selling a cash secured put option for passive income we’ll need to have 100 times the put strike in cash available in our brokerage account. So if we sell the $62 put, we’ll need $6,200 available for each put option contract well sell.

In this case we’re ok selling a put super close to the money for a few reasons. The first is that by selling an option contract that is right at the money we’re going to generate more passive income premium than we would at a different strike. If we get $0.70 in premium per share, our assignment cost basis would be just $61.30 per share. We get that by taking the $62 strike price and subtracting the $0.70 in option premium. We also already have 200 shares of OXY in this portfolio with a cost basis of $50.68 per share. If we add another 100 shares at $61.70 per share our cost basis per share will average out to $54.22. That’s still below Warren Buffett’s buy price for OXY, so we’re happy to own shares in that range.

With only 200 shares of OXY we want to be careful selling covered calls right now. We think OXY has potential to run up and we want to capture that gain. If we get assigned more shares at the $62 strike then we’ll have 300 shares in this portfolio, and then we would look at selling covered calls to generate passive income.

Weekly Trade

With OXY currently trading at $62.03 per share we sold the $62 cash secured put expiring 7/12 for $0.70. We’re putting up $62 per share, so we divide the $0.70 in premium into the $62 strike price and we get 0.0113. This is a nine day trade, and nine goes in to 365 days 40 times, so we multiply the 0.0113 by 40 and we get 0.452. That works out to a 45% annualized return. We’re happy with that. Last time we did a similar trade our put expired worthless. That could happen this time, or we could end up with another 100 shares of OXY. If we do get the shares, then we’ll sell a covered call on them as part of our routine options trade.

Cost Basis per Share