Earn Passive Income with a Strangle Option

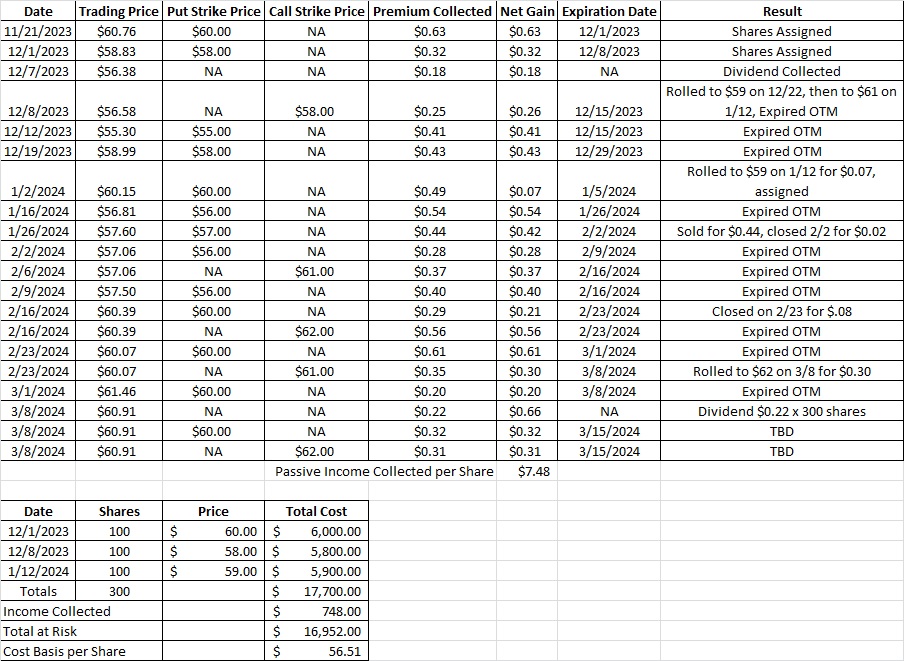

We’re using OXY to earn passive income with weekly options trades. Right now we have the strangle trade on that we opened last Friday, 3/1. We have the put option contract at $60 and the call option contract at $62. Both of those option contracts expire today, 3/8. With OXY currently trading at $60.91, both sides of that trade will expire out of the money. Here’s the article we wrote last week on how we set-up that strangle option trade.

The company we use for these weekly options trades is more important than the weekly trades themselves. Here’s an article that outlines why we like OXY right now.

So far we’ve been able to work our cost basis per share on OXY down to $56.94. Yesterday was the ex-dividend date for OXY. That means yesterday was the first day that OXY trades with credit for owning the shares going to the next dividend. To get the current dividend we need to be a shareholder of record as of today, 3/8. Since OXY is trading under our $62 strike on our call option contract we will keep those shares. And that means we’ll get the dividend for those shares. The dividend is $0.22 per share. In this portfolio we currently own 300 shares of OXY, so we’ll earn passive income of $66 from the dividend (300 x $0.22 = $66). Here’s the tool we use to research the dividend amount and ex-dividend date.

