Why Tranches are Important

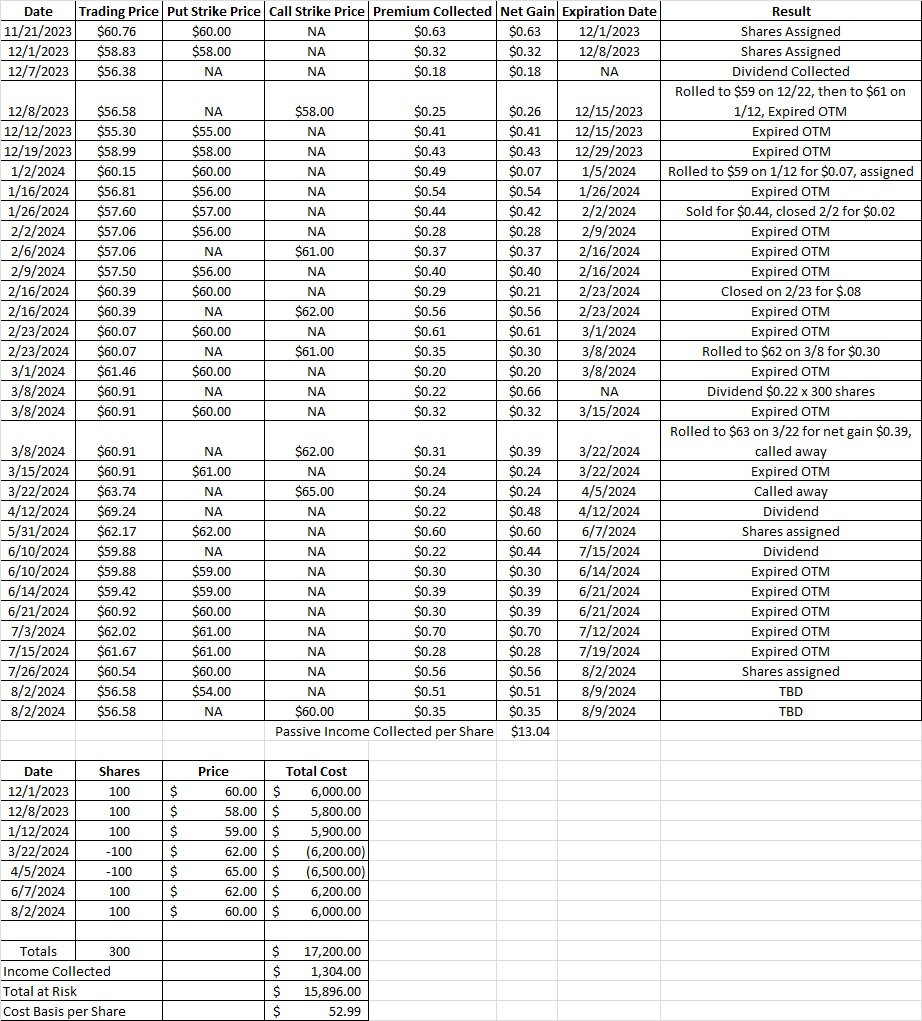

Our current options trade is a great example of why tranches are important. We currently have 200 shares of OXY in this portfolio with a per share cost basis of $49.91. We have a put option at the $60 strike that expires today, 8/2. With OXY currently trading at $56.58 our $60 put is in the money. That means we’ll be assigned the shares at the $60 strike unless we close this option contract before market close. We like OXY for the long term and we’re happy to buy shares at $60.

Since we’re going to buy shares of OXY at $60 we’re going to sell a call option contract at $60. Because we already have 200 shares of OXY in this portfolio, we can go ahead and sell the call right now rather than waiting until the new shares settle in our account next week to sell the call. This gets us a few more days of premium. We can only do this because we already own shares in our brokerage account. This is part of the reason why tranches are so important. By allocating our capital in pieces rather than all at once we’re able to get into positions at multiple price points. If we didn’t already own the shares we would need to wait for the newly assigned shares to settle before selling a covered call on those shares.

So with OXY trading $56.28 we’re going to sell a call at the $60 strike because that’s the price we’re buying our most recent tranche. The idea with this trade is to reduce our cost basis on the shares we own. We have room for five tranches of OXY in this portfolio. With the shares we’re buying today we’ll only have three tranches, so we’ll also sell another put option contract. We’ll sell that put below the current trading price.

