Selling Calls on an Up Day

We’ve been trading OXY lately, and today we’re selling calls on an Up Day. Here’s a link to our last weekly options trade, which was the $56 put that expires this Friday.

Right now OXY is trading at $58.12 and our per share cost basis on OXY is currently $57.82. Since the current trading price is higher than our cost basis per share, we can sell calls at a strike that is close to the money to generate lots of premium without having to worry about the call option contract expiring in the money. When a call option contract we sell expires in the money, the shares will be called away. Since our cost basis is lower than the strike price we’re using for the call option contract, we’ll still make money on the trade even if the contract goes in the money and our shares get called away. So we’re using our shares to generate some passive income with options premium. We’re not concerned about losing the shares.

Note that OXY’s quarterly earnings release is after market close on 2/14. So we’re selling a call through the earnings release. We’re ok with that because we’re using this batch of shares to generate as much options premium as we can. As long as we get more shares under the price Warren Buffett has been paying, and selling shares above our cost basis per share, we’re happy to be aggressive with our option strike prices. We’ll get more premium than usual selling a call because OXY is up $1.14 per share to $58.12 per share today. Selling calls on an Up Day will generally give more premium than selling calls on a Down Day. That’s why we generally try to sell puts on a down day and sell calls on an up day.

We also currently have an active put option contract at the $56 strike which expires this Friday, 2/9. Our expiration for the call option is Friday, 2/16. If OXY continues to trade between the $56 strike on our put option and the $61 strike on our call option, we’ll just keep the premium. We’ll also keep our current shares, and sell another call.

If the trading price of OXY is below $56 at market close this Friday, we’ll buy another 100 shares for each put option contract we sold at the $56 strike price. And if the trading price of OXY rises and the contract expires 2/16 with OXY trading above the $61 call strike, we’ll have 100 shares of OXY called away from us for each call option contract we sold. Whether our puts and calls expire in the money or out of the money, we’ll still keep the premium.

Weekly Trade

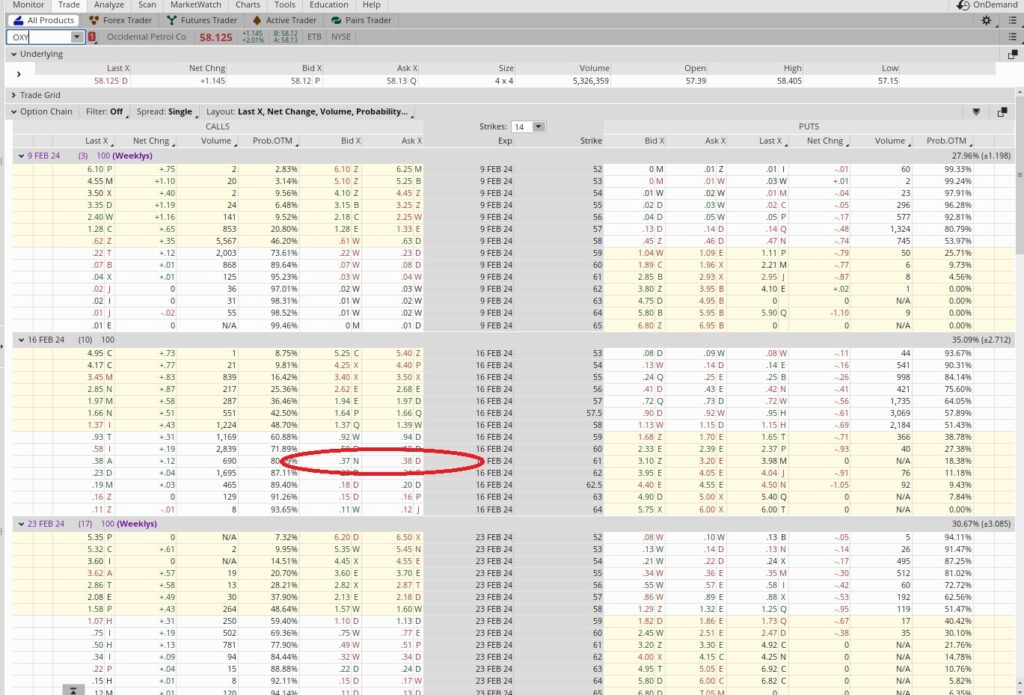

The $61 call option contract for OXY expiring 2/16 has a Bid of $0.37 and an Ask of $0.38. Today is 2/16, so this is a 10 day trade. There are 365 days in a year, and we divide that by the number of days in the trade. So 365 divided by 10 is 36.5. That 36.5 is our time multiplier. Our cost basis is $57.82, so that’s what we’ll use to figure our risked capital on this weekly option trade. The $0.37 in premium divided into our per share basis of $57.82 is 0.0064. We’ll multiply that by 36.5, and that gives us 0.2336. This weekly options trade works out to a return of 23.4% when we annualize it. Here’s a tool to help with the math.

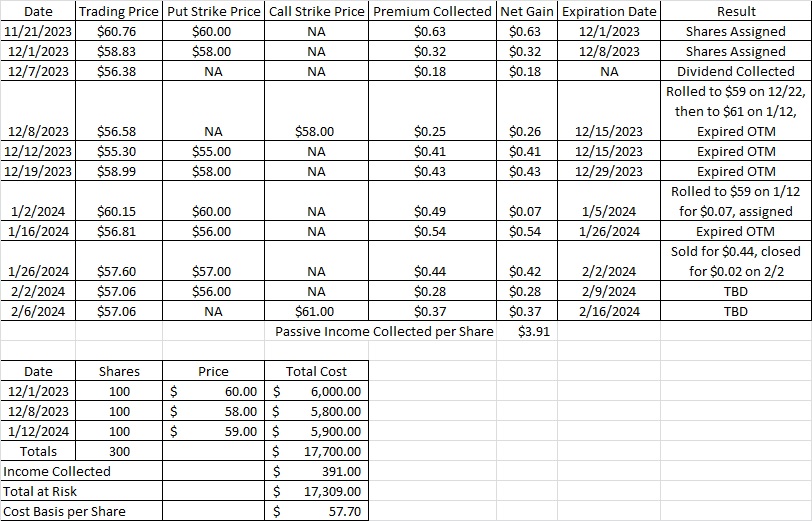

Cost Basis per Share

With this $0.37 in premium on the call option contract we will reduce our cost basis per share to $57.70. If the trading price for OXY increases and we well our shares at $61, our costs basis on our remaining 200 shares will be $56.05. Either way, we’re in a profitable position on this weekly options trade.