Buy to Close an Option Contract

Our call option contract went in the money, so this week we’re evaluating whether we should buy to close the option contract or sell the shares. Lately we’ve been selling puts and calls on OXY to earn weekly passive income. We have a call option on OXY at the $65 strike that expires today, 4/5. We sold to open the call contract on 3/22, and here is the post that walks through that trade.

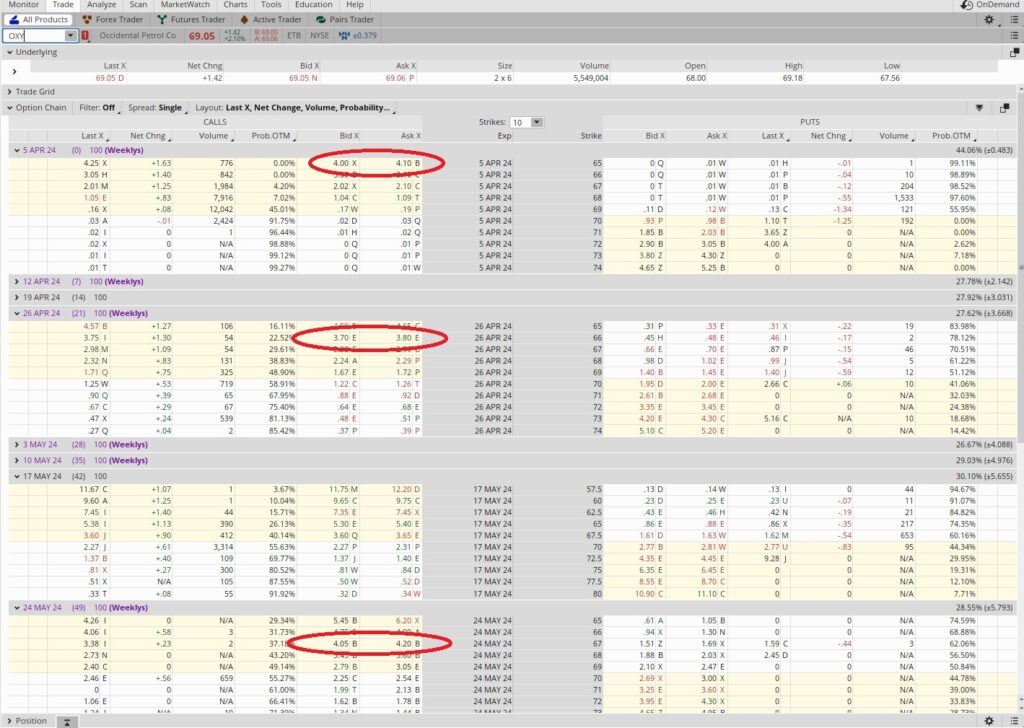

Today OXY is trading at $69.05, so our $65 call option contract is in the money. Now we have the choice to sell our shares at the $65 strike or buy to close the option contract. When we sold to open the call option contract we earned $0.24 in premium. So if we sell the shares at the $65 strike we’ll get $65 per share, plus we’ll also keep the $0.24 in option premium. That means we’ll receive a total of $65.24 per share if we sell the shares. If we buy to close the option contract we’ll buy back the contract that we sold to open, and then we won’t be obligated to sell our shares at the $65 strike.

The $65 call option contract on OXY has a Bid of $4.00 and an Ask of $4.10. So we can likely buy to close the option contract for $4.05 per share. We sold to open the call option contract for $0.24 per share, which means we’ll have a net loss of about $3.81 per share if we buy to close the option contract. Then we can sell to open another call that is further out in time to recoup that loss. So let’s look at some options.

We’ll be down $3.81 per share if we buy to close the option contract, so we’ll want to get at least that much on the next contract. On the 4/26 expiration date we can see the $66 call has a Bid of $3.70 and an Ask of $3.80. That means we’ll likely get $3.75 if we sell to open that contract, which is less than the $3.81. So let’s go a little further out in time.

The call option contract with the $67 strike expiring 5/24 has a Bid of $4.05 and an Ask of $4.20. So we can likely sell to open that contract for $4.10. That’s above the $3.81 we’d need to break even on the trade, so that’s a plus. The down side is that the expiration date is all the way out on 5/24, which is 49 days out. A lot can happen between now and then, especially when we think about an oil company. But if the trading price of OXY stays above $67, we’d sell our shares for $67 on 5/24. That’s $2 more than what we’d get if we sold the shares today.

