Sell a Strangle to Reduce Cost Basis

Our weekly options strategy for passive income this week is to sell a strangle to reduce our cost basis. Let’s walk through what exactly a ‘strangle’ is and how we’ll use it to reduce our cost basis per share.

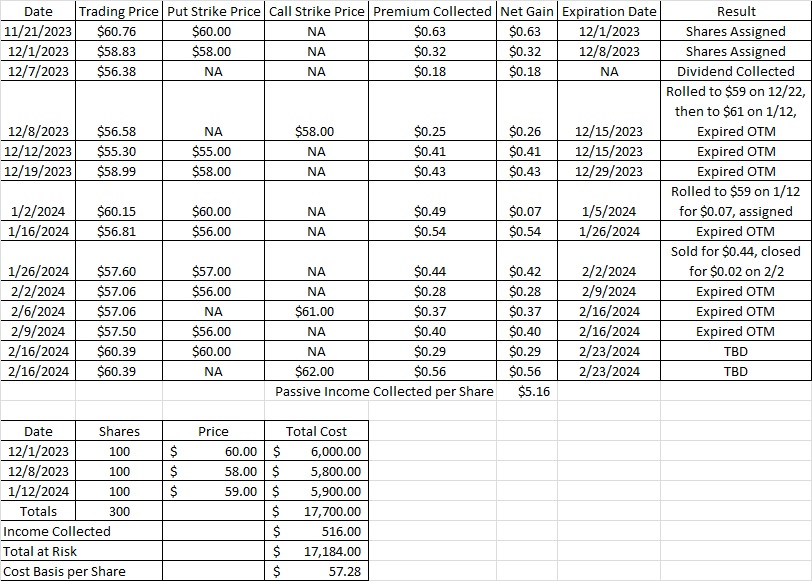

An options strangle strategy is when we have a put and a call on the same underlying company at the same time, but at different strike prices. These last few months our weekly options strategy has been to sell puts and calls on OXY. Each time we sell a put we collect some premium. And each time we sell a call we collect some premium. That premium we’ve been using to reduce our cost basis per share of OXY. We’ve been able to work our cost basis on OXY down to $57.56 per share. We’ve had a few posts recently about why we like OXY, and two of them are here and here.

