Weekly Options Trade to Generate Passive Income

My recent weekly options trade to generate passive income has been selling puts on Bank of America. Last week I chose to roll the trade for a profit rather than take the shares. Here is a link to that post.

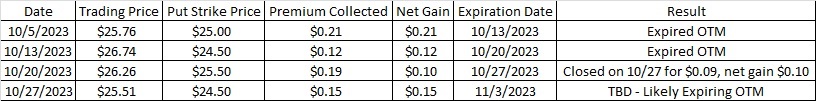

My trade history on BAC is as follows:

I have collected a total of 58¢ per share on my weekly options trade to generate passive income. I have not yet been put the shares on any of these option contracts.

BAC goes ex-dividend on 11/30, and the dividend is 24¢. I want to be sure I own some shares prior to that so I can collect the dividend. The 11/24 option expiration date is the last expiration date before BAC goes ex-dividend. Here is the tool I use to find that information.

If I don’t get assigned on puts I can buy shares outright if I really want the shares. Knowing that the dividend is coming up gives me an incentive to sell my put option contract on a strike that is closer to the money than I normally would. That way I increase the likelihood that I will get the shares. Either I get put the shares and collect the dividend, or I don’t get the shares and I collect the extra premium because of the closer strike price on the put option contract. Either way my weekly options trade will generate more passive income than usual.

The Strike

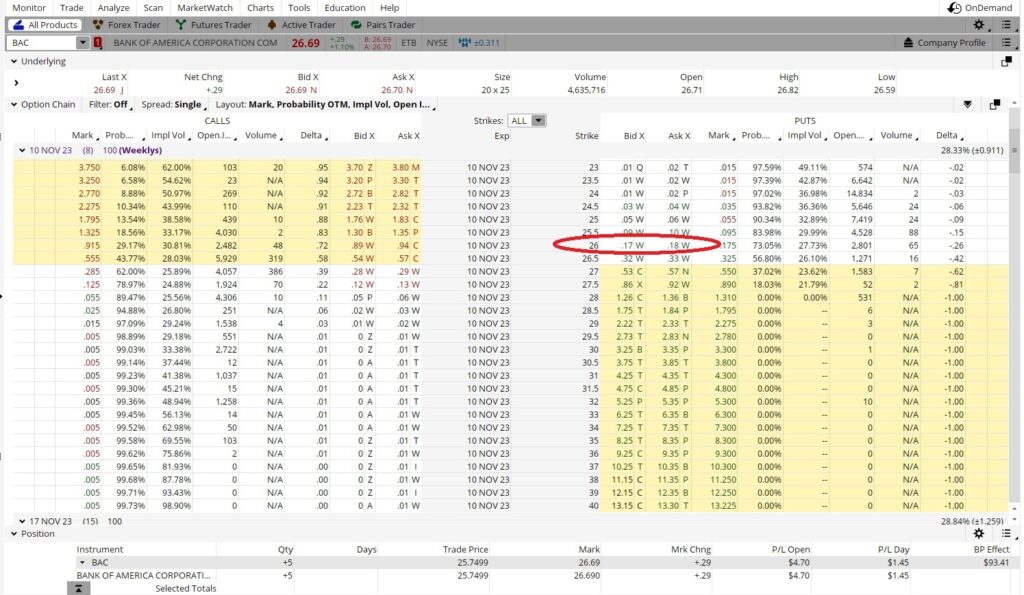

Right now BAC is trading at $26.69. There are a few choices I like for strikes right now, the $25, the $25.50 and the $26. Here is a link to my last post that talks about the charts.

I’d like my weekly put for passive profit to be one week out right now vs two weeks, so I’m looking at the 11/10 expiration date.

The $25 strike exp 11/10 has a bid of $0.05. That $0.05 divided into the $25.00 strike is 0.002. It’s a one week trade, so I multiply that 0.002 by 52 (because in theory I can do this trade 52 times in a year). 52 x 0.002 is 0.104, or a 10.4% return. I’d like my weekly put options trade to generate more passive income than that, so I’ll look at the next strike. The $25.50 has a Bid of $0.09, and $0.09 divided into $25.50 is 0.0035. That 0.0035 times 52 is 0.184, or an 18.4% annualized return. I want my annualized return to be more in the 25% range, so let’s look at the $26 strike. The Bid on the $26 strike expiring 11/10 is $0.17. $0.17 divided into $26 is 0.0065, times 52 is 33.9, or an annualized return of 33.9%. I’ll take that one.

COST BASIS

Now, if this goes in the money and I get assigned the shares, what’s my cost basis? I’ve collected $0.58 per share on my previous puts for passive income, and I’m getting another $0.17 on this put. That gives me equity of $0.75 per share. And if I get assigned I will also get the dividend from 11/30, which is another $0.24. My total basis will be the $26 strike minus my passive income. That passive income is the combined $0.75 in options premium and the $0.24 dividend, which right now totals $0.99. That means if I get assigned BAC shares at $26 on 11/10 my cost basis will be just $25.01. And then I’ll sell a call on those shares for my next weekly options trade to generate more passive income.