Weekly Income Options Trade

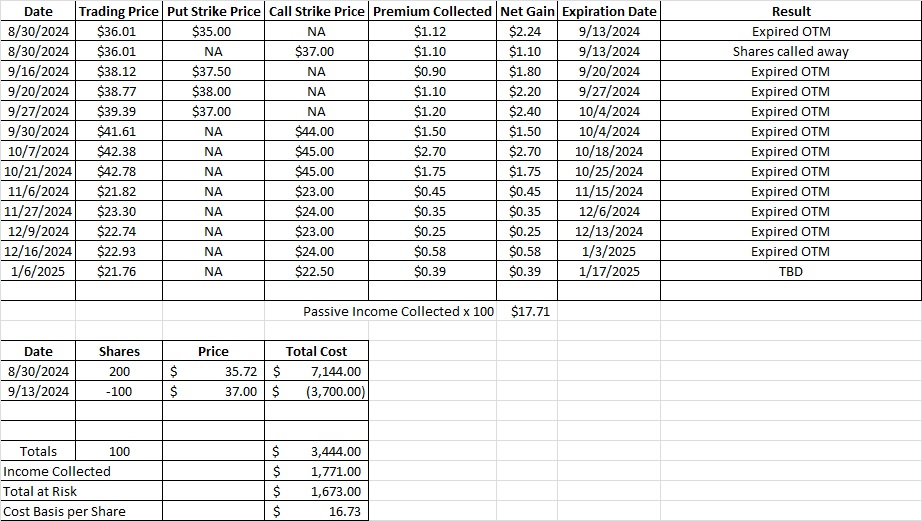

We’ve been doing weekly income options trades on CPRI lately. We have 100 shares of CPRI in this portfolio and our most trade expired out of the money last Friday, 1/3. CPRI is trading up over 7% today and is currently trading at $21.76. When companies have a strong day like today we like to sell covered calls above our cost basis. Since CPRI is on an upswing we’re going to get more premium by selling a call above the money than we normally would. These weekly income options trades have helped us work our basis down to $17.12 per share. As long as we sell our covered calls at a strike above that we’ll be making money. We’ll make money on the options premium and, if we’re called away, we’ll also make money selling the shares.

Our most recent weekly income options trade on CPRI was to sell the covered call at the $24 strike. That traded expired worthless out of the money last Friday. Since that trade expired now we have access to those shares again. So we’re going to sell another covered call.

