Put Option Contract for Passive Income

The put option contract I sold for passive income last week expired out of the money (OTM) again. That’s twice in two weeks my put for passive profit expired OTM without me getting the shares. The first put I sold on Bank of America (BAC) on 10/5 when BAC was trading at $25.76. On that put option contract I collected $0.21 in premium for the $25 strike that expired on 10/13. It was an eight day trade, which equates to annual return of a little over 37% on that risked capital. Here’s a post that walks through the why and how of that trade.

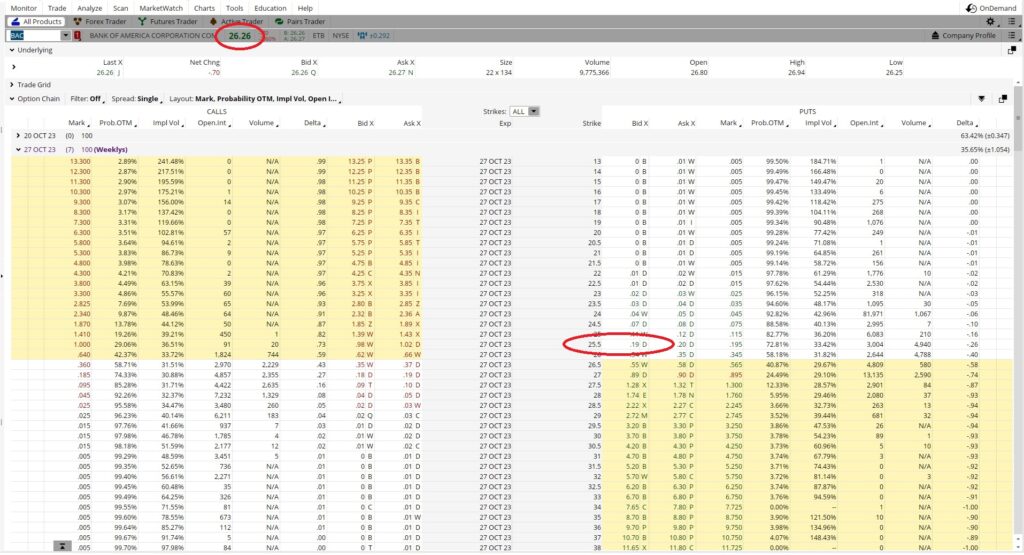

The next put option contract I sold for passive income on BAC was on 10/13 when I saw that my $25 put was going to expire OTM. On 10/13 I sold the $24.50 put option contract expiring 10/20 on BAC for $0.12 in premium. That was a seven day trade with an annualized return of 25.5%. Here’s a link to the post that walks through that trade.

Today is 10/20 and BAC is trading at $26.26, so my $24.50 put option contracts will expire OTM. Over the last two weeks the $0.21 per share on the first put option contract and the $0.12 per share on the second put total $0.33 per share on BAC in passive income, without actually owning the shares. Now the capital will be available for me to use again, so I’ll sell another put for passive profit.

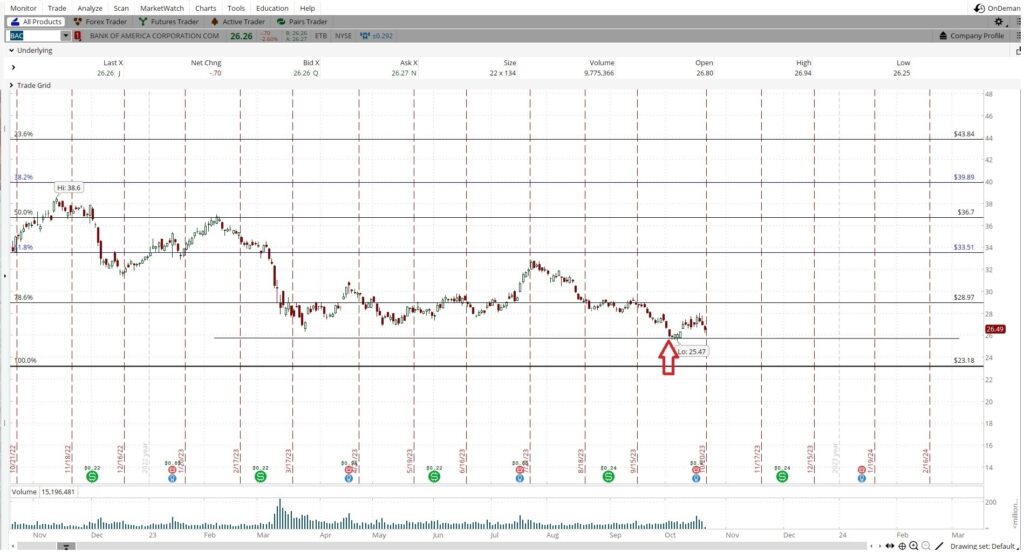

Right now BAC is trading at $26.26. On the BAC one year chart with daily candles I see a resistance line at about $25.50. I want to sell my put option contract for passive income at or below that resistance line. I’ll do that because it’s likely that the trade price will hesitate at that level for a day or two before dropping through it. That hesitation may be long enough for my put to expire out of the money rather than be assigned.

If I sell the $25.50 put I’ll get $0.19 in premium, and I’ve already made $0.33 per share on BAC over the last two weeks. So if I get assigned the shares at $25.50, my actual cost basis on the shares will be $24.98. That comes from the $25.50 strike price minus $0.52 (the $0.33 in premium from the last two weeks plus the $0.19 premium from this trade). Remember that to do this put option contract for passive income, I need to be happy owning shares of BAC at $24.98. Here is the tool I use to help me identify companies I want to own.