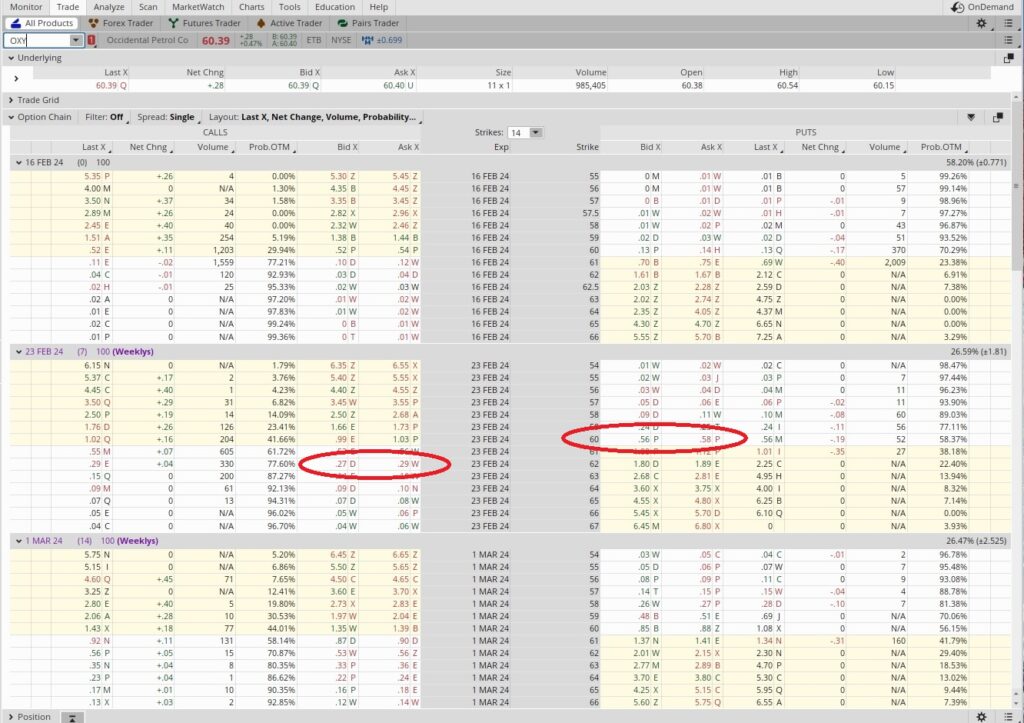

Right now we have a put on OXY at $56 that expires today, 2/16. We also have a call on OXY at $61, and that also expires today. Right now OXY is trading at $60.39, so both our put and call should expire out of the money today. Since our put was at the $56 strike, and one contract is for 100 shares, we’ll now have access to that $5,600 in capital that we were using for the $56 put. That means we can sell another put on OXY to generate some more passive income with options premium. We currently own 300 shares of OXY in this portfolio, and since our call at $61 will also expire out of the money today, we’ll still have all 300 shares. That means we can also sell another call on OXY to generate some options premium on the top end.

We know that Warren Buffett bought a tranche of OXY at $60.22 in December. That means that we can we sell a put at the $60 strike, and if we buy the shares we’ll be paying less than Buffett. That helps us feel pretty good about that $60 strike price for the put. Here’s the tool we use to do that research.

Since our cost basis on OXY coming into today is $57.56 per share, we can be pretty aggressive with our call strike. As long as our call strike is above our cost basis, we’ll make money on this trade. We’d obviously like to make as much as we can in passive income with our weekly options trade. We also want to balance that with optimizing what we get for the shares if we sell them.

If we wanted to maximize the options income we could sell a call that’s in the money at the $58 or $59 strike. That way we would generate a lot of premium by selling the call, and we would also be hedging a bit in case OXY were to drop back below $60 in the next week. We aren’t too concerned with a pull back in OXY right now, and we think there’s a good chance OXY will be trading higher than this in the near future. So instead of selling a call that is in the money, we’ll sell a call that is just above the money.

Weekly Options Trade

Selling a call at the strike that is closest and just above the money typically generates the most options premium. Since OXY is trading at $60.39 right now, that would mean selling the $61 call. On the option chain below we can see the $61 call expiring next Friday, 2/23 is trading at about $0.54. We can also see the $62 call has a bid of $0.27 and a call of $0.29.

Since our cost basis is $57.56 per share, that’s the number we’ll use to determine our multiplier. We were able to get $0.29 when we sold the $62 call option expiring 2/23. The $0.29 in premium divided by our cost basis of $57.56 is 0.005. This is a one week trade, and there are 52 weeks in a year. So we’ll multiply that 0.005 by the 52 weeks in a year, and that gives us 0.26. That works out to an annual return of 26%. So we’re generating an annualized return of 26% to agree to sell some of our shares of OXY for more than we paid for them. That works for us.

When we sell a strangle to reduce cost basis, we also sell a put option contract. We sold the $60 put expiring next Friday, 2/23 for $0.56. This is a one week trade, so our time multiplier is 52. We’re putting up $60 for each share in the contract to cover the put option, so we divide the $0.56 in premium into the $60. That gives us 0.0093. We multiply that 0.0093 by the 52 weeks in a year and we get 0.484. That’s an annualized return of 48%. We’ll take it.

Cost Basis per Share

So this week our passive income strategy for accredited investors gave us $0.29 on the call side and $0.56 on the put side. We’ve been able to reduce our cost basis per share down to $57.28.

Remember that the most important part of this strategy is the quality of the underlying company, not the strikes we’re picking. Also note that we can do this from anywhere. Whether we want to generate passive income in Minocqua, Wisconsin or we want to generate passive income in Columbus, Ohio, we can use this strategy to retire early.