Sell to Open a Put Option for Cash Flow

Today our weekly options trade for passive income is to sell to open a put option contract for cash flow. We’ve done some trading on earlier this year but nothing over the last few months. Here is our most recent trade on OXY. OXY ran up from the lows $60’s to the low $70’s, and for us $70 is too much to pay per share of OXY. But these last few weeks OXY had been in a down trend, and today OXY is trading at $62.17. So let’s take a look at selling to open a put option contract on OXY to generate some cash flow.

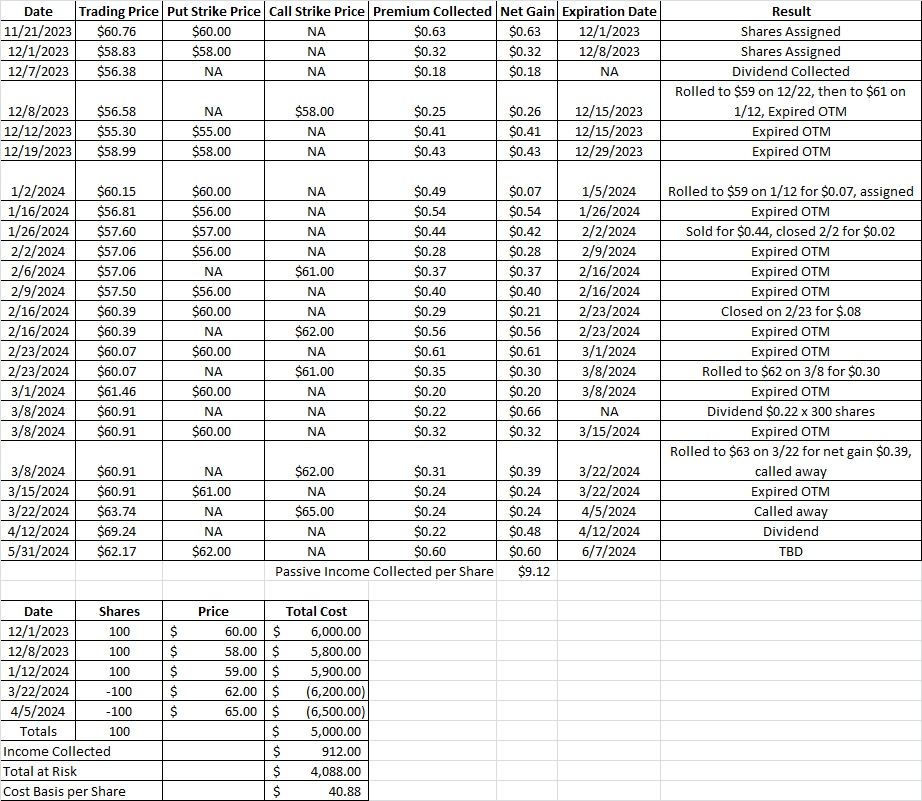

Here’s the recent price chart for OXY. We can see how it’s been in a down trend since it traded over $71 per share back on April 12th. Remember we traded OXYY earlier this year and we still have 100 shares of it in this portfolio. Our cost basis on those shares right now is down to $41.48. OXY has declared a dividend of $0.22 for owners of record as of 6/10. If we own more shares prior to 6/10 we’ll collect the dividend. So we’re going to be pretty aggressive when we sell to open this put to create some cash flow.

We can see that OXY hit a low of $60.76 on Wednesday, and OXY’s low yesterday was $60.92. Today is 5/31, and OXY opened at $61.33. That was the low for OXY so far today, and we’re just a few minutes before market close. So it looks like OXY will close above $62 today.

We ordinarily like to sell puts when the underlying is dropping vs rising. When the trading price is dropping there is more fear around the share price than when the price is increasing. That difference in fear means we’ll be able to generate more premium by selling to open a put option contract during a ‘down day’ vs an ‘up day’. And today is an up day. But OXY also goes ex-dividend on 6/10 (here is where we find that information). If we get assigned the shares we’ll get the $0.22 dividend. That doesn’t sound like not much, but it more than makes up for the premium difference in selling a put on an up day vs a down day.

