Scalable Sidehustle for Accredited Investors

Last week our scalable sidehustle for accredited investors was to sell a strangle. A strangle is an options strategy that includes selling both a put and a call on the same company. We sell the put strike below the trading price and the call strike above the trading price. The strangle uses the same expiration date for both contracts, and our objective is to collect options premium. We don’t mind buying or selling some shares, as our main goal is to generate income from the options premium.

If we sell a put and buy those shares, we’ll sell a call at that same strike price for the next expiration date. If we sell a call and we sell the shares, we’ll then sell a put at that same strike price for the next expiration date, hoping to replace the shares we just sold. Ideally, the company will continue trading in the range between our put strike and our call strike. If that happens we’ll collect and keep the options premium, both our put and call contracts will expire out of the money, we’ll keep the same number of shares we started with, and we’ll sell another strangle the next week. To do this options strangle strategy we need to have at least 100 shares of the company (to sell the covered call) and enough money to cover the put strike in case we get assigned those shares.

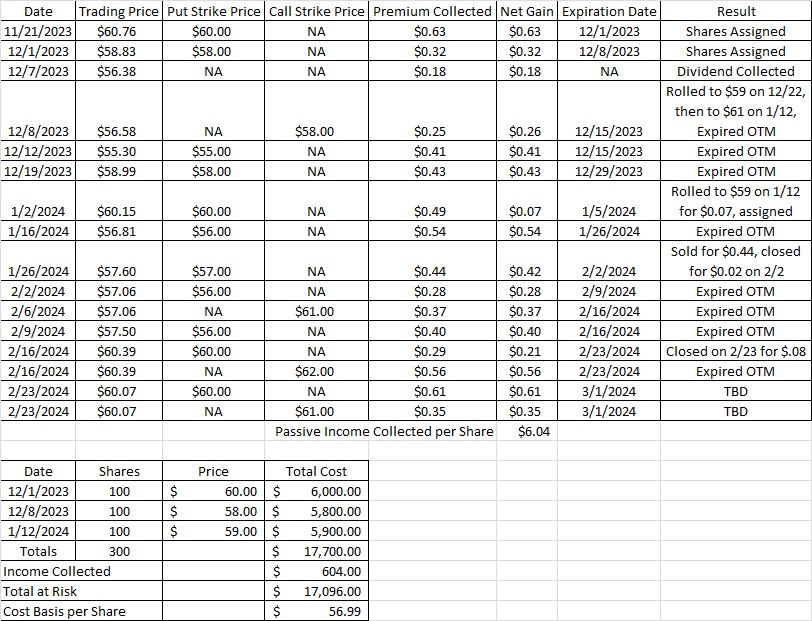

When using this scalable sidehustle for accredited investors, the quality of the company is more important than the option trades. We’ve been using OXY as our trading company recently. Here’s a post that walks through why we like OXY right now. Here’s the tool we use for researching companies like this.

