Roll Put Options to Different Strike Prices

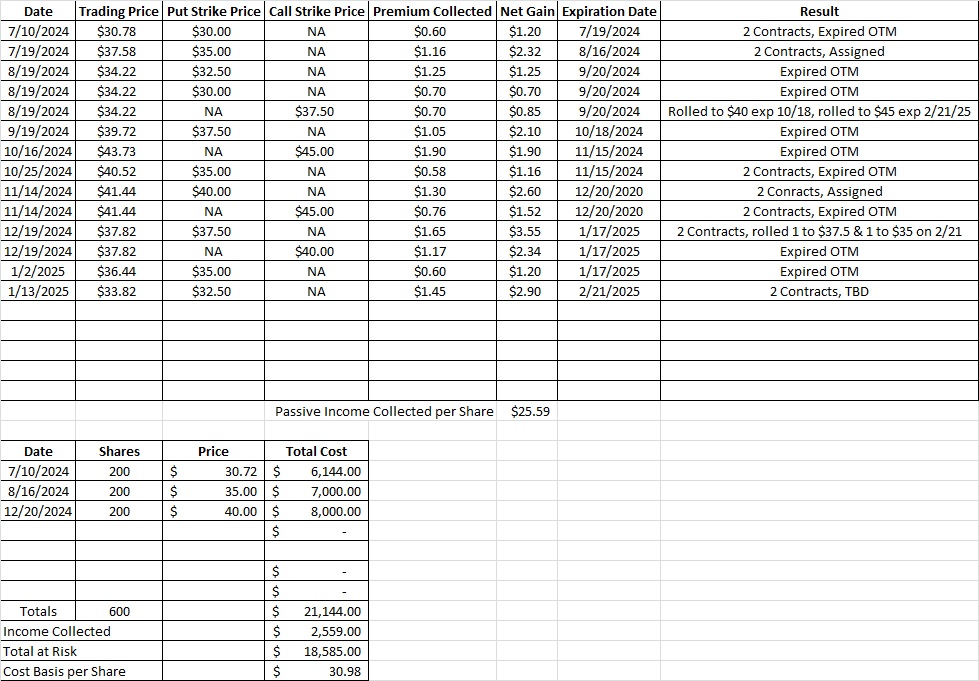

Today we’re going to roll two put options to different strike prices. We currently have 600 shares of MBUU in this portfolio with an average basis of $31.02 per share. We have two puts at the $37.50 strike price that will expire in the money (ITM) today, 1/17 at market close. Here’s the post that walks through that trade. Our choice is to either take the shares or roll the put options to different strike prices. Let’s walk through how we’re making that decision.

We sold to open the $37.50 put option contracts back on 12/19 for $1.65 each. Right now MBUU is trading at $35.50, so these put options contracts are in the money. With the $37.50 strike price our effective purchase price for these shares will be $37.50 minus the $1.65 in premium. That works out to $35.85 per share for these two contracts.

We’d be happy with that, but our current cost basis is $31.02, and we have 600 shares. If we didn’t already have 600 shares we’d be inclined to take the shares at the $35.85 and then sell calls on them at the $37.50 assignment strike. But since we have 600 shares already let’s explore some other options.

