Using Puts to Buy a Company

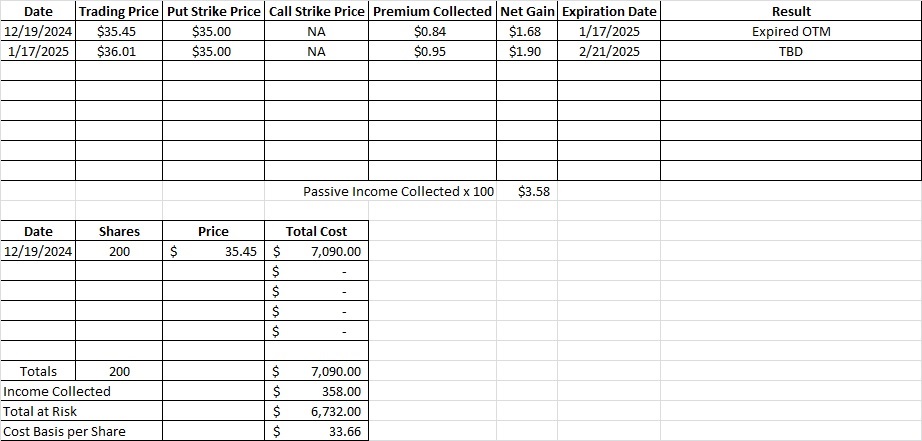

We’re using puts to buy a company. We recently bought 200 shares of RGR at $35.45 per share. Then we sold to open the $35 put option for the 1/17 expiration date. We brought in $0.84 per share in passive income when we sold to open each of those contracts. RGR was trading above $35 at expiration and those put option contracts expired worthless out of the money. So we kept the premium and reduced our basis from$35.45 per share down to $34.61 per share. Selling to open the put option contracts helped us reduce the basis of the shares we own without waiting for a dividend or selling any shares. We bought some shares right away to be sure we get at least a few shares, then we’ll use puts to bring down our basis and try to get more shares.

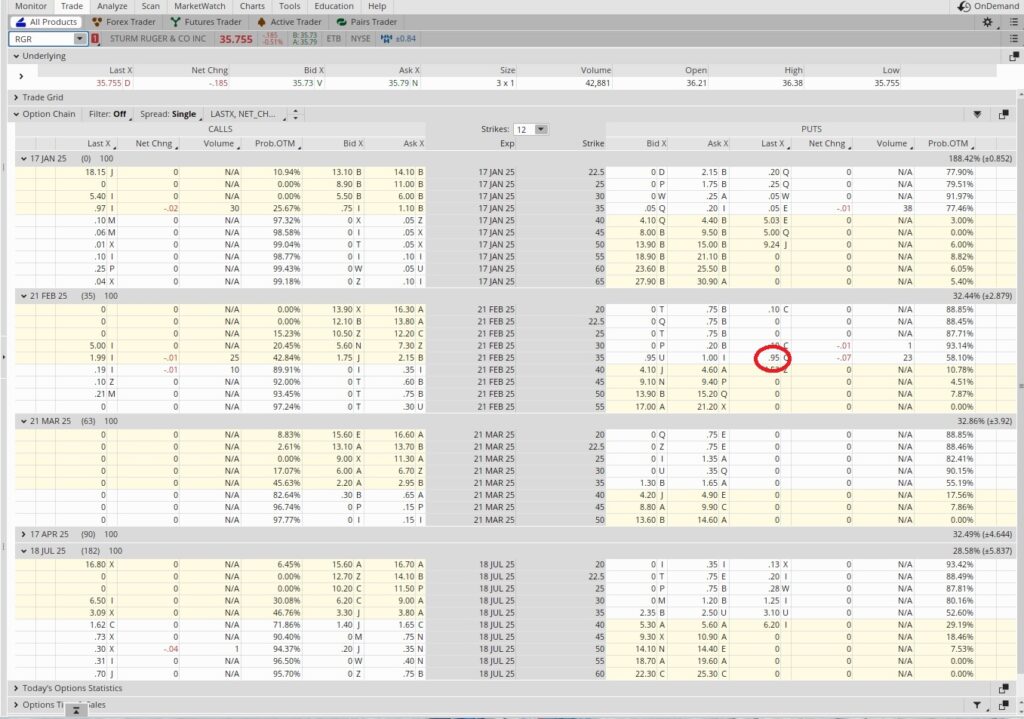

On the chart below we can see RGR is hovering around their 10 year floor at $35. They pay dividends, have a transparent annual report, and we think they have a solid management team. So we feel this is a good entry point.

We’re cognizant of the possibility that RGR could drop further, so we aren’t loading up on shares here. Instead we’re using put options to make a promise buy the company at $35. We’re comfortable paying that price per share, and we’re using the options market to get paid to make that promise. In this portfolio one tranche is about $7,000 for us, so we bought one tranche of shares outright, and now we’re selling another tranche of puts. If RGR drops down through our $35 strike we still have room in our portfolio for several more tranches. So this is our first bite of RGR.

Since our put option contracts expired we now have access to that capital again. With RGR trading in the same price range we’re going to sell some more put options for passive income. We sold to open the $35 strike for the 2/21 expiration date. We brought in $0.95 per share on that trade and we did two contracts. This trade brings our cost basis per share down from $34.61 to $33.66 per share. So we’ve made nearly $2 per share so far without collecting a dividend or selling any shares. Since we’re using puts to buy a company there is a chance we could buy shares with those contracts on 2/21. If RGR runs up away from our strike we’ll be in a better position on the shares we own. So whether RGR drops, stays where it is or goes up, we’re happy with this one.