Why We’re Taking the Shares

We’ve been generating passive income selling stock options on OXY, and today we’ll talk about why we’re taking the shares. We currently have a strangle on OXY, which is call and a put option contract active at the same time but at different strike prices. Our call option contract is at $61 and our put option contract is at $59. Both contracts expire today, 1/12.

The call option contract will expire out of the money, so we’ll just keep the premium and sell that call again. Our $59 put is in the money and will be assigned at market close if we keep the contract open. If we prefer to not get the shares at $59 we could buy to close the put option contract, then sell to open another put option contract at a lower strike price that is a few weeks further out in time. The most important thing about using weekly option trades to generate passive income is the company we’re trading, not the trades.

We currently have 200 shares of OXY in this portfolio. Each contract of 100 shares of OXY equates to roughly 1 tranche for us. We’re willing to allocate up to five tranches for OXY. Our current cost basis is $57.85, and here’s a link to the article that walks through how we did that.

Our decision point on this comes down to whether or not we feel $59 is a good price to pay for shares of OXY. We also need to balance that with how long we feel OXY is likely to trade near this price. d When we sell weekly options contracts as a passive income strategy for accredited investors we keep an eye on what the bigger fund managers are doing.

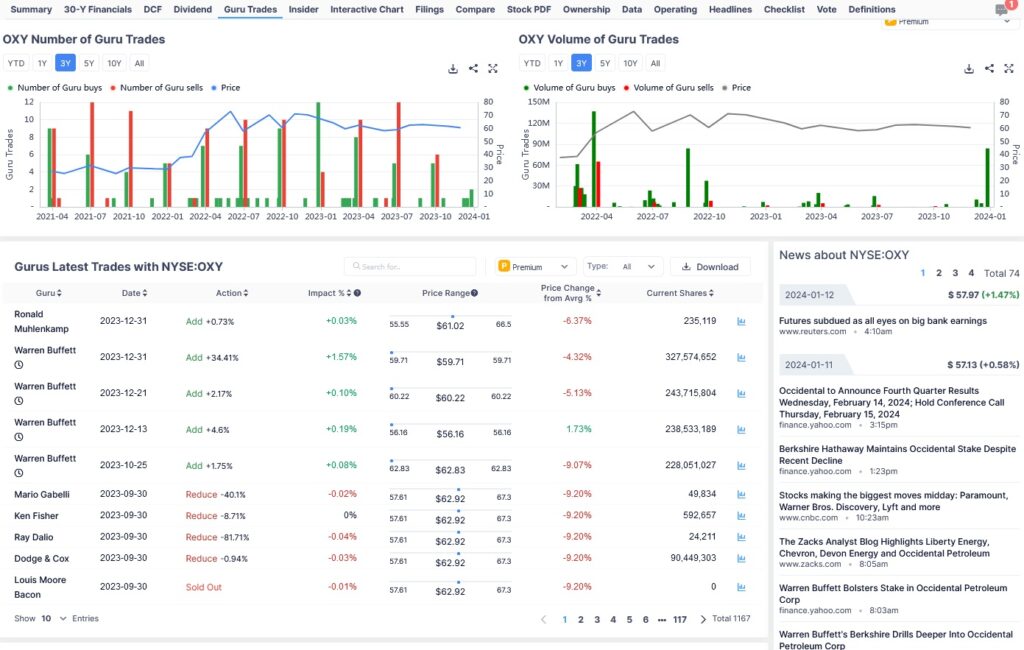

The Guru Trades

For OXY, one of their biggest shareholders is Warren Buffett. We can see on the graphic below Warren Buffett’s trade activity on OXY. Warren has purchased over 99 million shares of OXY over the last few weeks. We can also see how he currently owns over 327 million shares of OXY. We can see how he recently bought OXY at a per share price of $59.71. Before that he bought OXY at $60.22, $56.16, and more at $62.83. Here is where we got this information. With Warren Buffett buying OXY when it’s trading under $63, we feel pretty good about taking shares at $59. So that’s why we’re taking the shares instead of rolling the put option contract.

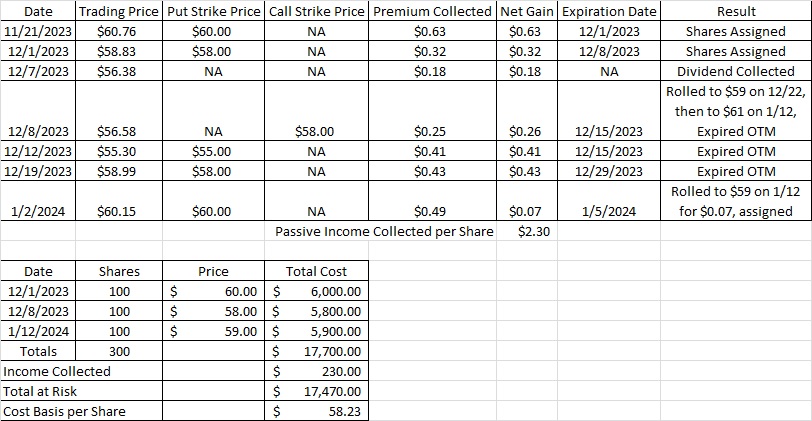

Cost Basis per Share

The table below shows our trade history for OXY and our current cost basis per share.