Weekly Option Trade

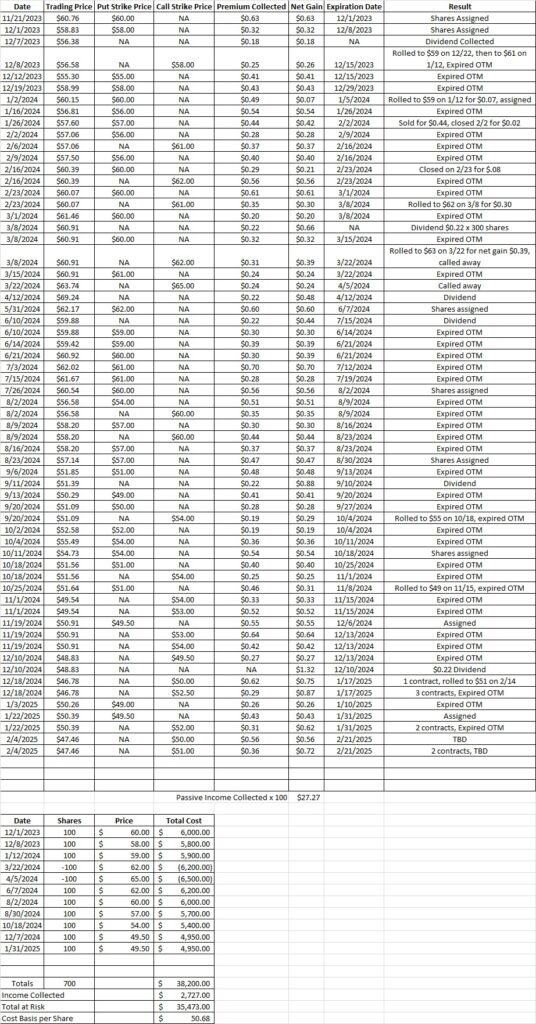

Our weekly option trade this week is selling covered calls. Selling these covered calls will generate passive income and reduce our basis on shares we own. We currently own 700 shares of OXY in this portfolio with a basis of $50.86 per share. We had two covered calls at the $52 strike that both expired out of the money last Friday. Here’s the post that walks through those trades. We also had a cash secured put option at the $49.50 strike, and we were assigned those shares. Now we’re going to sell calls to generate some options

premium for income. We’ll also use that premium to reduce our basis on the shares we own.

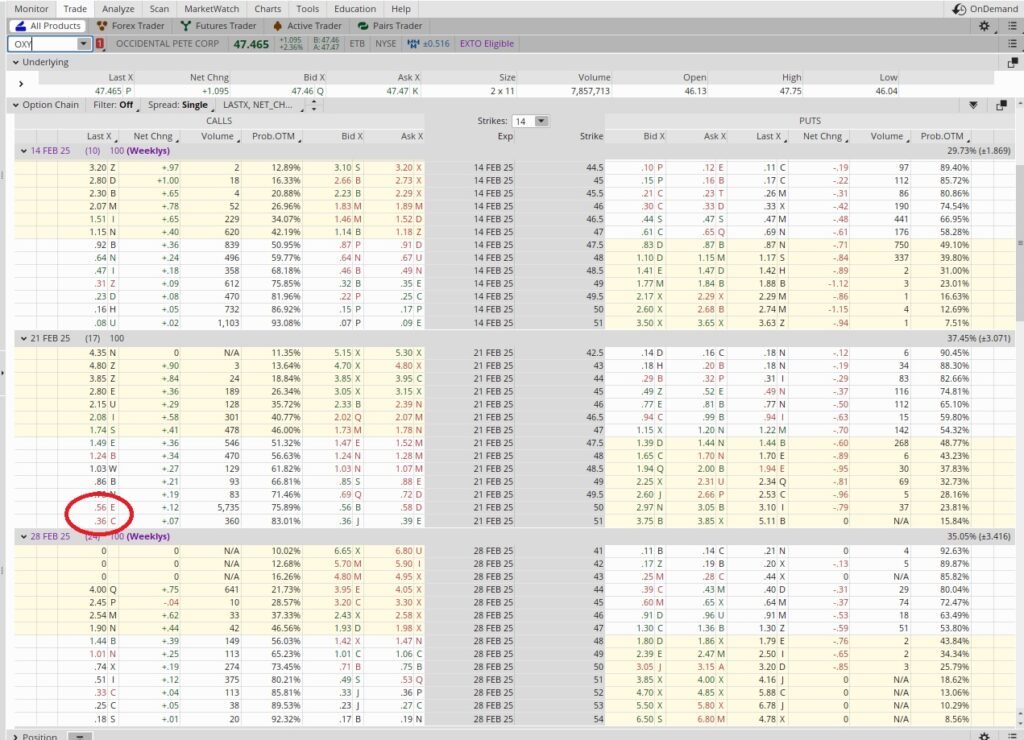

Right now OXY is trading at $47.39 per share. OXY has earnings coming up on 2/18 and we want to be aware of that when we pick our call. Since we have 700 shares we’re ok if we have some called away, so we’ll use the added volatility of the earnings call to improve the premium.

We’re also going to sell a cash secured put option on OXY, but OXY is up today. We’ll get more premium if we sell a put on a down day, so we’ll wait for a more favorable move to open that contract.

We sold to open one covered call contract for the $50 strike on the 2/21 expiration date for $0.56. We also sold to open two covered calls at the $51 strike for the 2/21 expiration date for $0.36 each. These trades bring in a total of $1.28 in premium. If OXY runs up through these strikes we can either let the shares go or roll the positions. If all 300 shares are called away on these contracts we’ll still own 400 shares. This weekly option trade brings our basis down to $50.68 per share.