Wheel Trade on MBUU

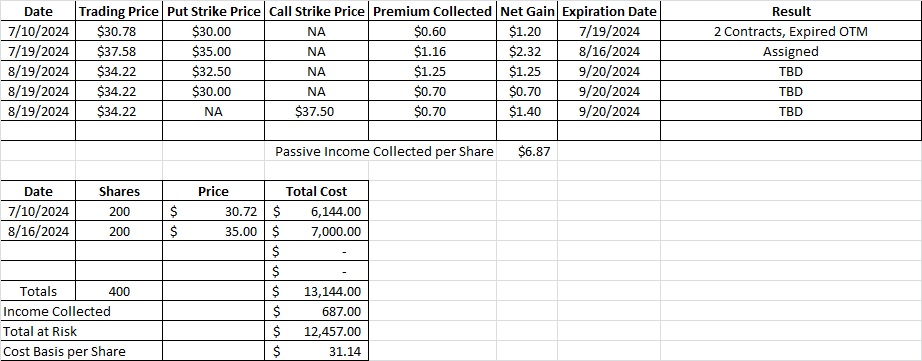

Our trade for today is a wheel trade on MBUU. Last month we sold cash secured puts on MBUU. Here’s the post that walks through how we opened that position. We had two puts at the $35 strike that expired in the money last Friday, 8/16. We were assigned those shares. Now we have 400 shares in our account with an average cost basis of $31.98 per share.

Now we’re going to sell a call above our cost basis and a put below our costs basis. If MBUU stays where it is we’ll reduce our costs basis per share by the premium we collect and we’ll also keep our 400 shares. Should MBUU rise above our call strike, the shares for those covered calls will be called away. If MBUU drops in price we’ll be obligating ourselves to buy shares at our put strike price. We think MBUU is worth more than the $34 it’s trading at today so we’re happy to buy more shares in this price range.

Weekly Option Wheel Trade

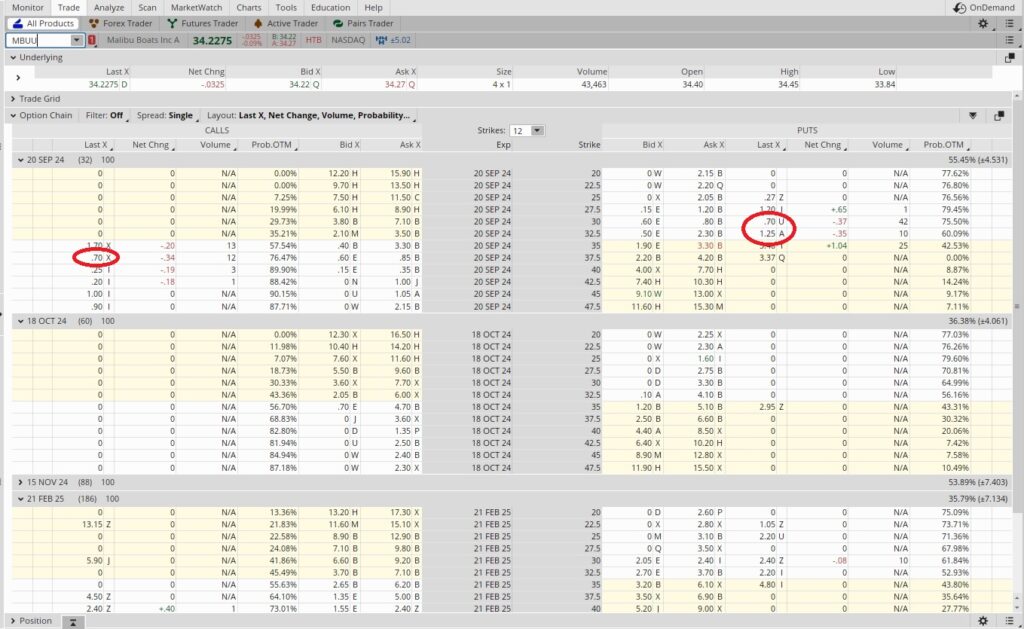

With MBUU trading at $34.22 right now we sold the $32.50 put for $1.25 and the $30 put for $0.70. If we’re assigned on the $32.50 put our cost basis per share on that contract will be the $32.50 strike minus the $1.25 in premium for a total of $31.25. That’s less than our current cost basis of $31.98 per share, so it helps us if we get those shares. It also helps us reduce our cost basis on our current shares if MBUU moves up away from our strike price and we don’t buy the shares. The $32.50 strike is pretty close to the money, and with the MBUU earnings call next week it’s possible we get these shares. In this portfolio one tranche for us is about $6,000. If we buy the shares on both of these puts we’ll still have room for two more tranches of MBUU.

This trade is for the September 20 expiration date, which is a one month trade. That means we could do this trade, or a similar trade on a different company, twelve times over the course of one year. The premium is $1.25, so divide that into the $32.50 strike price and we get 0.0385. Since we could do this trade twelve times in a year, we multiply that 0.0385 by 12 and we get 0.46. That’s an annualized return of 46% on the capital we’re risking on that $32.50 put. If we buy the shares on either of these put’s we’ll turn around and sell covered calls on them as part of our wheel trade.

We also sold the $30 put for the September 20 expiration date. We got $0.70 in premium on that put option contract. So we divide the $0.30 in premium into the $30 strike price and we get 0.023. Then we multiply that by 12 and we get 0.279. That works out to an annualized return of nearly 28%. Here’s a tool that walks through that math.

Then we sold the $37.50 call on two contracts for $0.70 each. We only did two contracts because the earnings call could cause the price to run up and we want to be sure we still hold some shares if that happens. If MBUU goes above $37.50 at expiration we’ll sell 200 shares at $37.50, which is above our cost basis. That will reduce our cost basis per share and we’ll still own 200 shares. If MBUU stays below $37.50 we’ll keep all 400 of our shares.

Trade Recap

To recap, we currently own 400 shares of MBUU. We sold two covered call option contracts at the $37.50 strike with the 9/20 expiration date. We also sold one cash secured put at the $32.50 strike for $1.25 in premium. Then we sold one cash secured put option contract at the $30 strike for $0.70 in premium. MBUU has an earnings call next week so we’re using that extra volatility to reduce our cost basis per share. If we’re assigned the shares on both puts we’ll still have room for two more tranches of MBUU in this portfolio. This wheel trade brought our cost basis per share on MBUU down to $31.14.