Sell a Cash Secured Put for Passive Income

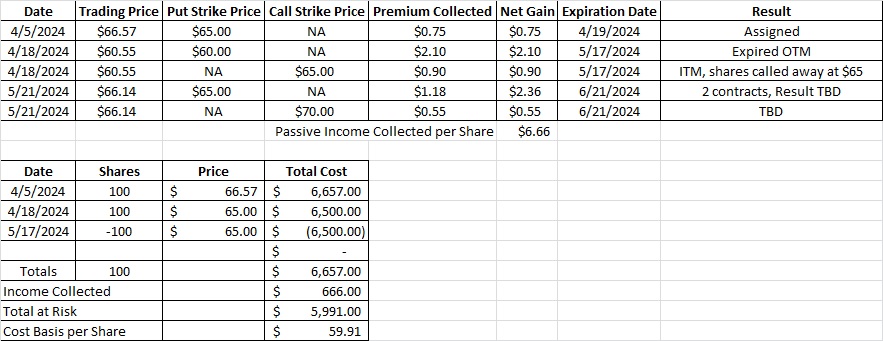

Today we’re going to sell a cash secured put to generate passive income. One of the companies we’ve been trading lately is HHH. We had one covered call at $65 and one put option contract on HHH that both expired last Friday, 5/17. Here is the post where we talked about the how and why of those trades.

HHH closed the trading day at $67.55, which was above the $65 strike price on our covered call. Since HHH was trading above the $65 strike price on our covered call at market close we had 100 shares of HHH called away. The strike price on our cash secured put was $60. Since HHH was trading above that at market close, our cash secured put option contract expired out of the money. So now we have 100 shares of HHH in this portfolio and our current cost basis per share is $62.82.

The Weekly Trade

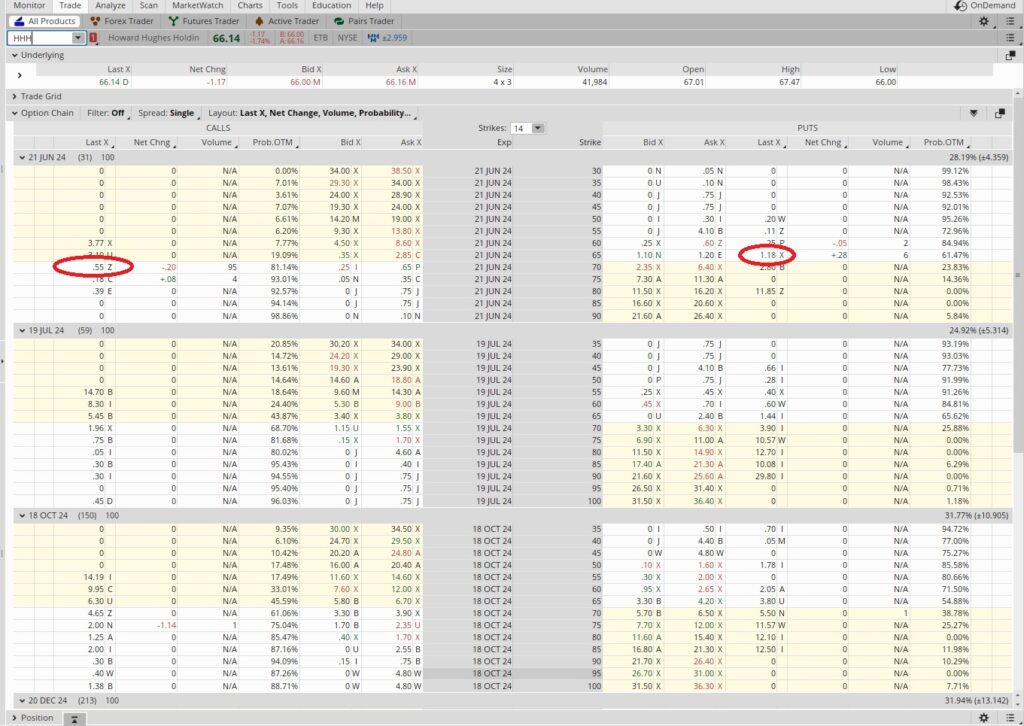

We still like trading HHH in this price range, so we’re going to sell cash secured puts again. HHH is trading at $66.14, and the $65 put expiring 6/21 has a Bid of $1.10 and Ask of $1.20. This is a one month trade, which means we could do this trade twelve times of the course of a year. We were able to get $1.18 when we sold two cash secured puts at the $65 strike. We take the $1.18 in premium and divide that into the $65 strike price and we get 0.182. Then we multiply that by the twelve times in a year we could do this trade, and we get 0.218. That’s a 21.8% annualized return to sell cash secured puts as a passive income strategy. Here’s a tool that helps with doing that math.

Cost Basis per Share

We currently have 100 shares of HHH, so we can sell a covered call on those shares. We sold the $70 call expiring 6/21 and we received $0.55 in premium for selling that covered call. That works our basis on HHH down to $59.91 per share. We’re hoping we’ll be assigned shares at the $65 strike when our cash secured put contract expire on 6/21. We think HHH has plenty of room to run up above $70 so we want to keep these shares. We’ll keep an eye on this trade over the next few weeks while we wait for the time decay to run its course.

To recap, last week we had 200 shares of HHH. We had sold a cash secured put at $60 and a covered call at $65. The $65 call went in the money and we sold 100 shares at our $65 strike price. That left us with 100 shares. Then today we sold two more cash secured puts at the $65 strike and a covered call at the $70 strike. Those contracts all expire on 6/21. As long as HHH continues to trade between $65 and $70 we’ll keep our shares as well as the premium from both sides of the trade. If HHH drops below $65 we’ll either buy the shares at $65 or roll the trade down to a different strike and out to another expiration date. If HHH runs up above our $70 strike we’ll either sell the shares at $70 or roll the covered call up to a higher strike at an expiration date that is further out.