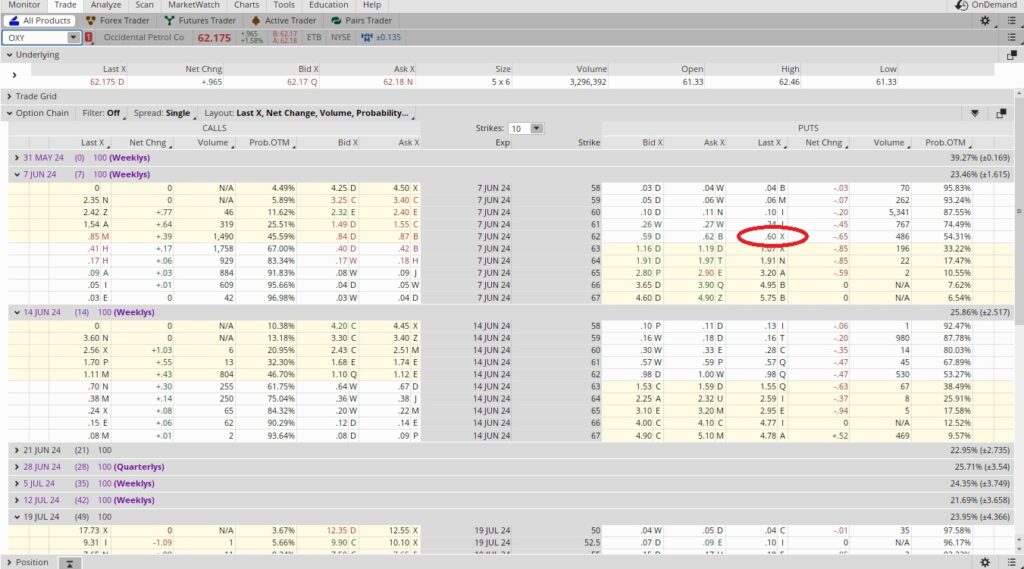

The option chain shows the option strikes for the June 7th and June 14th expiration dates. Since OXY goes ex-dividend on 6/10 we want to use the 6/7 expiration date. That way we’ll be able to collect the dividend if we get assigned the shares. Our choice is if we would prefer to sell to open the put option contract at the $61 strike or the $62 strike.

Weekly Trade

The $61 put option strike has a bid of $0.26. $0.26 in premium divided into the $61 share price is 0.0043. This is a one-week trade, so our time multiplier is 52. So 52 x 0.0043 is 0.2216, or an annualized return of 22.2%. Here is the tool we use to do that math. If we get assigned the shares we’ll also collect the $0.22 dividend, but that would only happen if the share price is trading below the $61 strike at expiration.

Our other choice is to sell the $62 put option contract. The $62 strike is going for $0.60. So we divide that $0.60 into strike price of $62 and we get 0.0097. We multiply the 0.0097 by the 52 weeks in a year we could do this trade and we get 0.502. That’s an annualized return of 50.2%. The $62 is right at the money, but if we get the shares our cost basis on these shares will be significantly less.

We’d start at the $62 strike minus the $0.60 in premium, which is $61.40. Then we would also take off the $0.22 dividend, which would bring our cost basis down to $61.18. We would then average the per share basis of $61.18 on these 100 shares with our cost basis of $41.48 on the 100 shares we currently own. That would result in a cost basis of $51.33. So even though the $62 strike is very close to the money, we’re going to sell to open that put for cash flow. If we get the shares we’ll also collect the dividend.

Cost Basis per Share

To recap, we currently own 100 shares of OXY. We sold to open the June 7th $62 put option contract to create some cash flow. If we get assigned the shares we’ll also collect the dividend, and our average cost basis per share will be $51.33. If we do not get assigned the shares, our cost basis will be $40.88 after collecting the premium on the put option we sold today.