Sell to Open a Put Option Contract

This week we’re going to sell to open a put option contract. When we enter an option contract we can either ‘Buy to Open’ or ‘Sell to Open’ the contract. When we Sell to Open a put option contract we are obligating ourselves to buy the shares of the underlying company at the strike price.

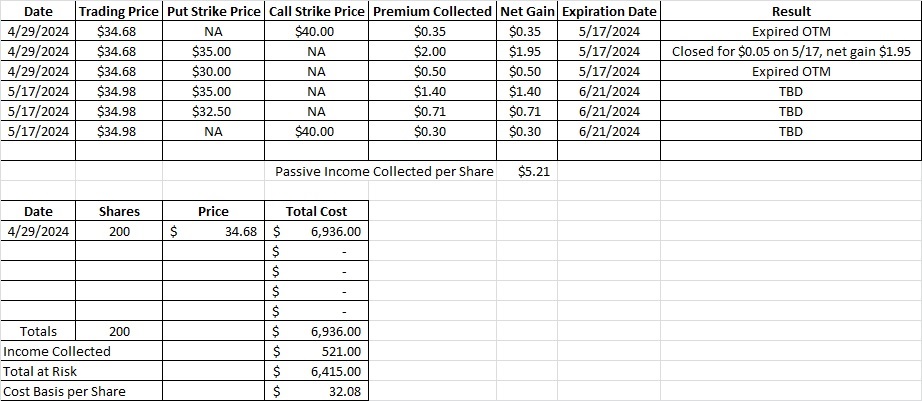

In this portfolio we currently own 200 shares of MBUU. We also have a put option contract that expires today, 5/17 at the $35 strike and another at the $30 strike. We collected $0.50 in premium per share on the $30 put strike and $2.00 per share on the $35 strike. Here’s link to the post that walks through those trades.

MBUU has been trading between $34 and $35 today, so our $35 put option contract is in the money. Unless MBUU moves up today our option contract at the $35 strike will obligate us to buy shares at $35 at market close today. Our $30 put option contract will expire out of the money and we’ll keep that premium.

We’re happy to own more shares of MBUU, but we already have one tranche of shares. Our cost basis is currently $33.26 per share. While taking shares at $35 would give us a bigger position in MBUU, it wouldn’t improve our cost basis. So one choice is to take the shares at $35. Another choice is to buy to close the put option contract at the $35 strike that expires today. Then we can sell to open a put option contract for the next expiration date at that same $35 strike. We’re going to do this because we’ll typically get more premium for selling an ‘At the Money’ put option than an ‘At the Money’ call option.

The Weekly Trade

It’s close to market close right now and our $35 put is in the money by just a few cents. We’re going to buy to close the $35 put option contract that expires today, 5/17. We sold to open this contract on 4/29 for $2.00 per share, and now we’re going to buy to close the put option contract for $0.05 per share. That gives us a gain of $1.95 per share on that trade.

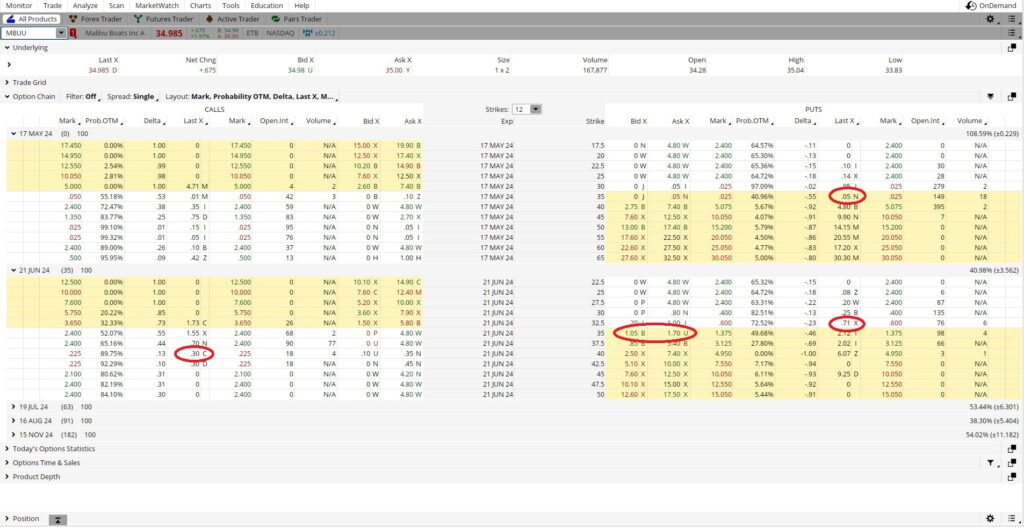

Then we’re going to sell to open the $35 put that expires on 6/21. That contract has a bid of $1.05 and an Ask of $1.70. We sold to open the put option contract for $1.40. We’re putting up $35 per share when we sell to open this put option contract, so we need to have $3,500 in our account to make this trade. We need that much because one contract is for 100 shares, and 100 x $35 is $3,500.

So we’re putting up $3,500 to make $140. It’s a one month trade, so we could do this trade twelve times in a year. $140 divided into $3,500 is 0.04. Then we multiply that by the twelve times a year we could do this trade, and that gives us 0.48. That means we’re getting an annualized return of 48% on the $3,500 we’re putting up when we sell to open this put option contract. Here’s a tool that can help with that math.

We also sold to open a put option contract at the $32.50 strike that expires 6/21. We got $0.71 in premium when we sold to open that put. The math on that one is $0.71 in premium divided into the $32.50 strike, which is 0.0218. This is a one month trade, so we could do this trade twelve times in a year. So we multiply the 0.0218 times the twelve months in a year and we get 0.262, or an annualized return of 26.2%. We’ll take it.

We also sold to open a call at the $40 strike that expires 6/21. We were able to generate $0.30 per share in passive income selling that stock option contract.

Cost Basis per Share

So to recap, we currently have 200 shares of MBUU. We had a put that expires today at $35 and another at $30. The $30 put will expire out of the money. We bought to close the $35 put and then sold to open the $35 put option contract for the 6/21 expiration date. We also sold to open the $32.50 put option contract for the 6/21 expiration date. Then we sold to open one $40 call option contract. We only sold one call option contract because there’s a chance that MBUU runs up above that strike and if it does we want to be sure we have some shares we can ride up. Our cost basis on MBUU is now $32.08.