Sell a Put as a Weekly Options Trade – 01-02-24

Our current weekly options trade for passive income has been selling puts and calls on OXY. Here is a link to our most recent weekly options trade on OXY: how to roll a call option contract.

We like OXY as a company to own for the long term for a few reasons. Some of those are that Warren Buffett owns a large portion of the company and has recently purchased more shares. Another is the recent instability in the Middle East as it relates to shipping. That is likely to impact oil prices. Here is a link to the tool we use for that research.

We had a put on OXY at the $58 strike with the expiration date of 12/29. OXY closed on Friday at $59.71, so our put option contract was out of the money at expiration. That means we keep the premium from entering the contract and we do not get assigned the shares. Now we have access to that capital, and we still like OXY for our passive income strategy for accredited investors.

Right now OXY is trading at $60.15. We currently have 200 shares of OXY, and we have one active call option contract at the $61 strike expiring 1/12/24. Since one option contract represents 100 shares of the underlying company, that one contract could sell half of our current stake in OXY. If OXY trades above $61 when the contract expires on 1/12 our shares will get called away. If we want to keep our shares and the call option contract is In The Money we can roll the call to a higher strike. While we’re generating some passive income on that call option contract, we can generate more passive income by also selling a put on the same company at the same time, but at a lower strike.

Between now and 1/5 OXY’s trade price can do three things: it can go up, down, or sideways. If OXY’s trading price rises we may have some of our shares called away. If OXY’s trading price drops we may get assigned another 100 shares and have 300 shares of OXY. OXY’s trading price going sideways means we’ll likely keep the 200 shares we have, not gain or lose any shares, and just keep the options premium.

Weekly Options Trade

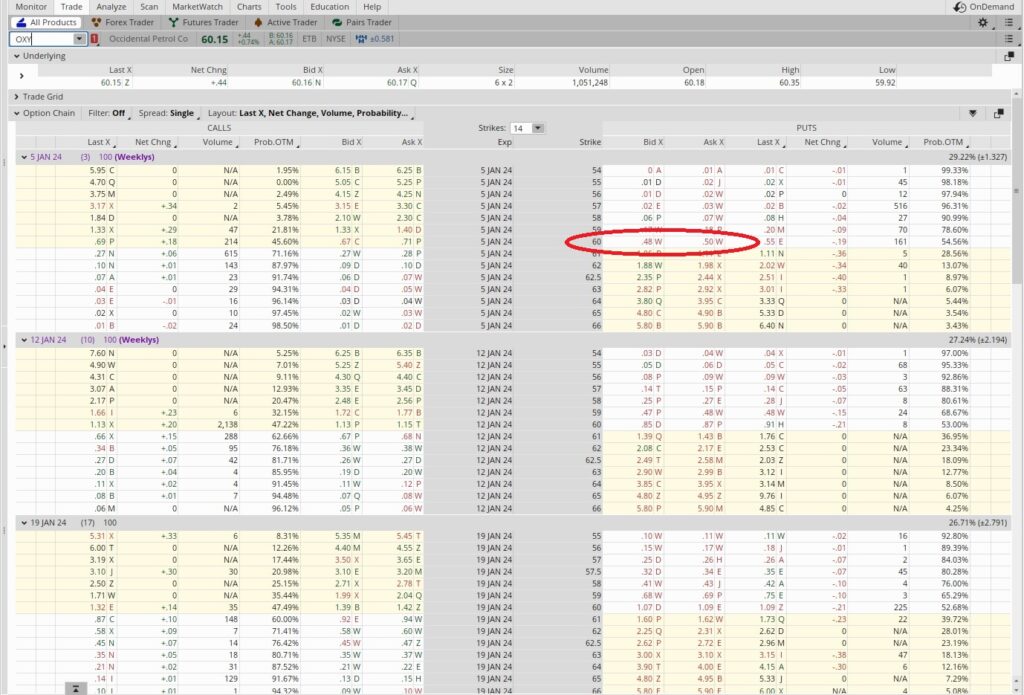

We can see OXY is currently trading at $60.15 per share. The $60 put option contract for the 1/5 expiration date has a Bid of $0.48 and an Ask of $0.50. One put option contract represents 100 shares of the company. That means we need to have $6,000 in our brokerage account to sell this put. We hit the bid at $0.49 so were able to generate $49 of passive income on our $6,000 of capital. We divide that $0.49 in options premium into the $60 strike price, and we get 0.00816.

Today is 1/2/24 and this put option contract expires on 1/5/24, which is three days from now. There are 365 days in a year, so we divide 365 by the length of this trade (3 days) and we get 121. In theory we could do this trade 121 times in a year. When we get into short trades like this we also like to look at this as a weekly options trade, which would give us a multiplier of 52 (because there are 52 weeks in a year). That seems more reasonable than a multiplier of 120+, so we’ll take the 0.00816 and multiply that times 52, and that give us 0.424. That means this trades will give us a return of 42.4% when we annualize it. We’ll take it.

Reduced Cost Basis per Share

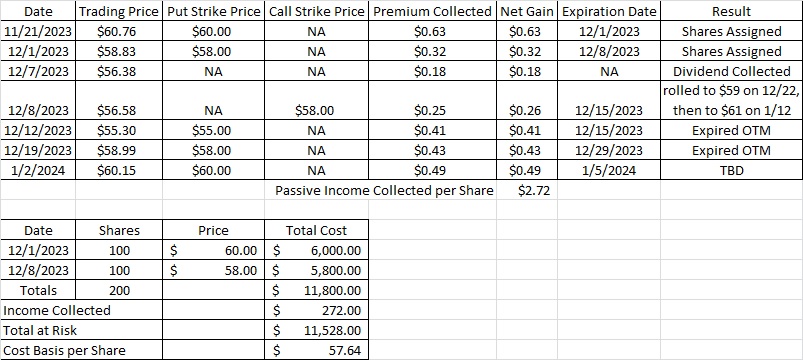

Our trade history on OXY is as follows:

We have this put option contract at the $60 strike expiring Friday, 1/5. We also have a call at the $61 strike expiring next Friday, 1/12. When we add the premium for this put option contract it brings our basis down to $57.64. With OXY trading at $60.15, we currently have $2.51 of equity in our shares. Dividing that $2.51 into our cost basis per share of $57.64 gives us a return of 4.4% so far. We started doing these weekly option trades for passive income on OXY on 11/21. Today is January 2, which is 42 days since we began this series of trades. 365 divided by 42 days is 8.7. We take that 8.7 and multiply it by our return of 4.4%. That gives us a return of 38% when we annualize it. Not a bad start.