Roll a Put Option to Avoid Assignment

When the trading price of a company drops below the strike price of a put option we need to roll the put option contract to avoid assignment. Lately we’ve been selling puts and calls on OXY to as a weekly options trade to generate passive income. Here’s a link to the trade we made earlier this week that we’re now going to adjust.

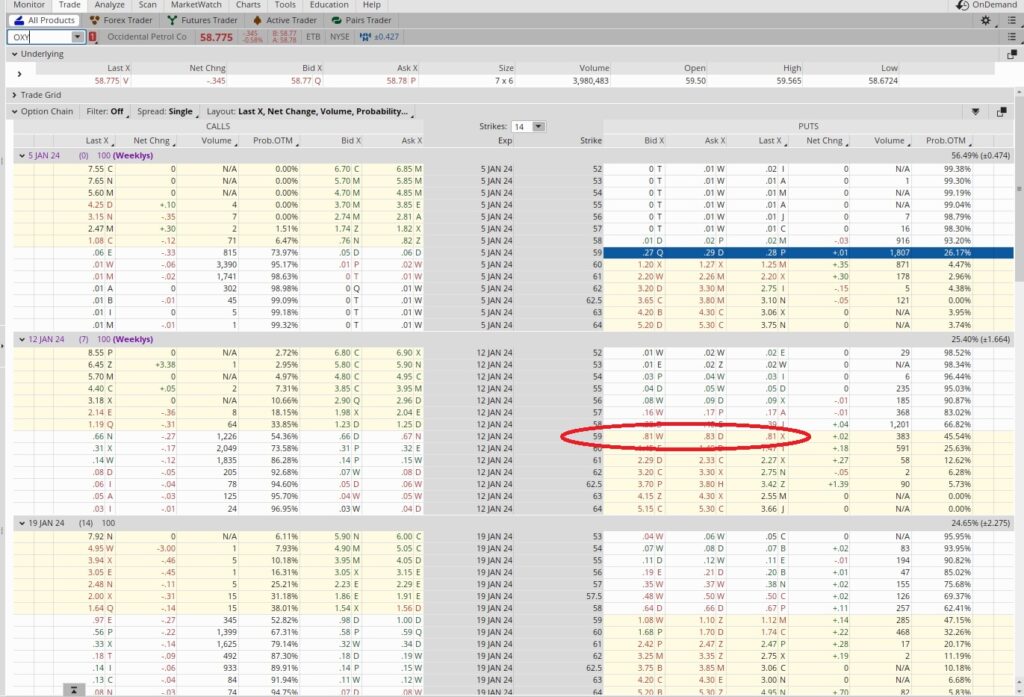

OXY is currently trading at $58.77. We have a call on OXY at the $61 strike expiring next Friday, 1/12. We also have an active put option contract on OXY at the $60 strike, and that expires today, 1/5. Since the trade price for OXY is below our strike price, we will be assigned 100 shares of OXY for each put option contract we have at the $60 strike that expires today.

We already have 200 shares of OXY, and for this account one tranche is about $6000. Since we already have 200 shares and getting more shares at $60 won’t reduce our basis, we’re going to roll this put option contract to avoid assignment. We sold the $60 put option contract for $0.49 per share. Right now that same contract has an Ask of $1.27 and a Bid of $1.20. We were able to buy back our $60 put for $1.24.

We’ll subtract that from the $0.49 we made in passive income by selling the put option contract. That leaves us with a negative $0.75 per share for this trade. So we’ll look at the upcoming expiration dates for a strike and date combination that will cover that $0.75 per share, and hopefully more. OXY’s next earnings call is at the end of February, and that could introduce some volatility in the trading price. When we look for a new put option strike and expiration date we want to be sure we’re in front of that earnings call date. Here is the tool we use to find that information.

Weekly Options Trade

In the option chain below we can see the $59 strike expiring 1/12 is trading for $0.82. That will cover the $0.58 loss from closing the $60 strike expiring today. It will also move us to a position where we might still get the shares next Friday, and make us a little passive income on the side. We also like the $59 strike because it’s closer to our current cost basis of $57.64 per share.

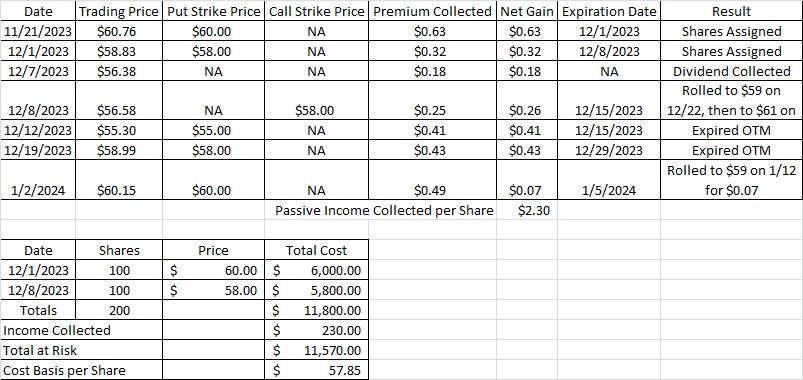

Reduced Cost Basis per Share

On the table below we can see the trade history for our weekly options trades for passive income on OXY. We rolled the put option contract to avoid assignment, and now we have an active put at $59 expiring 1/12. That trade nets out to a gain of $0.07, which brings our reduced cost basis per share to $57.85