Selling Options for Monthly Income

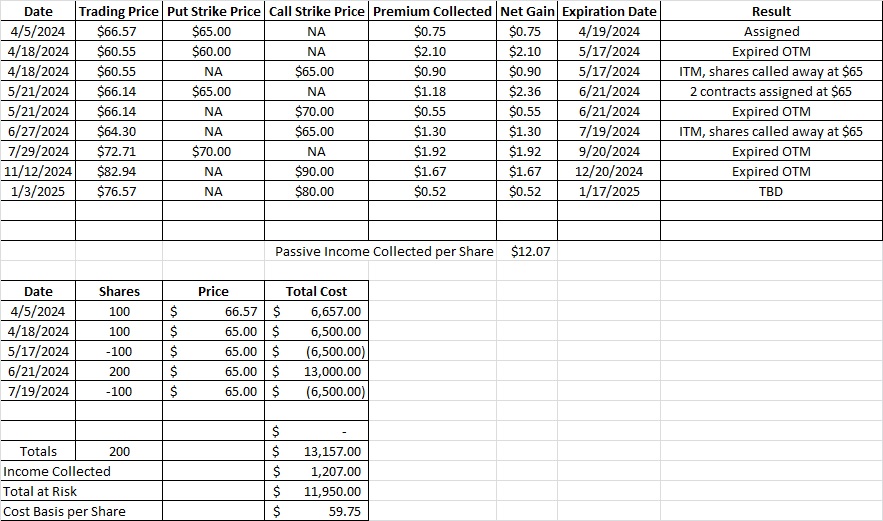

In this easy options trade we’re to walk through selling options for monthly income. We own 200 shares of HHH in this portfolio and we’ve worked our cost basis down to $60.01 per share. We sold to open the $90 covered call option contract on 11/12. That contract expired out of the money on 12/17. Here’s a link to the post that walks through that trade. We kept that premium and now we’re going to sell another covered call to generate some more options premium.

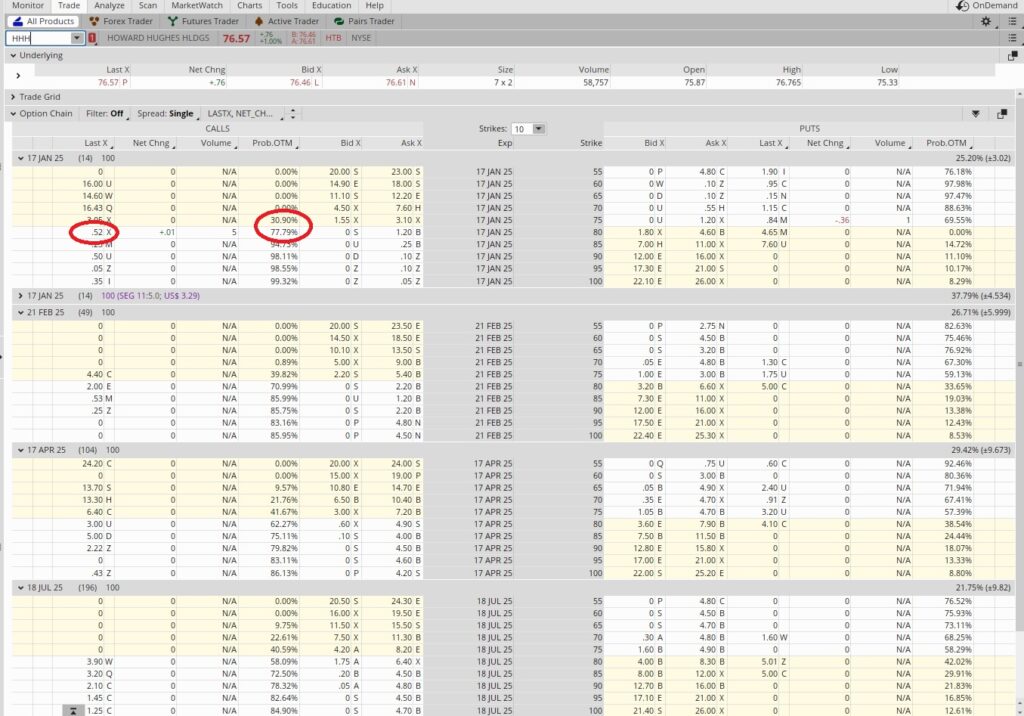

Today HHH is trading at $76.57. Since our cost basis now stands at $60.01 per share we can sell some of our shares at $80 and make money both the sale of the shares and also the sale of the options contract. When selling options for monthly income we try to optimize, not maximize the options premium. We like to balance the likelihood of being called away with premium we receive when we enter the contract. HHH has their earnings call on 2/27, so we don’t need to worry about that for this contract.

While we could sell the covered call at the $75 strike and get about $3.00 in premium, some of that premium would be intrinsic value. We’d only be getting about $1.43 in time value. With HHH trading at $76.57, the $75 call strike is already in the money by $1.57. So we take the $3.00 in premium that we would receive and subtract the $1.57, and that leaves us with $1.43. We can see the probability out of the money for the $75 strike is 30.9%. That means there is a 69.1% chance that the $75 strike will expire in the money. So we would be very likely to lose our shares if we enter the $75 covered call.

We could also sell the $80 call option for monthly income. That strike has an 77.79% probability out of the money. That means it’s quite unlikely that HHH will be above $80 at expiration, so we’ll likely keep both the premium and our shares. Then we can sell another covered call option for monthly income again next month.

We sold to open the $80 covered call for the 1/17 expiration date for $0.52. That reduces our cost basis down to $59.75 per share. If HHH goes in the money we’re happy to have some of our shares called away at $80 because we’d be making about $20 per share on the sale. It would also reduce our cost basis on our remaining 100 shares by $20 per share, which would bring our cost basis on our remaining 100 shares to about $40 per share. If HHH continues to trade below $80 from now through expiration in two weeks, we’ll keep both our shares and the premium. We feel this is the most likely scenario, so we made the trade.