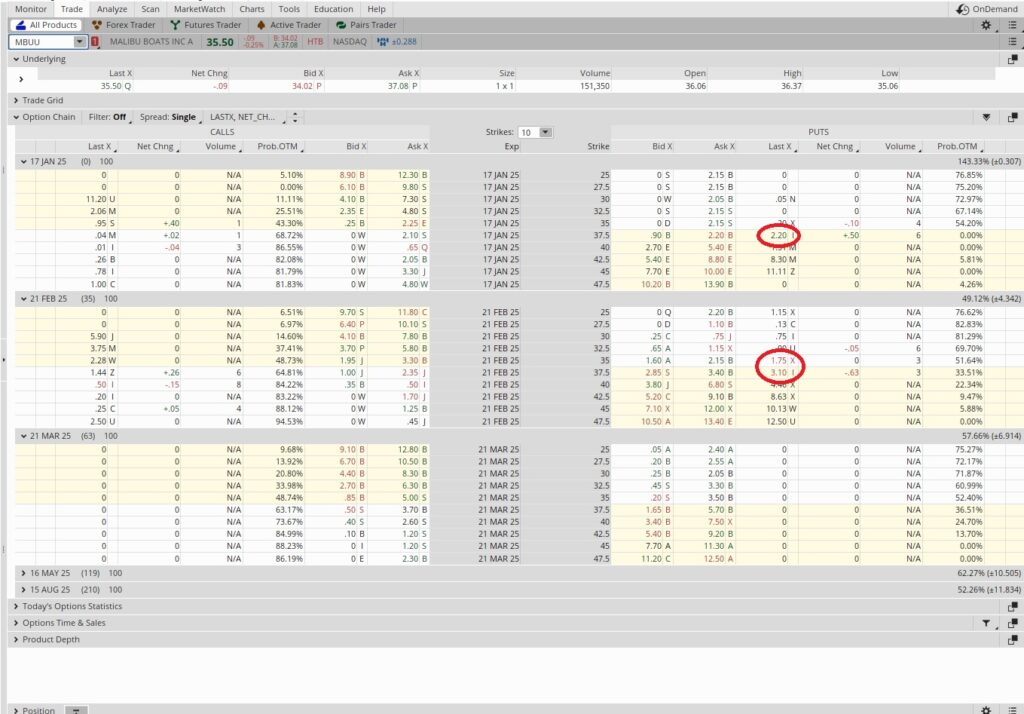

One choice is to buy to close the $37.50 put options that expire today, 1/17 and then sell them again at $37.50 for the 2/21 expiration date. It would cost $2.20 to buy to close each contract. Since we brought in $1.65 in premium when we sold to open each contract we include that in our calculation. We brought in $1.65, we subtract the $2.20 to buy out of the contract from that, and that leaves us with a negative $0.55. So we need to get at least $0.55 when we sell to open the replacement contract for us to break even on the trade. Ideally we’ll get $2.20 or more per contract so we can make some additional cash flow on this trade. Then we’d keep the premium from the first trade and make up for exiting the trade.

We can see the $37.50 put option for the 2/21 expiration date is going for $3.10 right now. That would make up for the $2.20 we spent getting out of the first contract, but with MBUU trading at $35.50 that contract is already $2.00 in the money. That means we’d only be getting $1.10 in time premium. We figure that because it’s the $37.50 strike, MBUU is trading at $35.50, so we’re in for $2 right there, and the total premium is $3.10. That $3.10 minus the $2.00 in intrinsic value is $1.10. We’d prefer to have our strike just outside of the money so we get more time premium vs intrinsic premium.

We can see the $35 put is $1.75. With MBUU trading at $35.50 all $1.75 is time premium because MBUU trading out of the money right now. So the ITM put option at $37.50 is actually giving less time premium than the out of the money put option at $35. But if we buy back two contracts for $2.20 each and then we sell to open two replacements at $1.75 each we’d be losing money. And we’d prefer to make money. So we’re going to roll our put options to different strike prices to make up that difference.

We bought to close two contracts of the $37.50 put on the 1/17 expiration date for $2.20 each. That’s $4.40 total. Then we sold to open one put at the $37.50 strike for the 2/21 expiration date for $3.10. Then we sold to open another put at the $35 strike price, also for the 2/21 expiration date. When we add the $3.10 to the $1.75 we get $4.85. That’s more than the $4.40 we paid to exit the first trade, so we’re good there. It also puts us in a better position if MBUU drops because we’ll be buying 100 shares at $37.50 and another 100 at $35. That saves us $2.50 per share on the $35 put option contract.

Weekly Trade Recap

To recap, we brought in $1.65 per share on each of two put option contract when we sold to open the $37.50 puts. That’s $3.10. Then we bought to close those same contracts for $2.20 each, which is $4.40. That gave us a temporary loss of $1.30. Then we sold to open one contract of the $37.50 put on the 2/21 expiration date for $3.10. We add that to the negative $1.30 and it gives us $1.80. Then we sold to open the $35 put for the 2/21 expiration date for $1.75. That $1.75 plus the $1.80 gives us a net gain of $3.55 on these trades. The kicker though is that it positions us to save another $2.50 per share on that $35 put option if MBUU drops.

By rolling the put options to different strike prices we have a guaranteed return of $3.55 on these trades. We a possible total gain of $6.05 including the potential assignment.