Close Weekly Options Trade Early at a Profit

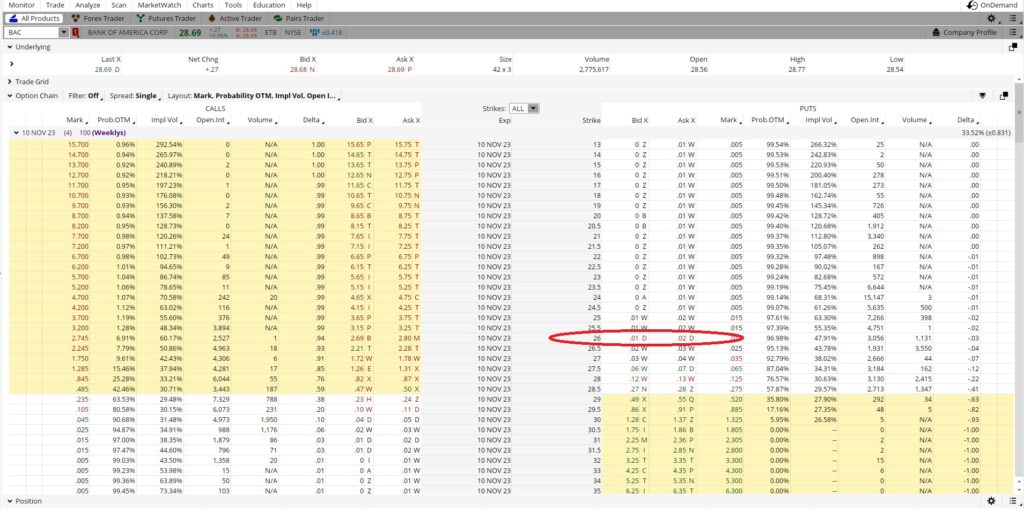

Sometimes I close my weekly options trade early at a profit. Last Thursday I sold a put on Bank of America at the $26 strike expiring 11/10 for $0.17. BAC was trading at $26.69 at the time. It was a one week trade with a return that annualized out to over 33%. Here is the post that walks through that trade.

The put contract at $26 means I need to have enough in my account to cover that $26 times the 100 shares that could be assigned on the put, or $2600. And I need that for each contract I sold. If I sold 10 contracts, that’s $26,000. If I close these weekly put option contracts early at a profit I’ll have access to that $2,600 for each contract again.

Capital Allocation

BAC has run up the last few days and is now trading at $28.69. Since the trading price of BAC moved up away from my put strike, the trade went my way. Now my $26 puts expiring this Friday, 11/10 are less likely to end up in the money. When I sold the put I received $0.17 in premium for a one week trade on a $26 strike. The math on that was $0.17 premium divided into $26 strike for 0.0065. Since it is a one week trade I could do that trade 52 times in a year, so I multiply the 0.0065 times 52. That gives me a return of over 33%.

But now that same contract that I sold for $0.17 in premium has an Ask of $0.02. That means the put option contract I sold last Thursday for $0.17 I can now buy back for $0.02. My total possible gain on this options contract for passive income is $0.17 per share if I let it run through expiration and it expires out of the money (OTM). I’m about halfway through the duration of the contract and I’ve already captured over 85% of the total possible gain. Is it a good idea to close my weekly options trade early at a profit?

If I close my weekly options trade early at a profit I will be guaranteed of collecting the profit. I’m not overly concerned that BAC will drop back through my $26 strike by this Friday. I’m pretty sure the options contract I sold for passive income will expire out of the money.

Return on Capital

The return on capital for this weekly options contract is now just $0.02 on $26 over the next five days. The math on that is $0.02 to close the contract divided into the $26 strike, which is 0.000769. The contract is still active for the five trading days from today through Friday. So I take 365 days in a year and I divide that by the five trading days, and I get 73. That means I could have this five day trade active 73 different times over the course of one year. If I multiply the 0.000769 times the 73 and I get 5.6, or a 5.6% annualized return. I want more than just a 5.6% return on my capital, so I’ll think about closing my weekly options contract early at a profit.

I can also think about what I have already made on the options contract I sold for passive income. Today is Monday, so it has been four days since I opened the contract. I can close the contract now for $0.02. I take the $0.17 I made my selling the option contract for passive income, and I subtract the $0.02 it would take to buy back that same contract. That gives me $0.15. $0.15 divided into the $26 strike is 0.00577. I take 365 days in a year and divide that by four days, and that gives me 91.25. The 91.25 times the 0.00577 is 0.5265, or a return of over 52% if we annualize it.

That’s even better than the 33% return I had projected when I sold the put option contract for passive profit last Thursday. So my annualized return is higher if I close my weekly options trade early at a profit than if I let it run to expiration.

A downside to closing the trade early is that I will need to pay the contract fee to my broker. If I let the put option I sold for passive income run through expiration and it expires out of the money I don’t have to pay the contract fee.

Right now I have two tranches of BAC shares. I want another tranche because it has a $0.24 dividend coming up on 11/30. Here is the tool I use to find that. Since I want more shares of BAC so I can collect the dividend, I’ll close my weekly options trade early at a profit of $0.15 per share. That will free up $2,600 per contract in my account. That will give me the capital to generate more passive income by selling stock option put contracts on BAC before it goes ex-dividend on 11/30.