Put Option Expires Worthless

Today we’re selling a put option on OXY, and there’s a good chance this put option expires worthless. Back on 5/31 we sold a put option on OXY at the $62 strike with the 6/7 expiration date. We were assigned those shares and we’ll receive the dividend on those. OXY went ex-dividend today, 6/10. Here’s a post that explains how and why we sold that put option contract. We now own two hundred shares of OXY in this portfolio with a per share cost basis of $51.44. We’ll collect the dividend of $0.22 on 7/15, and that will reduce our cost basis per share down to $51.22.

We’ve been using OXY for our option wheel trades recently because Warren Buffett owns a significant percentage of Occidental. He’s been a buyer of shares from the low $60’s per share and lower. Just last week Berkshire Hathaway bought another 2.5 million shares of OXY at an average price of $59.75 per share. Here’s a link to the SEC filing for those transactions. Berkshire now owns 250,583,605 shares of OXY. As of March, Berkshire owned about 28% of Occidental, and with this transaction that ownership stake has increased. Here is a link to the tool we use to do that research.

Since Berkshire Hathaway is continuing to buy shares we feel OXY has a floor in the upper $50’s per share. So we can likely sell an option contract at a strike price that is just under the money and have the put option expire worthless.

Weekly Option Trade

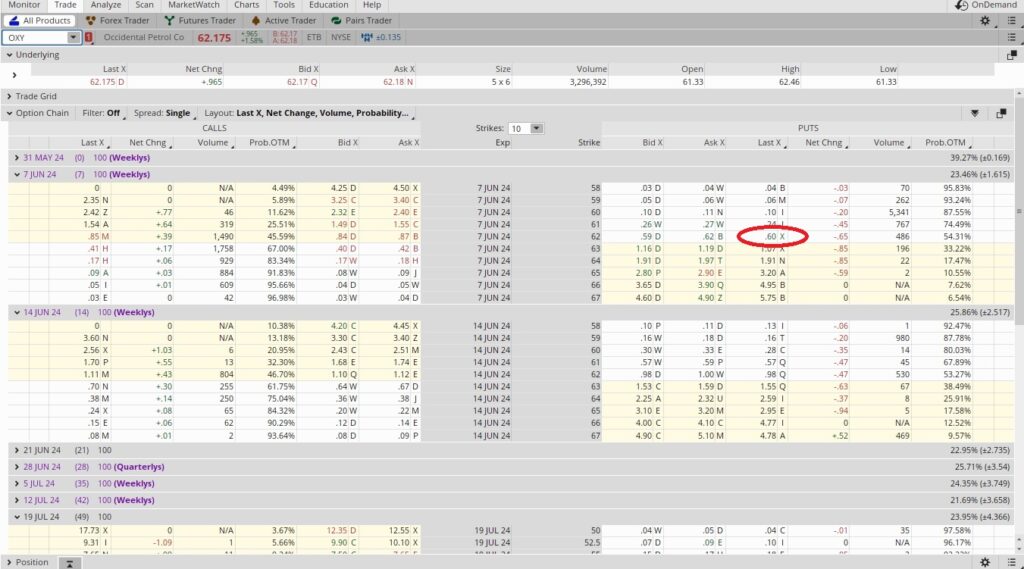

Here is the option chain for OXY including the 6/14 expiration date. We can see the $59 put option strike has a Bid of $0.28 and an Ask of $0.32. We sold the $59 put for the 6/14 expiration date for $0.30. Since this is a cash secured put we’ll need to have 100 x our strike price ($5,900) in our account for each contract we sell. So we’re putting up $5,900 to make $30 over the course of four days.

There are 365 days in a year, and we divide that by the number of days in this trade, which is four. That gives us a time multiplier of 91, because we could theoretically do this trade 91 times in a year. We divide the $0.30 in premium into the $59 strike price and we get 0.0051. Then we multiply that by our time multiplier of 91 and we get 0.463. That’s an annualized return of 46.3%. We’ll take it. Here’s a tool that helps with that math.

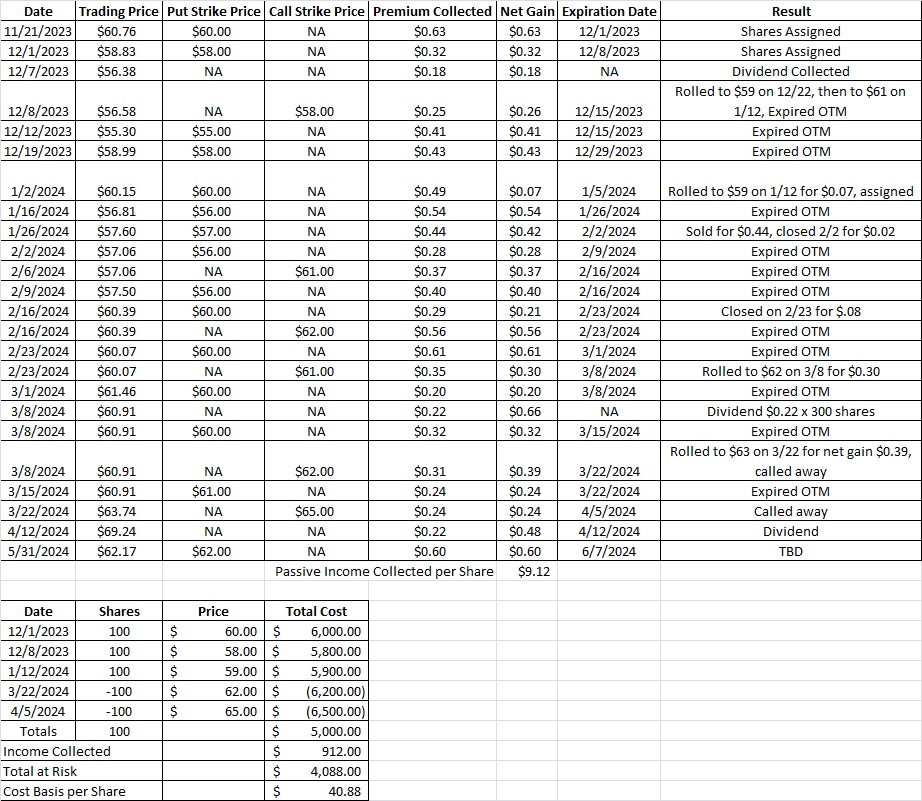

Cost Basis per Share

With this trade we were able to generate another $0.30 per share in passive income with a simple options trade. That brings our cost basis per share on OXY down to $51.07. We think it’s likely this put option expires worthless on Friday, 6/14. If it doesn’t then we’ll buy the shares at $59 and sell calls on those shares. This way we’ll continue our weekly option trades to generate passive income.