Roll a Tranche of Puts

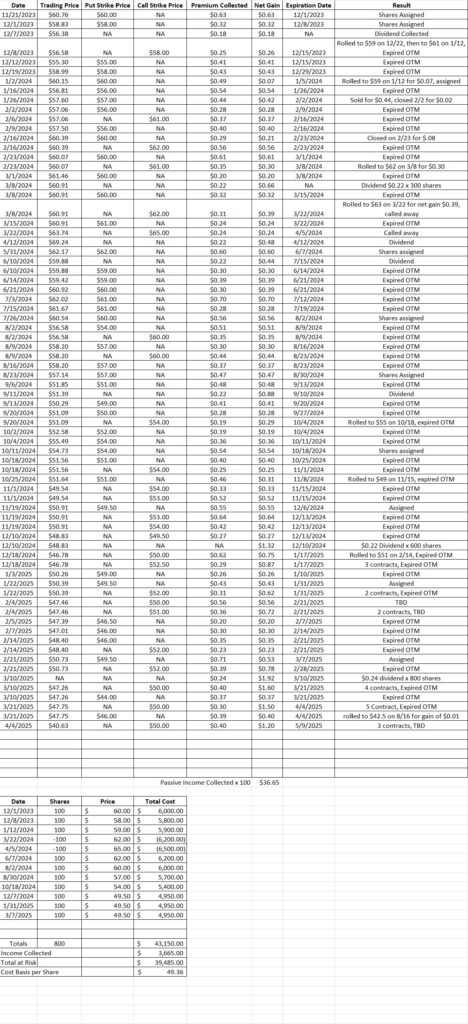

Today we’re walking through our decision to take the shares or roll a tranche of puts. We’ve been trading for cash flow the oil company OXY lately. In this portfolio we currently own 800 shares with a basis of $49.51 per share. We were doing pretty well with our position until the Trump Tariffs this week. On 4/2 OXY closed at $49.33 per share. Right now OXY is trading at $40.63 per share. That’s a drop of $8.70 per share, or a little over 17%, thanks to Trump’s Trade War. With a big move like that happening so quickly we need to evaluate whether or not we want to take the shares and sell calls on them. Our other choice is to roll a tranche of puts. We have the $46 put option that expires today, 4/4. Now is the time to either take action or take those shares.

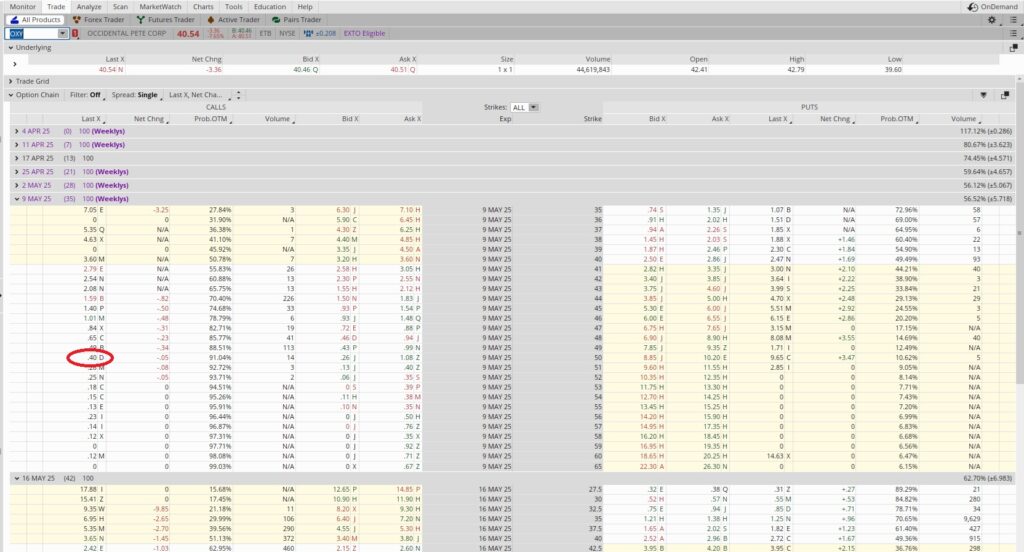

If we roll the put option contract we will buy back the put options we sold to open. Then we’ll sell another put option that is further out in time and at a lower strike price. To do that we need to look at what it will cost us to buy to close the option contract. We brought in $0.39 per share on the put option we sold for today’s expiration date. With OXY trading at $40.63 it’s going to cost us about $5.50 to close that position. So we take the $0.39 we brought in and subtract the $5.50, and that gives us a negative $5.09 per share. So we need to look for another put option contract that would give us at least $5.09 per share.

To get a $5+ option premium on a company trading at $40 we’ll need to go out quite aways in time. We want to find the sweet spot between the premium and strike price. The first thing we’ll do is see how long we need to go out to make up the $5.09 per share in premium while being as far away from our current strike as possible. We can see the $42.50 strike on 8/15 gives us $5.10, almost exactly what we need to break even. We could go out another month to 9/19, and that same $42.50 strike would give us $5.40. We’d rather save a month and forgo the extra $0.30.

Another choice we have is to collect more premium on the front end and pick a strike that is closer to where we are now. We could go with the $45 strike on that same 8/15 expiration date and collect $6.85. That would give us a net gain of $6.85 – $5.09 which is $1.76, but we’d be $2.50 further away from the money. That means we would lose another $0.74 if we get assigned at $45. Since we want to put ourselves in the most favorable position we can when we roll a tranche of puts, we’re going to use the $42.50 strike on 8/15. Since we’re nearly fully tranched in OXY we’re going to roll it down as far as we can.

We also have five contracts of the $50 call that expires today, 4/4. Those calls will expire worthless out of the money. So we’ll keep that premium as passive income. We’re also going to sell to open the $50 covered call for the 5/9 expiration date. OXY has earnings on 5/7, and the uncertainty from the earnings release will give us a little extra premium. Here is where we find that. We have five contracts outstanding right now and we have 800 shares. Since our $50 calls will expire today we currently have 300 unencumbered shares. So we’re going to sell three of the $50 calls for the 5/7 expiration. That gives us $0.40 per share on each contract and brings our basis down to $49.36. On Monday we’ll have another 500 unencumbered shares and we can sell more calls on those.

Weekly Trade Recap

We rolled out $46 put to the $42.50 strike on the 8/16 expiration date. We had a gain of $0.01 per share on that contract. By rolling a tranche of puts we’re putting ourselves in a better position than taking the shares today at $46. Then we sold to open three contracts of the $50 covered call for the 5/9 expiration date. These passive income trades bring our basis on OXY down to $49.36 per share.