Strangle Option Strategy

A strangle option strategy is when we sell both a covered call and a cash secured put on one company with the same expiration date. If the put and the call are at different strike prices it’s called a ‘Strangle’. If we use the same strike price for the both the put and the call it’s called a ‘Straddle’. This is an easy options trade that generates some strong premium. We use this trade when we own shares of a company that is trading in a range where we’re comfortable adding a few more shares to our position or selling some of the shares we own. The idea behind this type of trade is to use the option premium to create some passive income for us and reduce our cost basis for the shares we own.

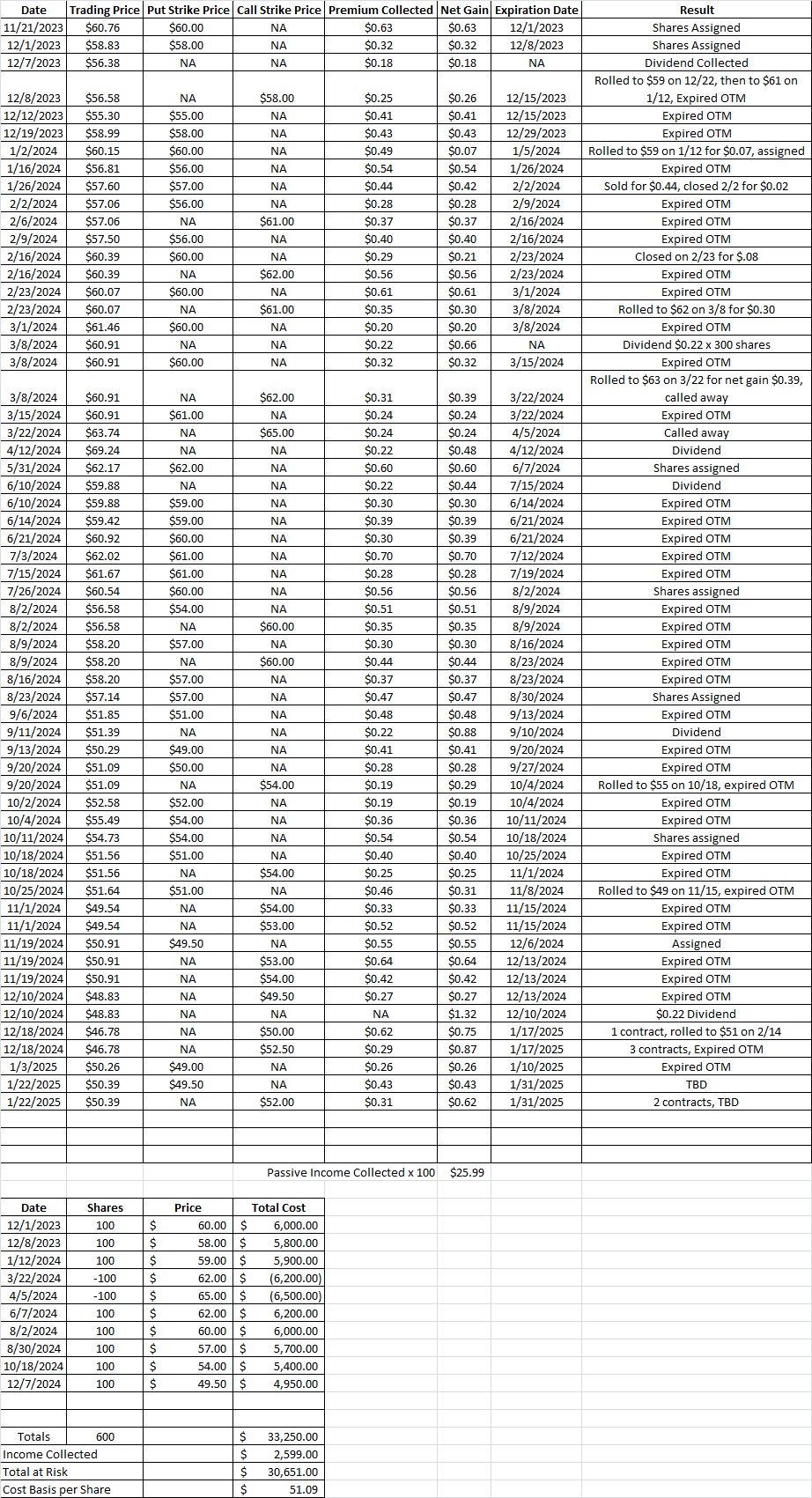

We currently own 600 shares of OXY in this portfolio and our cost basis is $51.26 per share. We can sell covered calls above our basis and we’ll make money if our shares are called away. If we sell a covered call at the $52 strike we’ll make money on the difference between the $52 strike and our $51.26 cost basis. We’ll also make money from the premium we get when we sell to open the contract. Here’s our most recent post on our OXY trades.

We’re not selling covered calls on our entire position in case OXY runs up through our call strike. We want to be sure we still own shares of OXY when it eventually makes its run back up to the high $60’s. Right now we’re just making some trades to generate some cash flow, so we’re only going opening two contracts. If we sell these shares we’ll still have 400 shares of OXY left in our portfolio for the run up.

