Sell a Covered Call Option for Passive Income

Today we’re going to sell a covered call option for passive income on HHH. This simple options trade is the second half of the wheel option strategy. Here is our most recent post on HHH. A wheel option trade is when we sell to open a put option contract with a strike price that is below the current trading price of the company. When we sell to open the option contract we collect option premium, and we keep that premium regardless of what happens with the contract.

Selling the put option contract obligates us to buy shares of the company at the strike price. Then we wait for the put option contract to expire. If the trading price of the company stays above our strike price, our put option will expire worthless. Should that happen we’ll sell another put option contract for passive income. If the trading price is below our strike price at expiration, we are obligated to purchase shares of the company at the strike price. We could roll the position if we do not want to buy the shares. If we take the shares we sell a covered call option at or above the strike price of our put.

Selling a covered call is when we make a promise to sell our shares at a strike price we choose. We also pick the expiration date and the amount of premium we’ll accept to sell the covered call option contract. As long as we sell a covered call option above our assignment strike we’ll make money on the trade. We made money from the option premium when we sold to open the put. We’ll make more money when we sell a covered call. That option premium is our passive income. If the trading price of the company is higher than our strike price on the covered call our shares will be called away at our strike price. If the trading price stays below the strike price our call option will expire out of the money. Then we can sell another covered call to create more passive income.

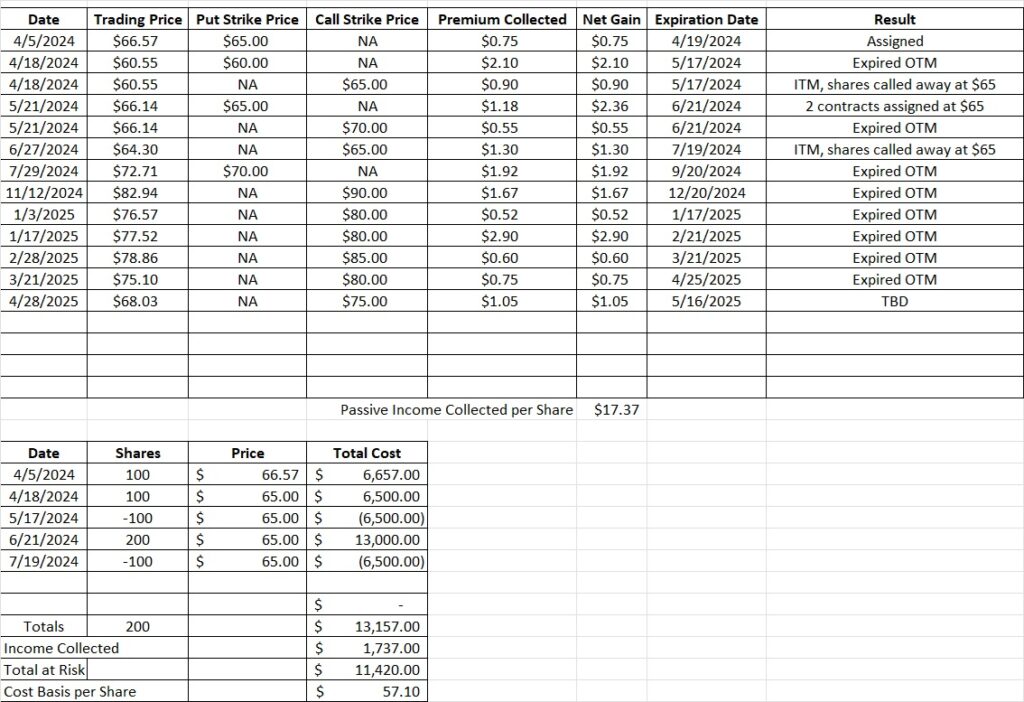

Right now we have 200 shares of HHH in this portfolio with a basis of $57.63 per share. We can sell a covered call at any strike above that and make money if the shares are called away. The closer to the money we sell a covered call the more option premium we’ll generate. But the closer to the money we sell a covered call, the more likely we’ll have our shares called away. So we need to balance the risk/reward of having shares called away vs option premium for passive income.

