Sell Put Options to Collect a Dividend for Passive Income

I’m selling put options to collect a dividend for passive income. Bank of America has a dividend of $0.24 and it goes ex-dividend on 11/30. That means I need to own shares of BAC before 11/30 to collect the dividend, as 11/30 is the first day BAC will trade without giving the dividend for the current period.

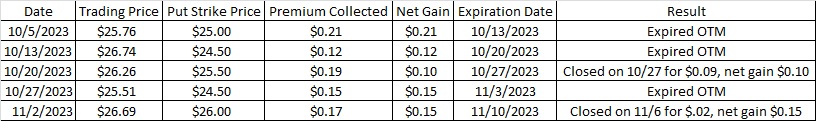

I’ve been selling put option contracts on Bank of America over the last few weeks. Here’s a post that talks through the how and why. And here is a table that shows my trade history on BAC. So far I’ve collected $0.73 per share on BAC without assignment of the shares.

I currently own two tranches of BAC and I’d like to add another tranche before it goes ex-dividend on 11/30. Here is the tool I use to find out the ex-dividend date. I have the choice to buy the shares outright. Or I could sell put options and get paid to agree to buy the shares that I want to buy, at a price I want to buy them, by a certain date. I’ll go with the latter and use put option contracts to generate passive income.

On this one year chart with daily candles we can see that BAC recently ran up over $28 and has since pulled back a bit. It’s now trading at $27.80, and I can see a support/resistance line that it has hit several times over the last seven months right around $27.60. It hit that line this morning and bounced off it. So I want my put option contract to be below that support line. If the support line holds and I do not get the shares, I still have another chance to get shares on the 11/24 expiration. So right now I’ll sell a put option contract just below the support line. I’m ok with getting the shares because I want to collect a dividend for passive income.

Picking the Put – The Math

Today is 11/8, and the expiration date of 11/17 is nine days away. I take 365 days in a year and divide that by 9, which gives me 40. So I could theoretically do this nine-day trade 40 times in a year. That ‘40’ is my multiplier.

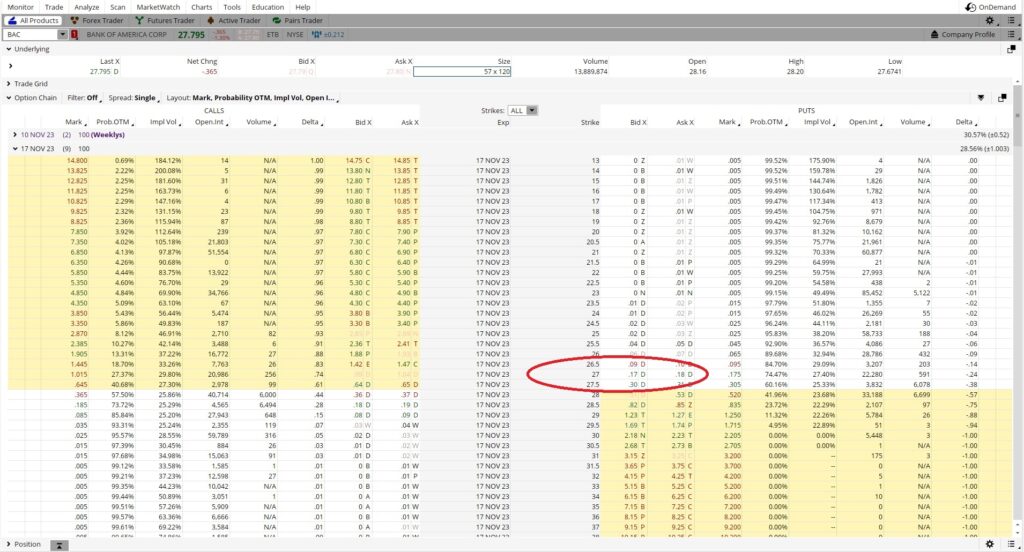

The next factor is the strike price. I could do the $26.50, the $27, or the $27.50 strike. Since one put option contract represents 100 shares of the company, I take the strike price and multiply it times 100 to get the amount of capital I will need in my brokerage account for each put option I sell. The $26.50 strike would require $2,650 in my account for each put option contract. Here is the option chain for BAC.

The $26.50 put has a Bid of $0.09. That means I would get paid $0.09 x 100 = $9 for each put contract I sell. I take the $0.09 and divide that into the $26.50 strike, which is 0.0034. I take that 0.0034 and multiply it by the number of times in a year I can do this trade, which is 40, and I get 0.136. The $0.09 premium on the $26.50 strike yields a 13.6% return if we annualize it. I’d like a higher return than that, so let’s look at the $27 strike.

The $27 strike expiring 11/17 has a Bid of $0.17. $0.17 divided into $27 is 0.0063. That 0.0063 times the 40 multiplier is a return of 25%. That sounds better than the 13.6% on the $26.50. I’m ok being this close to the money because I want the shares so I can collect a dividend for passive income.

I could also sell the put at $27.50. That has a Bid of $0.30. $0.30 divided into $27.50 is 0.0109. The 0.0109 times the 40 multiplier is 0.436, or a return of 43.6% annualized. That’s a much higher return than the 25% on the $27 strike.

The down side with selling a put at $27.50 is BAC ran up to $28.93 on 11/3 and has started pulling back since then. Today’s low (so far) is $27.67. I’m hesitant to sell a put that close to the money because I don’t want the shares at $27.50 if BAC is trading lower than that. If I sell the $27 put and I get assigned, I’ll have collected premium of $0.17 on the put expiring 11/17 in addition to the $0.73 I’ve already collected. That’s $0.90 in premium, which means my actual cost basis on the shares would be $27.00 – $0.90 = $26.10. And then I would get the $0.24 dividend on top of that.

So I’ll sell the $27 put. If I get assigned I’ll collect the dividend and then sell calls on the shares. If I don’t get assigned I can sell another put closer to the money that expires on 11/24. Since I want to collect a dividend for passive income, I want the shares. So even if I don’t get the shares this time, I still have another chance at the shares the following week before BAC goes ex-dividend.