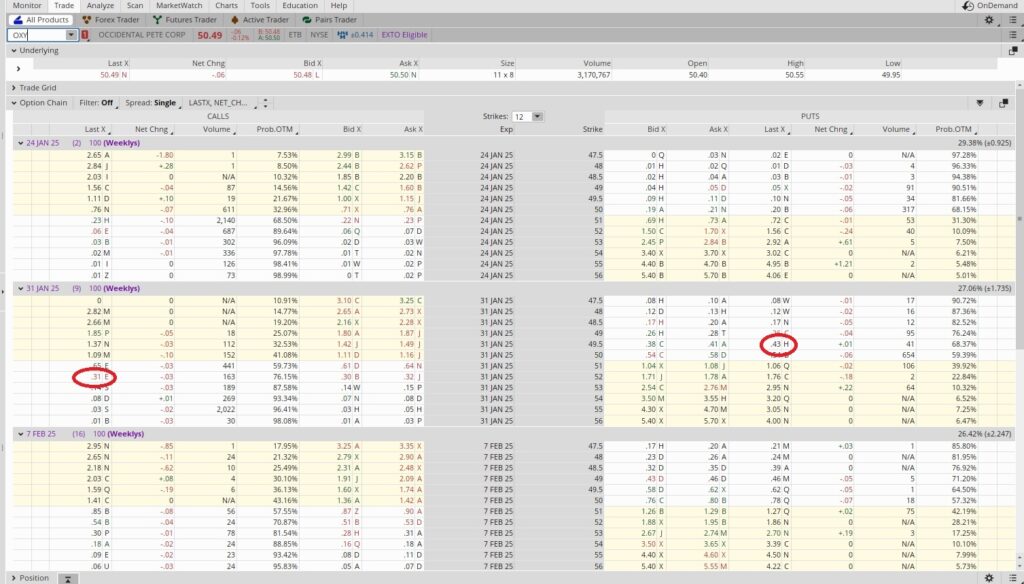

We sold to open two contracts of the $52 covered call that expires Friday, 1/31. This easy options trade gives us $0.31 in premium, which is $0.62 when we combine the two contracts. If OXY runs up through our $52 strike we can either let the shares go or roll the position. Rolling the position means we could buy to close the contracts and then sell to open new contracts to replace them at a different strike price and expiration date. The calls are half of the strangle option strategy.

We also sold to open the $49.50 put option for the 1/31 expiration date for $0.43. Today is 1/22, so this trade is effective for 9 days. There are 365 days in a year, so we divide 365 by 9 and we get 40. That’s our time multiplier. Then we divide the premium for entering the trade by the strike price. So we take $0.43 and divide that into $49.50 and we get 0.0087. Then we multiply that by our time multiplier of 40 and we get 0.347. That works out to an annualized return of 34.7% on the capital we’re risking by selling this put. We’re only selling this put at this strike because we’re happy to take more shares of OXY in this price range. Here’s a tool that helps do this math. The put is the second half of the strangle option strategy.

To recap, we sold a cash secured put at the $49.50 strike and two covered calls at the $52 strike. Both sets of trades expire 1/31. After collecting the premium this strangle option strategy reduces our cost basis on OXY down to $51.09 per share.