Produce Passive Income Selling Options

Lately we’ve been using a strangle option strategy on OXY to produce passive income selling options. Right now we have a $60 put and a $62 call on OXY. Here’s a link to the post that walks through those trades. Both of these option contracts expire today, 3/15. Last week we sold the $60 put for $0.32 and the $62 call for $0.31. Right now OXY is trading at $62.38, so our $60 put will expire out of the money and we will keep the premium. Our $62 call is in the money, so if we don’t roll it we will sell those shares at market close today.

OXY went ex-dividend on 3/7, and we’ll get the current dividend of $0.22 per share on 4/15. Here’s where we find the dividend info. We wanted to be sure we got the dividend so we were being careful on our call strike last week. Now we can look at whether we want to keep our shares or let them go. We currently have 300 shares of OXY in this portfolio, so even if we decide to sell these 100 shares we’ll still have 200 shares left.

Weekly Option Trade

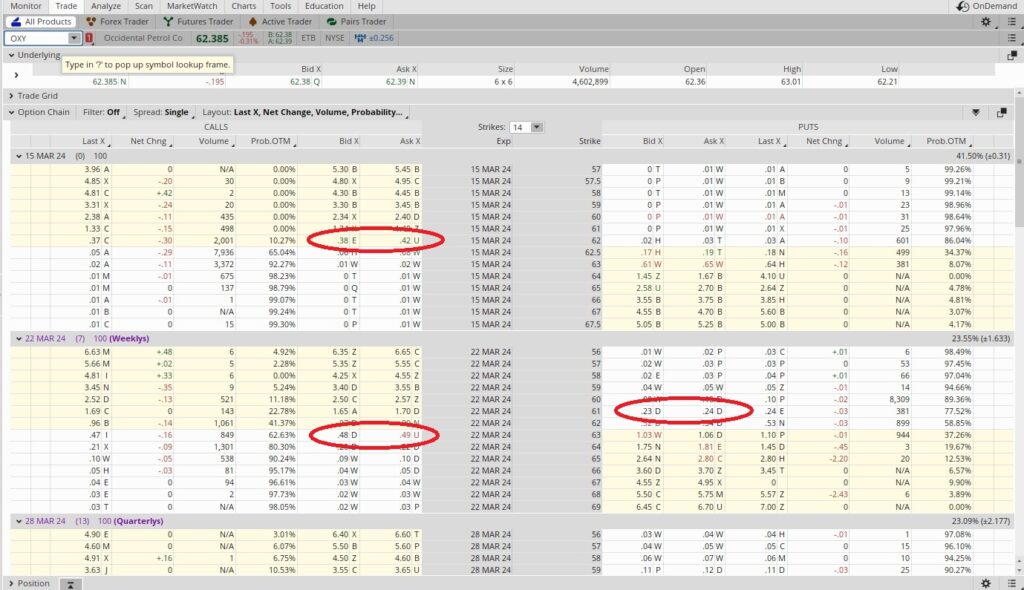

On the option chain below the $62 call expiring today has a Bid of $0.38 and an Ask of $0.42. Since we sold the $62 call for $0.31 last week, that acts as a credit toward buying back the call. If we buy back the call for $0.40, we’ll spend $0.40 per share to close the call option contract. Since we received $0.31 in premium when we sold to open the contract, we take that from the $0.40 we’ll pay now to close the contract. So $0.40 minus the $0.31 we made when we sold to open the contract gives us a net negative of $0.09 per share on this leg of the strangle option trade.

We can then sell a new call option for next Friday, 3/22, for us to recuperate what we paid to exit our ‘In The Money’, or ITM, call option. The $63 call is trading for $0.48. We’ll add that $0.48 per share to our negative $0.09 per share. That gives us a net positive $0.39 per share. So by rolling the call option contract we’ll produce more passive income than we would be just letting the shares go. We’ll also have the possibility to sell our shares for $63 versus the $62 we would have sold them for if we had not rolled the trade.

We’re ok selling the call this close to the money for a few reasons. One is that our cost basis is currently $56.51. If this call option contract goes in the money we’ll be selling this tranche for a profit. If OXY runs up through our $63 strike we’ll have the choice to sell the shares or roll the trade again. And if we roll it again we’ll produce passive income by selling the option premium. Another reason is that we have 300 shares. So even if we sell 100 shares at $63, we’ll still have another 200 shares to ride this train a little further.

Let’s also take a look at the put side of the strangle. Last week we sold the $60 put option contract. Since OXY moved up this week we’ll want to move our put strike up a little to make sure we’re getting an acceptable rate of return on our capital. The $61 put option expiring 3/22 has a bid of $0.23 and an Ask of $0.24. This is a one week trade, and there are 52 weeks in a year, so our time multiplier is 52. We take the $0.24 in premium and divide that by the $61 strike. We’ll need to put up $61 per share for this trade. That works out to $6,100 because one contract is for 100 shares. So $0.24 divided by $61 is 0.0039. That, multiplied by 52 is 0.205, for an annualized return of 20.5%. Here’s a tool that helps with the math.

Cost Basis per Share

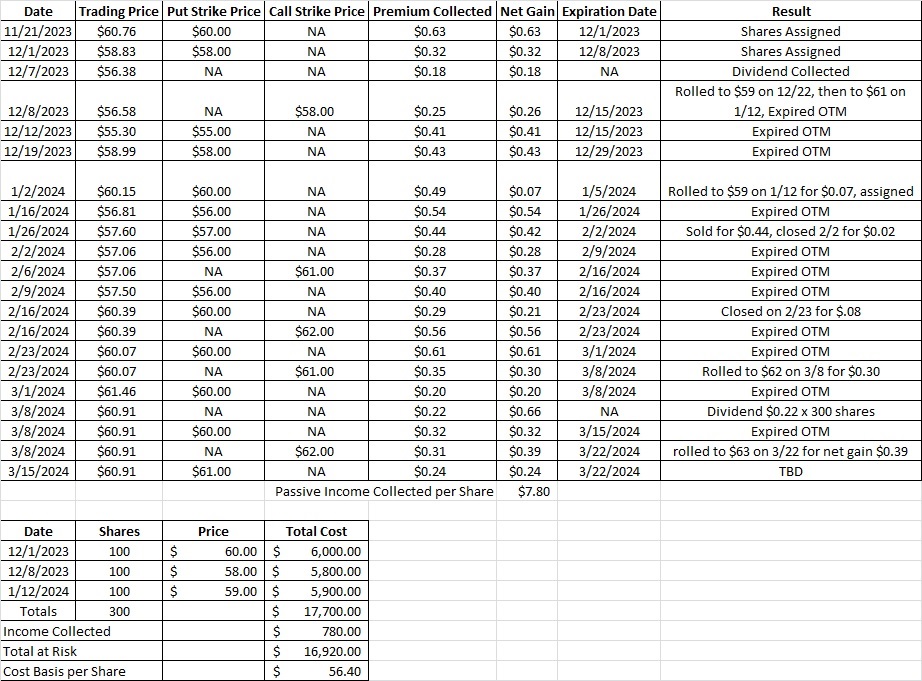

The table below shows how we’ve been able to produce passive income selling options on OXY. Including the strangle option contracts we sold to open today, our cost basis per share on OXY is now $56.40. When making option trades like this, remember that the quality, value and trading price of the company are more important than the options trades. If the trade goes against us and we end up with shares, we want to own a good company.