Put Option Contract for Passive Income

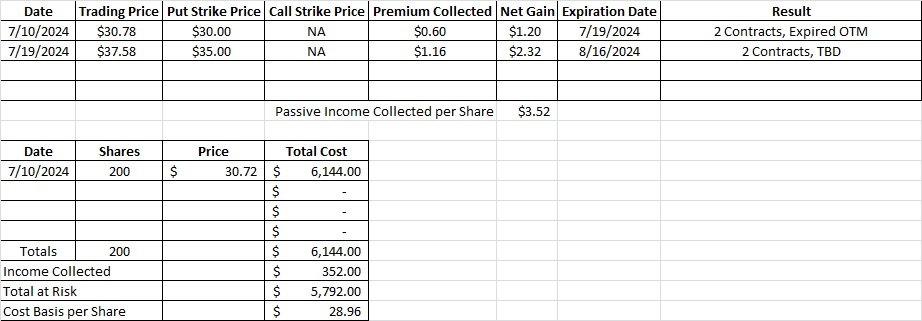

Our goal is to generate passive income selling stock options. We’d prefer to do this with as little risk possible. Last week we bought 200 shares of MBUU outright at $30.72 per share. Then we sold to open two put option contracts at the $30 strike price. We collected $0.60 in premium on each of those puts. Those puts will both expire worthless today, 7/19. So now we have access to that capital again and our cost basis currently stands at $30.12 per share. MBUU ran up quite a bit last week and into this week and is now trading at $37.58 per share. Here’s the post where we walk through how we opened the position.

Weekly Options Trade

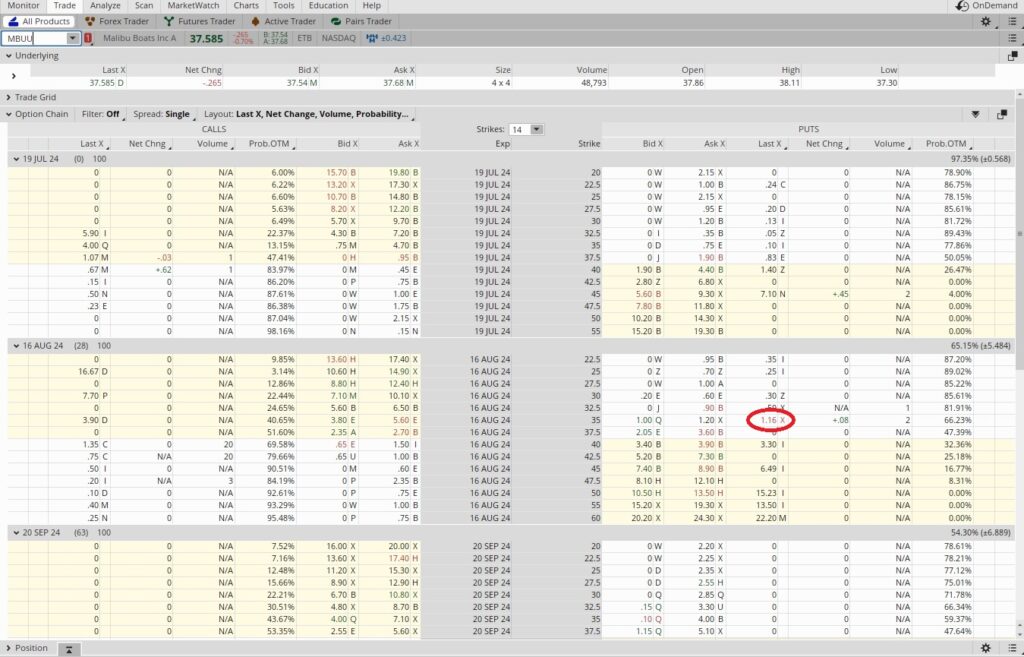

Today we sold to open two contracts of the MBUU $35 put with the 8/16 expiration date. We received $1.16 in premium for each contract. Each contract is for 100 shares of the underlying. That means we need to have 100 x $35 ($3,500) in our account for each cash secured put option contract we sell. We’ll keep the $1.16 per share in premium regardless of whether or not we are assigned the shares. So we’re putting up $35 per share to make $1.16 per share. When we divide $1.16 into $35 we get 0.33. This trade is one month long, so we could do this trade twelve times over the course of a year. So we multiply the 0.33 times 12 and we get 0.397. That works out to an annualized return of 39.7%. We can generate that passive income selling stock options. Here’s the tool we use to do that math.

When we sell to open a put option contract we need to be aware of any upcoming earnings calls for the underlying company. In this case, MBUU has their earnings call scheduled for 8/27. Here’s the resource we use to find that information.

Cost Basis per Share

We like to use puts to generate passive income selling stock options because only two things can happen. One possible outcome is the share price of the underlying will stay above our strike price and the put option contract will expire out of the money worthless. The other possible outcome is that we are assigned the shares. In this case, we’re happy to own more shares of MBUU at our assignment strike price of $35. And if we are assigned shares at $35, our cost basis per share for this tranche will be $33.84. We arrive at that by taking the $35 assignment price and subtracting the premium we received ($1.16) to enter into the contract. Either way, we’ll still keep the premium of $1.16 per share.

Our overall cost basis per share if not assigned will be $28.96. If we get assigned the shares our overall cost basis per share will be $31.98. Either way we’re able to generate passive income selling stock options with a routine options trade.

Put Option Contract Trade Recap

We currently own 200 shares of MBUU in this portfolio. We sold to open two cash secured put option contracts on MBUU. We sold the $35 strike with the 8/16 expiration date and we received $1.16 per share in premium ($232 total). Our costs basis now stands at $28.96 per share with MBUU trading at $37.58 per share.