How To Roll a Put Option for Passive Income

I’ve sold puts to generate passive income selling stock options on the same company over the last few weeks. I’m using Bank of America (BAC), and this post talks about why I chose that company for a passive investment.

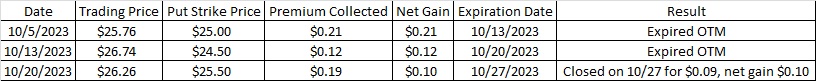

Here is the history of puts I’ve sold on BAC to generate passive income selling stock options:

Here are posts showing how I chose these puts to generate passive income selling stock options for trades on 10/5/23, 10/13/23, and 10/20/23.

The put I sold last week to generate passive income selling stock options was the $25.50 strike expiring 10/27, and right now BAC is trading at $25.51. So I have a choice. Doing nothing means I could possibly be assigned the shares when the contract expires when trading closes today. I could close the contract, which means I would buy back the contract I sold when I opened it. I could also close the contract and sell another at a lower strike price that is further out in time. This practice known as ‘rolling’ the trade.

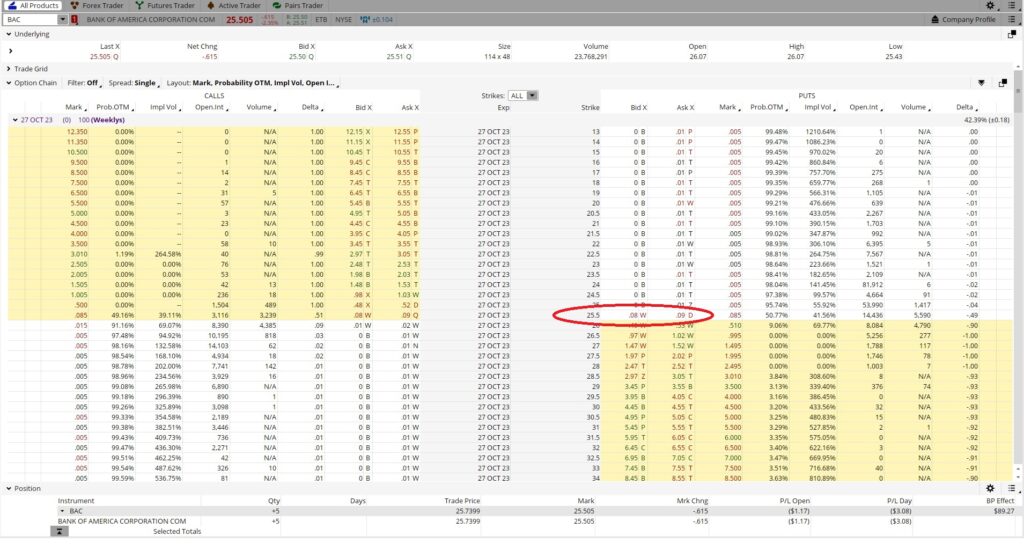

I would rather roll the trade to a lower strike than get assigned the shares, so I can ‘buy to close’ the contract that I ‘sold to open’. The $25.50 put option contract I sold to generate passive income that expires today, 10/27, is trading for $0.09. When I ‘sold to open’ the contract I received $0.19 in premium. By buying to close the contract for $0.09 I still keep the difference in premium, which is $0.10. By closing the trade now I make $0.10 per share. Leaving it open gives me the possibility of full profit of the entire $0.19 premium or being assigned the shares. So I closed the trade for $0.09. That means that I’ve made $0.43 per share on BAC over the last few weeks. And I don’t yet own the shares.

Here is today’s chart on BAC. We can see the support line at $25.76 that we drew last week didn’t hold. The trading price for BAC fell down through that support to a low of $25.18 on Wednesday, 10/25. Yesterday BAC pulled back above our $25.50 strike, and today that put we sold to generate passive income may or may not expire OTM.

Since the $25.76 support line didn’t hold and BAC has not traded in this range since Fall of 2020, I want to update my chart to go back far enough so I can see what happened last time BAC was trading in this range. Here is a five year chart with weekly candles.

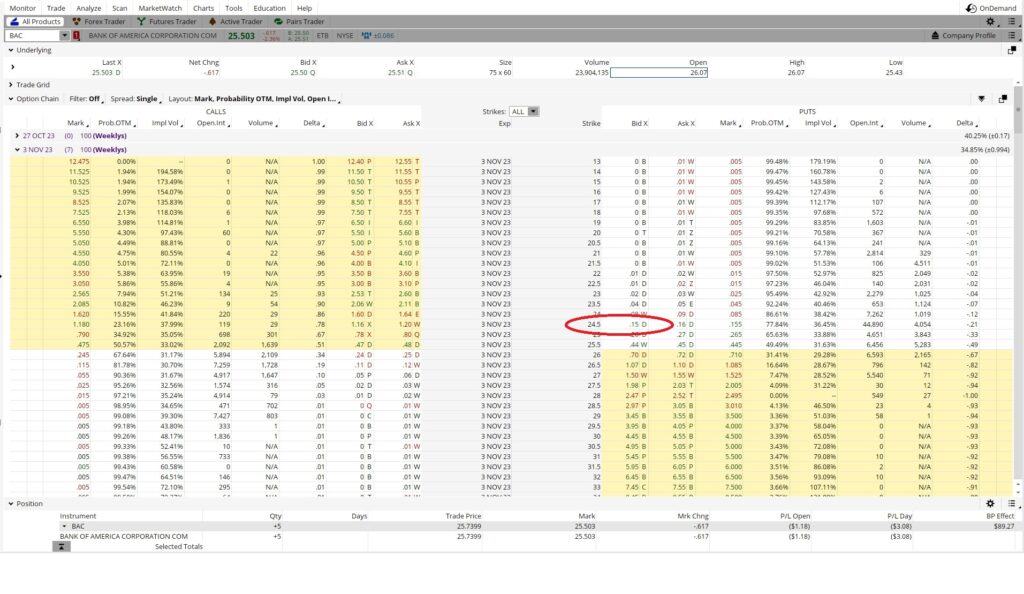

I can see a support line around $25.20 and another, stronger support line around $23.15 on the other side of the price channel. The trading price bounced off the $25.20 support line on Wednesday before it pulled back up. Since it blew through my first support line at $25.76 and then hit my next support line around $25.20, I want the next put I sell to generate passive income by selling stock options to be below that $25.20. I could go with the $25 strike expiring 11/3 for $0.26 or the $24.50 strike for $0.15.

Since there is a Federal Open Market Committee meeting on 11/1 I want to give some space in case they announce another interest rate hike. So I’m going to go a little further away and sell the $24.50 put to generate some passive income with stock options. The $24.50 put expiring 11/3 is giving premium of $0.15, which is 0.0061. Since this is a one week trade I could theoretically do this trade 52 times in a year. I multiply that 0.0061 by 52, which gives me a theoretical annualized return of over 31%. I’ll take it.