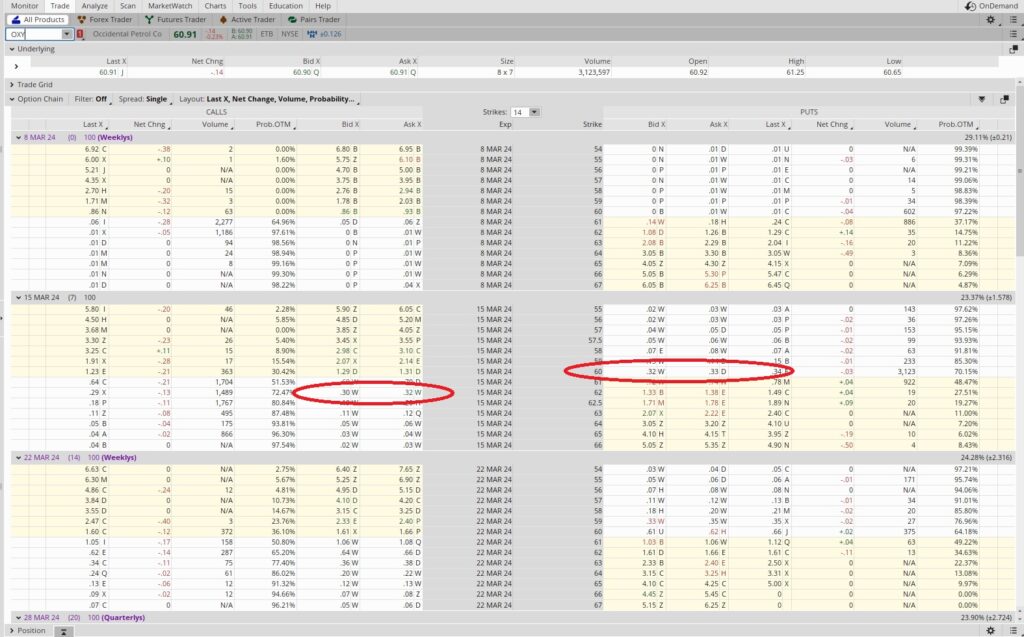

This week we’re going to open a similar strangle option trade to earn passive income. With OXY trading at $60.91 the $60 put expiring on 3/15 has a Bid of $0.32. Since one put option contract is for 100 shares, we’ll need at least $6,000 in our brokerage account to cover the trade (100 x the $60 strike). We’ll only need the $6,000 if the trading price of OXY drops below $60 and we get assigned the shares. If the trading price of OXY stays above $60 through the expiration date next Friday, 3/15, we’ll just keep the premium without buying the shares. Either way, we want to have the capital to cover the cost of the contract in our account before we make the trade.

Since this is a one week long trade we could do this trade 52 times in a year. Since we’re putting up $60 per share, we’ll divide the premium of $0.32 into $60, and that gives us 0.0053. Then we’ll multiply that 0.0053 times 52 weeks, which gives us 0.277. That’s an annualized return of 27.7% on that leg of the options trade. Here’s our annualized return calculator tool that will help with the math.

On the call side of the strangle option trade we sold the the $62 strike for $0.31 per share. On this leg of the trade we’ll use our cost basis per share of $56.94 to determine our annual return. We’ll do that because we’re selling the call on shares we already own. This is also a one week trade that expires on 3/15, so our time multiplier is 52. We take the $0.31 in premium and divide that into our cost basis per share of $56.94. That gives us 0.0054. Then we multiply that 0.0054 times the 52 periods in a year that we could do this trade. That gives us 0.283. That’s an annualized return of 28.3%. That works for us.

So this week we were able to generate $0.32 on the put leg and $0.31 on the call leg of our strangle option strategy. That means we were able to earn passive income of $0.64 per share on the two contracts we used for this trade. We also got the dividend of $0.22 per share on the 300 shares of OXY in our portfolio, so we reduced our cost basis per share down to $56.51.

Let’s take a step back on this series of trades. We started our first put on OXY back on 11/21/23. Today is 3/8/24, so we’ve been at this for 108 days. There are 365 days in a year, so we divide that by 108 and we get 3.38 periods in a year. Right now OXY is trading at $60.91 and our cost basis per share is $56.51. $60.91 – our cost basis of $56.51 is $4.40 of profit. That $4.40 divided into our cost basis of $56.51 is 0.078. We take that 0.078 and multiply it by our time multiplier of 3.38 and we get 0.263. That’s an annualized return of 26.3%. Using the Rule of 72, we’ll double our portfolio every three years if we consistently generate an annual return of 26%. So we’re feeling pretty good about earning passive income in Minocqua, Wisconsin with this series of trades.