Let’s walk through the math if we buy to close the option contract. We’ll get an extra $0.05 in premium if we roll the $65 call that expires today to the $67 call that expires on 5/24. That part is a guarantee. What isn’t guaranteed is selling our shares at $67 on 5/24 rather than $65 today. This is a 49 day trade, and 365 divided by 49 is 7.5. So we take the $0.05 premium for the trade and divide that into the $65 per share that we would get today if we sold, and that gives us 0.00077. We multiply that by our 7.5 time multiplier and we get 0.0058. That means our annualized return on this trade would be 0.58%. That’s not great.

If we get called away at $67 we’d also get the extra $2, so for that we’d be getting $2.05 for the trade, not just $0.05. If we divide $2.05 into the $65 we’d receive today by selling, we get 0.0315. That, times our time multiplier of 7.5 is 0.236. That equates to an annualized return of 23.6%. That’s ok, but not great. And it’s not a guarantee.

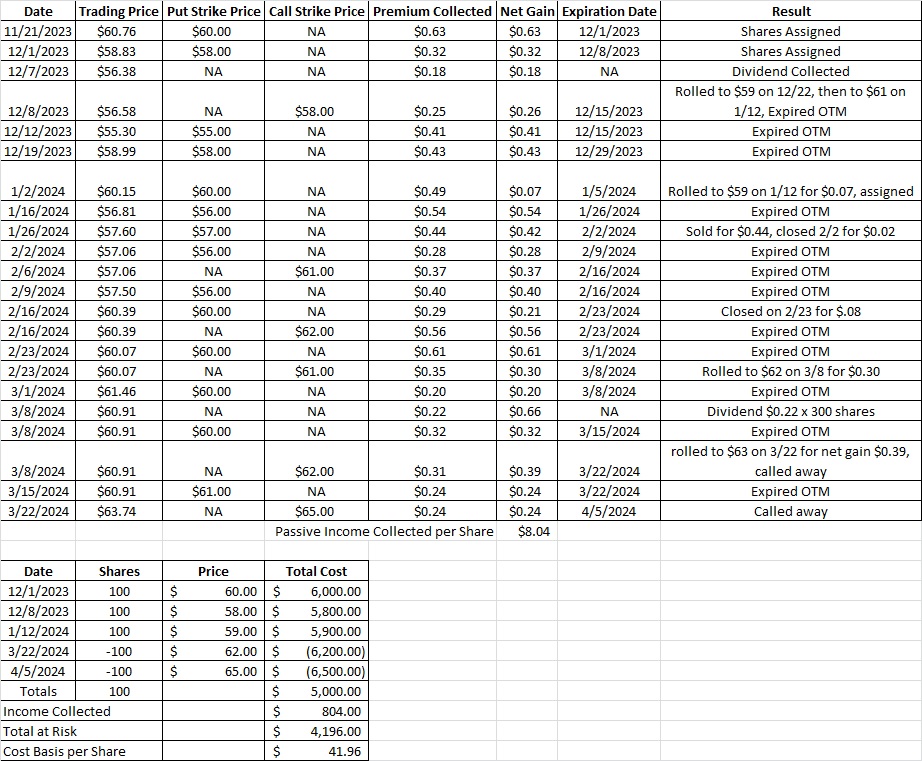

Cost Basis per Share

Let’s also look at our cost basis if we sell the shares today at $65. We’d sell 100 shares at $65, which is half of our remaining stake of OXY in this account. We’d receive $6,500, and that would reduce our cost basis on OXY to $41.96 per share.

So the question is whether or not to roll out of the position. If we buy to close the contract and sell to open a new one, we’ll get an annualized return of less than 1%. We can make a better choice than just 1%. If we get called away at $67 we’ll get an annual return of 23.6%. That’s solid, but not guaranteed. Or we can sell the shares today, get $6,500, and reduce our cost basis on our remaining 100 shares of OXY to $41.96 per share. OXY would need to drop quite a bit for us to ever lose money on it, and we’d have $6,500 for something else. A big factor for us in this decision is whether or not we have a ‘something else’ to do with that capital right now. And yes, we do. So we’re going to let the shares go.