Weekly Options Trade

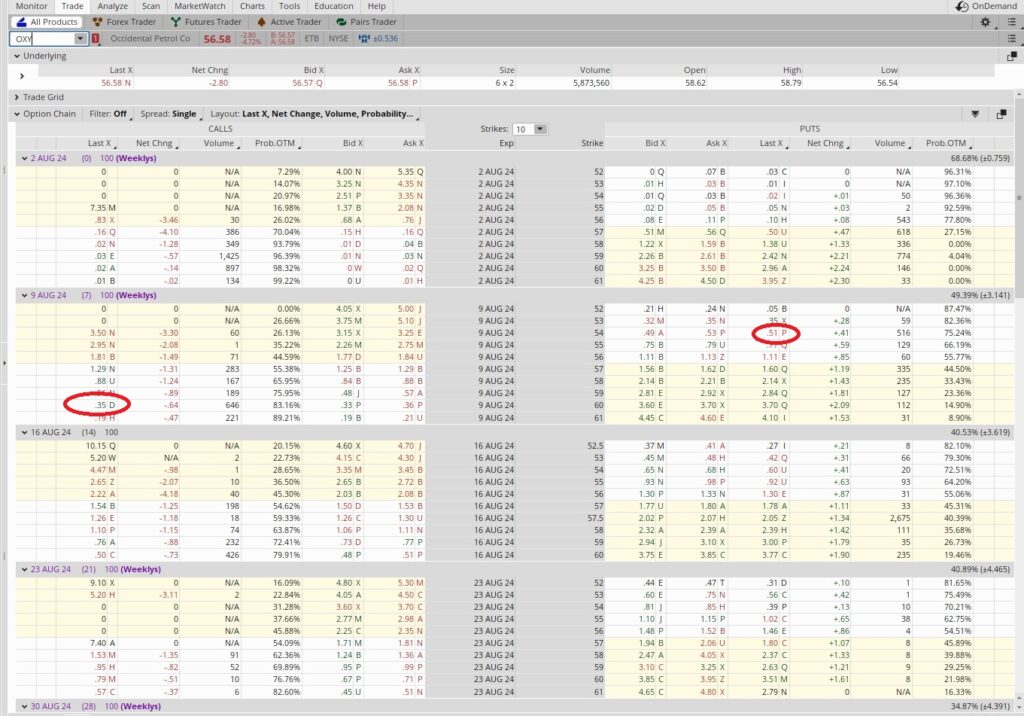

We sold the $60 call with the 8/9 expiration date for $0.35. On the covered call option contract we’re making a promise to sell 100 shares of OXY for $60 on (or before) the 8/9 expiration date. We bought those shares for $60 minus the $0.56 in option premium we earned from selling the put. So if we sell them at $60 we’re still making a profit of the $0.56 in premium from the put and the $0.35 from selling the call. That works out to $0.91 in option premium over the course of two weeks. So we’re using $6,000 in capital to make $91 in profit.

So far we’re only using that capital for two weeks (one week for the put and one for the call). There are 52 weeks in a year, so that means we’re tying up this capital for 1/26th of the year. If we did a trade similar to this every two weeks over the course of the year we’d make $91 x 26 = $2,366. If we divided that $2,366 into the $6,000 we’re using on the trade we’d be at 39.4%. That equates to an annualized return of 39.4%. That’s solid enough for us.

We also sold the $54 put option contract for $0.51. On the put we’re making a promise to buy 100 shares of OXY for $54 per share. We’re earning $0.51 in premium for selling to open that put option contract. So we divide the $0.51 in premium by the $54 we’re risking and we get 0.0094. This is a one week long trade, so in theory we could do this trade 52 times of over the course of a year. So we multiply the 0.0094 by 52 and we get 0.491. That’s an annualized return of 49.1%. Here’s a tool that helps with the math.

Keep in mind that we’re talking about a theoretical annualized return when we say that. It’s not likely that we could do this same trade at this same strike price on this same company every week for a year. But we could probably find a similar trade at a different strike price on a different company. What we’re really saying is that we’re using some capital for a specified period of time and we’re getting paid a specific amount for using that capital. If we continued doing that multiple times over the course of a year then we’d have our theoretical annualized return.

This is another reason why tranches are so important. We’re able to do this strangle option trade because we broke up our allocation to OXY into several batches rather than putting our entire allocation into one trade. If OXY goes up above $60 we’ll have one tranche called away but keep our other two tranches. If OXY drops below $54 we’ll buy another tranche at that lower price. And if OXY stays above $54 and below $60 per share we’ll keep the premium and our three hundred shares. Either way we’re happy with the end result.

Trade Recap

We’ll be assigned one hundred shares of OXY today, 8/2 at $60. We sold a call at the $60 strike for the 8/9 expiration date for $0.35. We also sold a put for the 8/9 expiration date at the $54 strike. These simple option trades have now reduced our cost basis per share on OXY down to $52.99 per share.