Sell Put Options for Double the Premium

My weekly options trade for passive income this week is to sell put options contracts for double the premium. Recently my weekly options trade as a passive investment strategy has been selling puts on Bank of America. Here is the article on why I’m selling puts on BAC as my passive income sidehustle.

How the Dividend Doubles the Premium

BAC has a dividend of $0.24 on 11/30. So I need to own shares of BAC prior to 11/30 if I want to collect the $0.24 dividend as part of my passive income sidehustle. Here is the tool I use to find out the dividend information.

I currently have puts on BAC at $27.00 that will expire out of the money (OTM) tomorrow, 11/17. Here is the post that walks through that weekly options trade for passive income. I want to collect the dividend with my weekly options trade as my passive investment strategy. So I have a choice. I could either buy shares of BAC outright, or I could sell a put option contract on BAC that is very close to the money or in the money. When I pair the premium I’ll collect to sell the put with the dividend I’ll collect if I get the shares, I’ll effectively sell a put for double the premium on this trade.

Selling a put that is very close to the money like this will generate the maximum premium, but it does not guarantee that I will get the shares. The extra premium I generate for selling the put right at the money or even one strike in the money can more than make up for the dividend if I don’t get the shares. The $0.24 dividend would be nice, but if I can generate close to that in premium without owning the shares I’d be happy just collecting that. I could also sell a put option contract that is further in the money, but there is a balancing act with how far in the money to sell the put vs the amount of premium the options trade will generate.

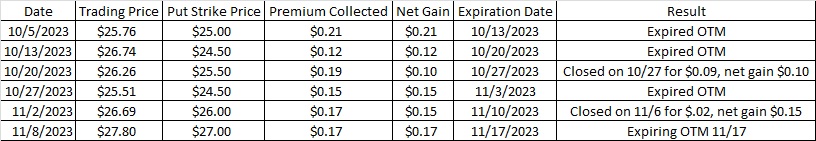

Here are the trades I’ve done the last few weeks on BAC:

So far my passive investment strategy as a business owner has earned $0.90 in premium since 10/5. The put strike prices of the trades averages out to $25.42. The most recent put expires 11/17, which is a total of 43 days since I began this passive investment strategy. 365 days in a year divided by the 43 days I’ve been doing these trades is 8.5. The $0.90 in total premium divided into the average put of $25.42 is to 0.0354. That 0.0354 times the 8.5 multiplier is 0.3009, or a return of about 30% if we annualize it. That’s pretty good, especially for not having been assigned the shares on any of these option contracts.

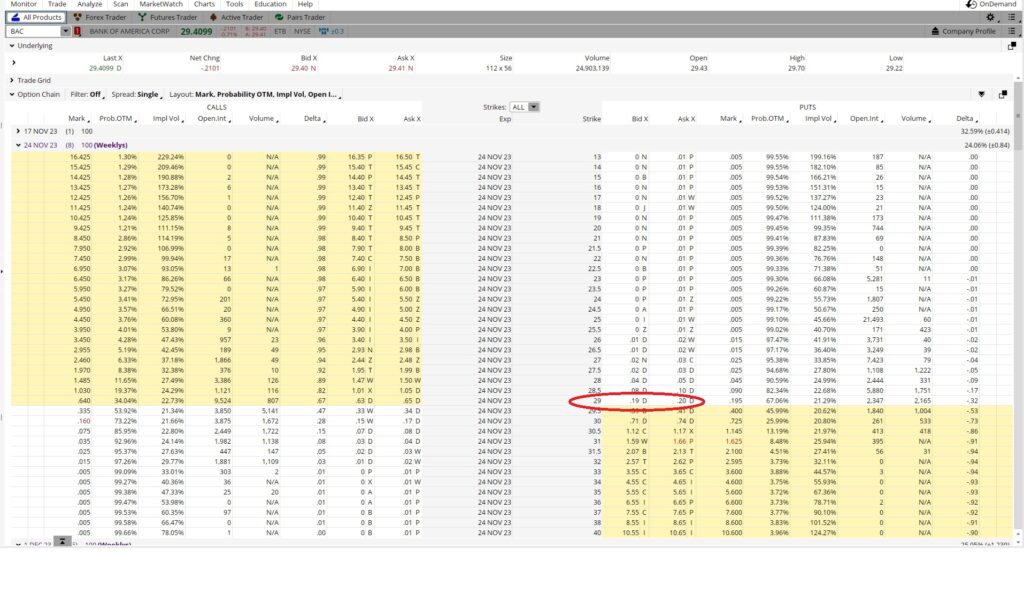

Today I’m selling puts on BAC that expire on 11/24. If I want to sell put option contracts for double the premium, this is my last chance. BAC goes ex-dividend on 11/30, so if I get assigned on the 11/24 contract I’ll have the shares and be an owner of record when they allocate the dividends.

My Cost Basis per Share

My passive income sidehustle selling put option contracts on BAC has earned me $0.90 per share so far. That means my cost basis will decrease by $0.90 per share if my option contract goes in the money and I get the shares. The $29 put expiring 11/24 is trading at $0.19. It’s a one week trade expiring next Friday, 11/24. I divide the premium of $0.19 into the $29 put option strike, and that is 0.0065. I multiply that by the number of weeks in a year, because this is a one week trade. So 52 x 0.0065 is an annualized return of 33.8%. That’s over 25%, which works for me.

If I get assigned the shares I will then also collect the dividend at the end of the month. The dividend is $0.24, and I’ll add that to my reduction in basis. If I get assigned at $29 my cost basis will be $29 minus the $0.90 I’ve collected so far, minus the $0.19 in premium for this weekly option trade, and minus the $0.24 dividend. That means my cost basis will be $27.67 on this tranche of BAC shares. With the dividend coming up I can effectively sell a put option contract for double the premium. If I get the shares, my cost basis will reduce by the amount of the premium as well as the amount of the dividend.