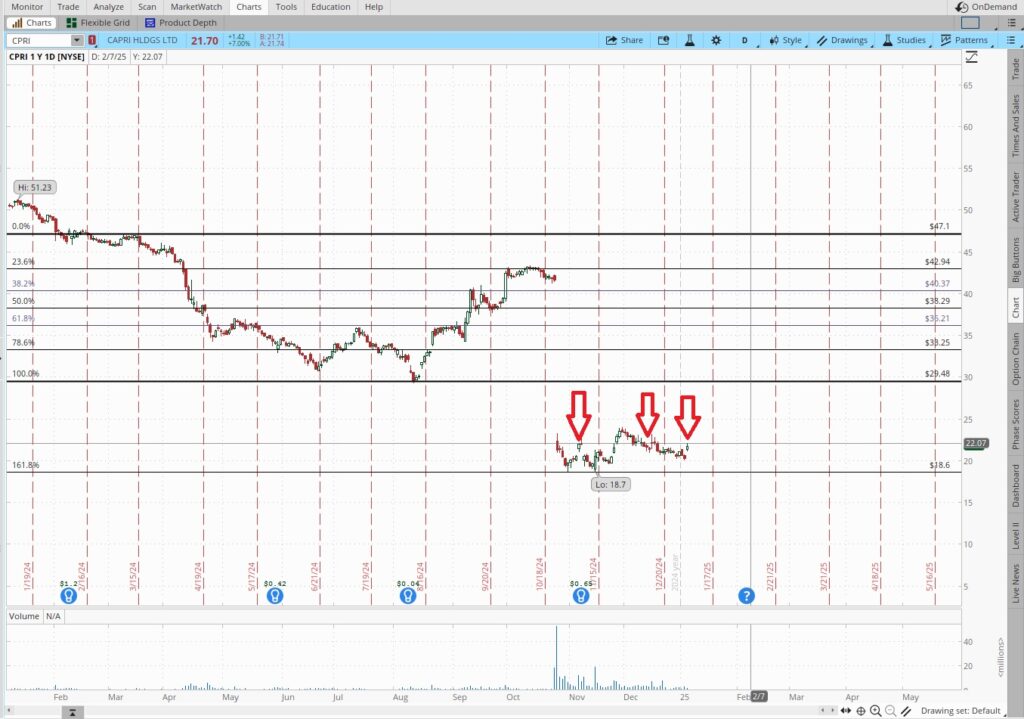

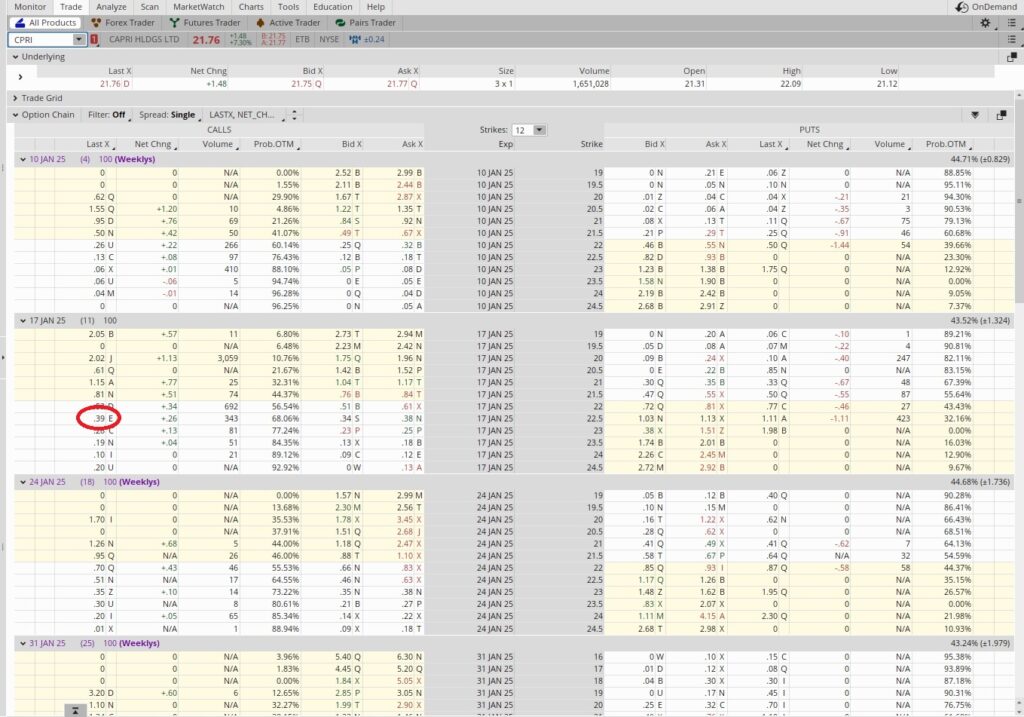

We can see a level of resistance at about $22.16 per share. So we’d like our call strike to be above that. We also want to be close enough to the money that we generate a healthy return.

We chose the $22.50 strike for the 1/17 expiration date and we received $0.39 in premium for the trade. If CPRI runs up through our strike we have the choice of letting the shares go or rolling the trade. Rolling the trade means we could buy to close the contract we sold to open. Then we would sell to open another covered call with a higher strike price that is further out in time. That way we would sell more time premium to make up for the cost of buying to close the original contract.

If we sell the shares at $22.50 we’ll actually be getting $22.89 per share because of the $0.39 in option premium. If CPRI stays below $22.50 we’ll keep both the premium from our weekly income options trade and our shares. Then we’ll sell another covered call. The premium for this trade brings our basis down to $16.73 per share.