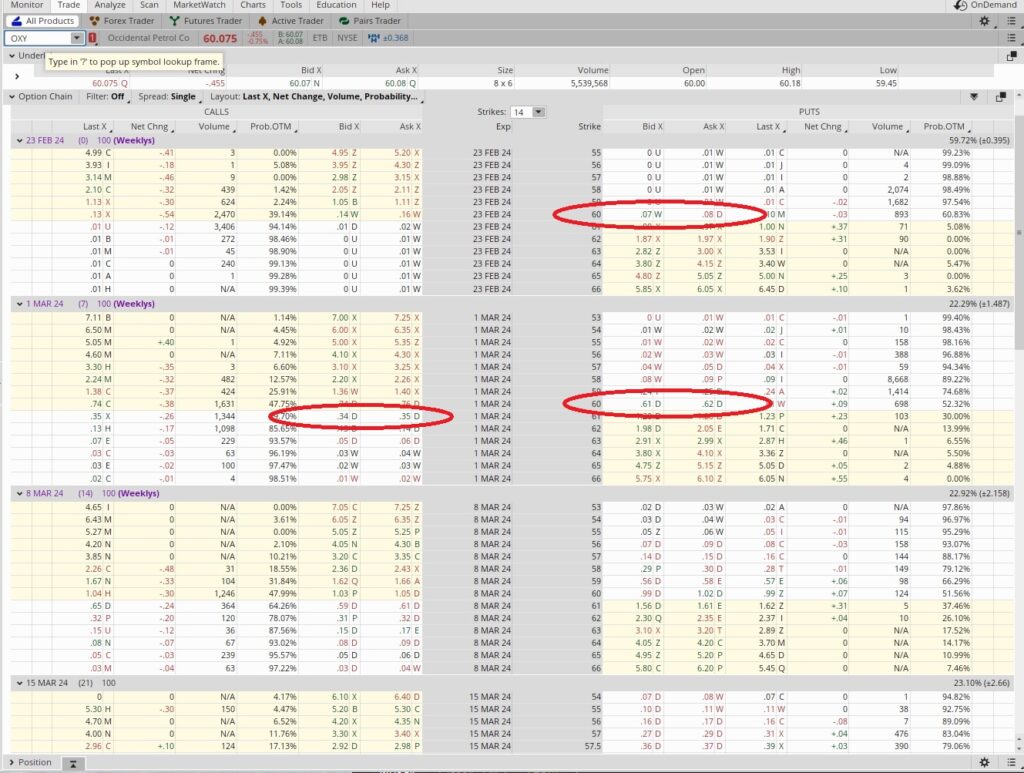

Our options trade last week was to sell the $60 put and the $62 call, both expiring today, 2/23. Right now OXY is trading at $60.07, which is right between our two strikes. If we don’t do anything right now, there’s a good chance both our $60 put and our $62 call will expire out of the money. Since $60.07 is really close to our $60 put strike, we’ll roll that put to the 3/1 expiration date. Rolling an option contract means we’re going to close our existing trade and open a new trade. In this case we’ll be closing our put strike at a profit. Then we’ll sell another one at the same strike for next week.

We’re going to let our call option expire out of the money rather than closing it. When we close the option contract we need to buy it back, and that costs us. We also need to pay the broker’s contract fee, which also eats into our profit. We don’t need to pay either of those we if just let the contract expire.

Last Friday we sold the $60 put option on OXY expiring 2/23 for $0.29 per share. Right now that same put option contract has a bid of $0.07 and an Ask of $0.08. We were able to buy the put option contract back to close it for $0.08. Since we sold that contract for $0.29, we subtract the $0.08 from our income, and that leaves us with a profit of $0.21 per share.

Note that OXY has a dividend of $0.22 per share coming up on 3/7, and we’d like to capture that. We can also include that as a factor in our decision on which put strike we pick. We can sell a put that’s very close to the money, because if we get put the shares the dividend acts as a bonus to our options premium.

Weekly Options Trade

With OXY trading at $60.07 we’re going to sell the $60 put strike expiring next Friday, 3/1. The Bid on that is $0.61. Then we’ll add the $0.22 dividend to that premium, for a total gain of $0.83 if we get assigned the shares. If our put expires out of the money we will not buy the shares, but we’ll still get the $0.61 premium from the options contract.

This is a one week trade, so we could do this trade 52 times in a year. We divide the $0.61 premium on the put into the strike price of $60 for a multiplier of 0.0102. We multiply that by our 52 time periods in a year, and that gives us 0.5304. That equates to an annualized return of 53%. That 53% assumes we don’t get assigned the shares. If we do get assigned the shares we’ll also get the $0.22 dividend, which would make our return even higher.

On the call side we can also generate some premium, but we need to remember the $0.22 dividend. We’d prefer collecting the dividend vs not collecting the dividend, so we need to keep that in mind when we pick the strike for our call option contract.

With OXY trading at $60.07 the closest strike above the money is the $61 strike. We can sell that strike with the 3/1 expiration date for $0.35. If OXY runs up above $61 between now and then we could roll our $61 call option to a higher strike with a different expiration date so we could capture the dividend. But this dividend is only $0.22. While it would be nice to collect it, on $61 per share $0.22 isn’t a huge deal if we don’t get it. If the dividend were a larger percentage of the share price we would be more careful about selling the call so close to the money.

As it stands entering into these trades our cost basis per share on OXY is $57.28. So that’s the number we’ll use to determine our annualized return. The $0.35 in premium divided by our cost basis of $57.28 is 0.0061. We’ll multiply that by 52 (because this is a one week trade, and we could do this trade 52 times in a year), and that gives us 0.317. That’s an annualized return of 31%. We’ll take it.

One of the nice things about a passive income strategy like this is that it can be done from anywhere. Whether I’m an accredited investor in Minocqua, Wisconsin or I’m looking for a passive income strategy in Reno, Nevada, it’s easy to ramp up to a larger quantity.

Reduced Cost Basis per Share

After selling puts and calls in a strangle options strategy on OXY we’ve been able to generate $6.04 per share so far. This scalable sidehustle for accredited investors has helped us reduce our cost basis per share down to $56.99. And we’ve done that without selling any shares.