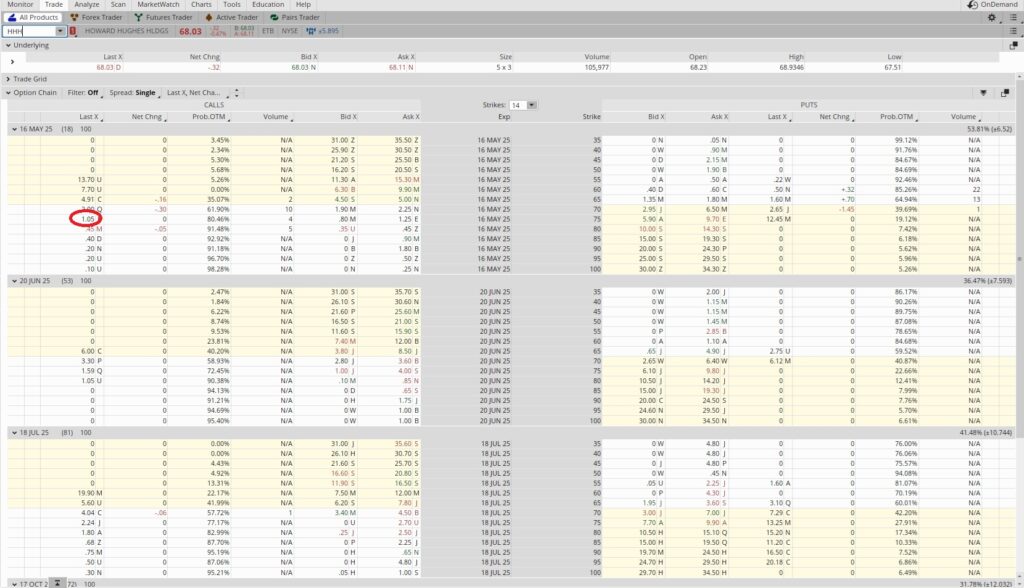

We should also consider that Bill Ackman’s Pershing Square has an offer of $90 to buy HHH. If that deal were to go through we would get $90 for our shares. If it does not go through, the trading price will likely fall. We want to use our shares to generate passive income regardless of what does or does not happen with the Pershing Square offer. So we’re only going to sell a covered call for passive income with one contract. That way if HHH runs up and our shares are called away we’ll still own 100 shares for the Pershing Square offer.

We sold to open the $75 call option contract for the 5/16 expiration date for $1.05 in option premium. That reduces our basis from $57.63 per share down to $57.10 per share. Since today is 4/28 and this covered call option contract expires on 5/16, there are 18 days from now until expiration. There are 365 days in a year, and when we divide that by 18 we get 20. So in theory we could do this trade, or a similar trade on another company, 20 times over the course of a year. Our basis before doing the trade is $57.63 per share, so that’s our capital at risk. We divide the $1.05 in premium by $57.63 and we get 0.18. Then we multiply that by 20 and we get 0.364. That’s an annualized return of 36.4% on the capital we have at risk. We’ll take it.

Weekly Option Trade Recap

We sold to open one contract of the $75 covered call on HHH for the 5/16 expiration date. We brought in $1.05 in premium. Even though we have 200 shares we only sold to open one contract. In the event HHH runs up through our strike we’ll still have 100 shares. The table below shows our trade history on HHH. We entered the position by selling puts on HHH. After we bought shares with those puts we started to sell a covered call on our shares. We’ve done that each month and have worked our basis down to $57.10 per share with HHH trading around $68 today. Here is the option calculator tool we use to help us determine the return on our easy options trade. This links to the basis reduction template we use to track our trade history.