What’s a Good Return on a Passive Income Investment?

If I ask ten different people, ‘What is a good annualized return on a passive income investment?’ I will likely get ten different answers. Most would probably be in the 8-10% range, and some might be as high as 15%. So let’s compare our weekly options trade for passive income over the last couple months to that bar.

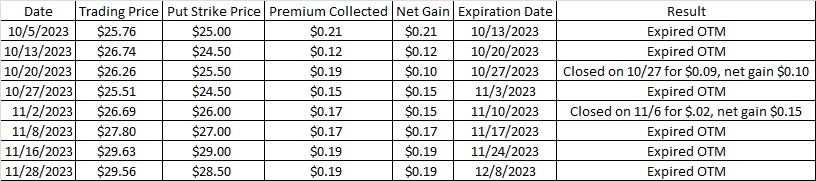

Our weekly options trade as a scalable sidehustle over the last couple months was selling put option contracts on BAC. We started that trade by selling a put option contract on 10/5 with a 10/13 expiration date. That trade expired out of the money, and we continued selling puts on BAC through November. Our most recent put option contract on BAC expired out of the money last Friday, 12/8. Here is the history of each of those trades and the result of each one.

We’ve done a total of eight trades on BAC so far. The average strike price on those puts was $26.25. So we needed $26.25 per share set aside to cover the put option contract in case we were assigned the shares. Each put option contract represents 100 shares, so we needed $2,625 to cover each put contract we sold.

Our net gain on the premium of those puts was $1.28. We divide that $1.28 in premium into the average strike price of $26.25, which is 0.0487. The first trade was on 10/5 and the last put option contract expired on 12/8, which is 64 days. We take 365 days in a year and divided that by 64 days, and that gives us 5.7. That means we have 5.7 periods of 64 days in a year. Another way to say that is we could do this same trade 5.7 times in a year. So we multiply that 5.7 by the 0.0487 and we get 0.2778. That works out to an annual return of 27.8% on this passive income investment if were to continue doing this trade over the entire year.

In my opinion, that 27.8% is a pretty good annualized return on a passive income investment. It’s tough to think of another passive income strategy for accredited investors that can consistently yield a 20%+ annualized return.

Here’s the current price chart on BAC. This is a one year chart with daily candles. We can see a support/resistance line at about $30.45. We can also see a recent price channel from the low around $25 back on 10/27 up through $31 on 12/4. Then BAC broke out of this channel and has gone sideways for a few days. That run up from $25 up to $31 is a gain of $6, which on the $25 start point is an increase of 24%. That’s a substantial move up, and it puts BAC a bit above my buy range.

Cost Basis per Share

On the trade history above we can see our weekly options trades for passive income have given us $1.28 already. So if I sell a put right now at $30, my cost basis per share on BAC would be $30 minus the $1.28 in option premium I have already, which would be $28.72. Then I would also subtract from the cost basis the premium from the current put option contract. Right now that’s $0.15 on the $30 strike. So my actual cost basis per share would be $28.72 – $0.15 = $28.57 if assigned. That’s a bit higher than I want to be on BAC.

Another option is to wait and see if BAC pulls back down. If it does, I can use my weekly option trade to generate a good annualized return on a passive investment like this.

The company is the most important part of selling put option contracts as a passive income strategy for accredited investors. Selling puts on a company that is trading too far above the price we’re comfortable paying for the company means we could end up owning the company at that higher price. Then the share price could drop while we own the shares, and we don’t want that to happen. This is one reason why it’s helpful to have a list of companies I like, with my valuations of those companies completed and up to date. Here’s the tool I use to help build that list.

If BAC is the only company I know, I might find myself trying to squeeze in more weekly options trades at questionable prices. Instead, I have choices for other companies that are trading at more attractive prices right now. So I can still generate a good annualized return on a passive income investment like selling stock options right now by selling puts on different companies.