How to Roll a Call Option

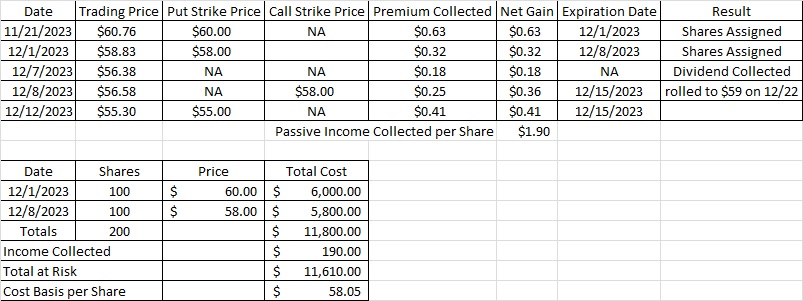

Today we’re going to roll a call option contract that is in the money. Last week our weekly option trade for passive income was to sell a call option contract on OXY. We sold the $58 strike for $0.25 in premium. That weekly option trade for passive income expires today, 12/15. Here is the post that walks through that trade.

We like OXY as a company for a number of reasons. Probably the most simple reason is that Warren Buffett likes OXY. This week he just bought another 10 million shares of it. Here’s where we found that information.

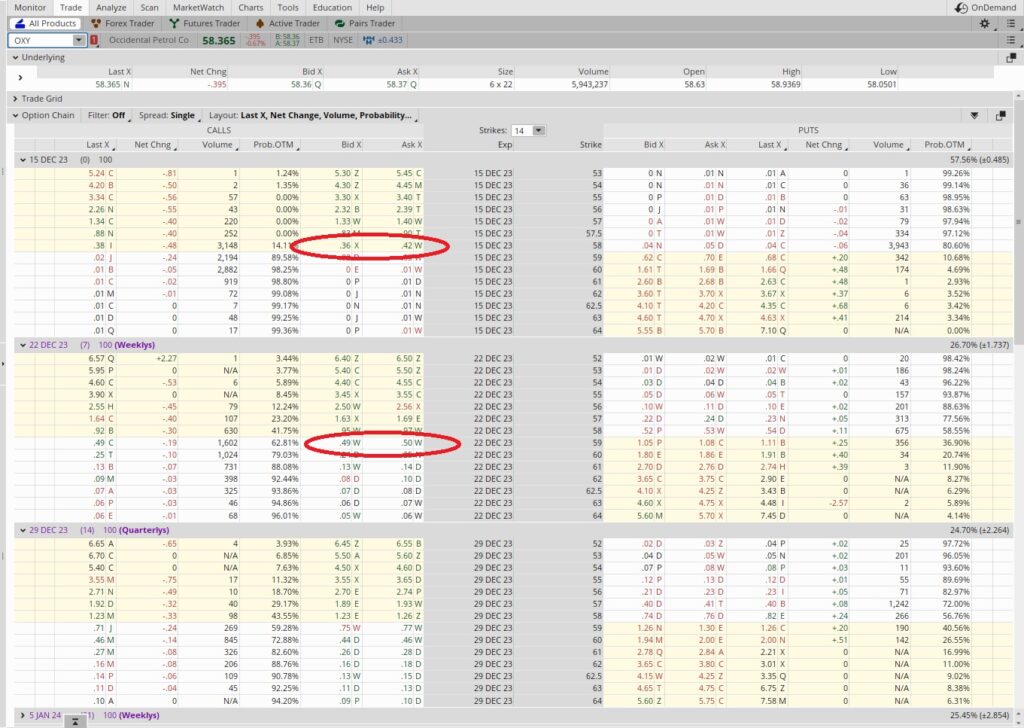

Right now OXY is trading at $58.37. That is above the $58 strike for our call option contract that expires today. If we don’t close that trade our shares of OXY will get called away at $58. We could let the shares go at the $58 strike and make the money we planned to make. Or we could roll the call option contract because it is in the money. We’d prefer to keep these shares if we can. Let’s look at the option chain for today’s expiration on 12/15 and the next two expiration dates. OXY has enough volume that their option contracts have weekly expiration dates. That gives us more choices to roll this weekly option trade for passive income.

We have the $0.25 in premium from the call we sold last Friday, 12/8. Right now that same call option contract is trading for $0.38. If we buy that call option contract back for $0.38, we would subtract the $0.25 in equity we have in that call. Then we need to find another call option contract that would give us at least $0.13 so we can break even on this trade. But we don’t want to break even. Our passive income strategy for accredited investors is to make money selling stock options, so we’ll want to find another call we can sell that will make up for the $0.13 loss on buying back the $58 call that expires today. ‘Rolling’ call option contract is when we close an existing call option and open a new one at a higher strike, further out in time.

The Weekly Trade

The $59 call option contract that expires next Friday, 12/22 is trading for $0.49. We could sell that call, take out the $0.13 loss for buying back the $58 call that expires today, and still have a profit of $0.36. It would also mean that we’ll get an extra $1 per share if we get called away because that would happen at $59 next week versus the $58 this week. So we would get the profit in premium of $0.36 plus the $1 in appreciation in the sale price, for a total gain of $1.36 for keeping the trade on through next Friday, 12/22. If OXY stays below $59 we would collect and keep the $0.36 in premium, and then have the opportunity to sell the call again.

Cost Basis Per Share

Our cost basis on OXY is now $58.05 per share. If OXY goes above $59 and these shares get called away our cost basis will be $57.10 per share.