Passive Income Sidehustle

Last week my passive income sidehustle strategy was to sell the $25 put expiring 10/13 on Bank of America. Here is the post that walks through the why and how of that trade. BAC was trading at $25.76 when I made that trade, and now BAC is trading at $26.74. The put option contract will expire Out of the Money (OTM) today, so I won’t be assigned the shares. The premium I collected when I entered into the contract is straight profit for me. It also means the $2,500 I put up for each contract is no longer at risk, so now I can use that capital for another passive investment.

I still think Bank of America is a good company for my passive income sidehustle with a good leader in Brian Moynihan. The big time investment managers like it, and here is the tool I use to find that information. Their earnings call is next Tuesday, 10/17. The upcoming earnings call means there will be an announcement on how BAC has performed recently. Some analysts will ask questions, and after the call we will have a better idea of the company’s recent performance. The uncertainty about what will happen on the earnings call regarding recent performance and forecasts are why the premium on the BAC option contracts is higher right now than normal. After the earnings call that premium will likely decrease. So that elevated premium helps increase the return of selling puts on BAC as a passive income sidehustle.

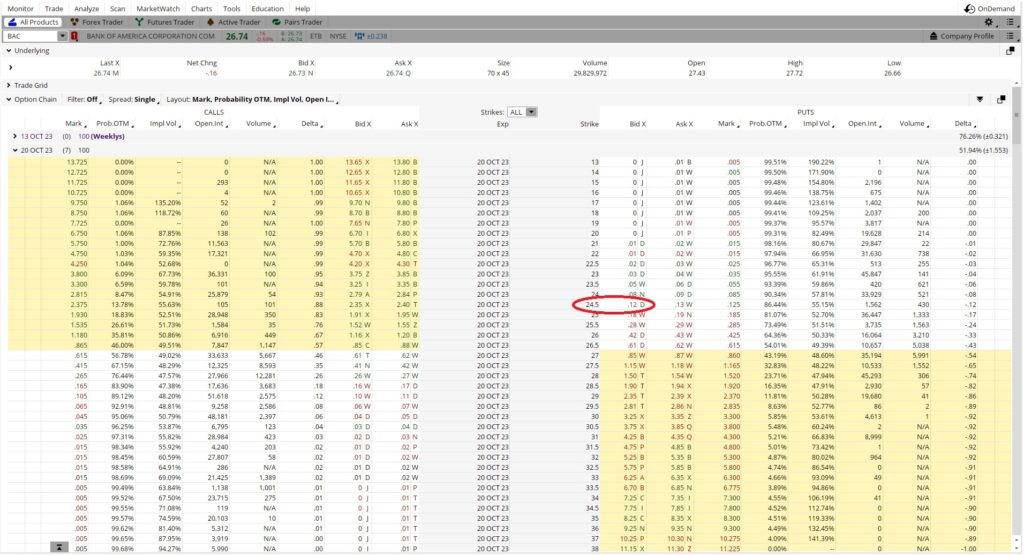

With the elevated premium due to the upcoming earnings call, the $24.50 BAC Put option contract expiring 10/20 has a Bid of $0.12.

A person who likes BAC at $24.50 per share could sell a put option contract at the $24.50 strike expiring 10/20 for 12¢. The $0.12 premium on the $24.50 strike is 0.0049, and this is a one week trade. The capital I need to cover the Put option contract (100 shares x $24.50 strike price = $2,450) is at risk for one week. There are 52 weeks in a year, so I could do this trade 52 times in a year. That 52 x 0.0049 = 0.255, which is a return of 25.5% when we annualize it.

If BAC is trading below $24.50 per share at expiration I will get put the shares at the $24.50 strike. If BAC is trading above $24.50 at expiration the contract will expire OTM and I will not get the shares. Either way, my passive income sidehustle gives me the premium of $0.12 per share. That works out to an annualized return of 25.5%.